The NAREDCO-Knight Frank Real Estate Sentiment Index report for Q1 2024 has revealed a significant surge in market confidence, marking a decadal high. This remarkable achievement underscores the robust economic landscape in India, with stakeholders across the board expressing heightened confidence and optimism.

Rising Confidence in the Real Estate Sector

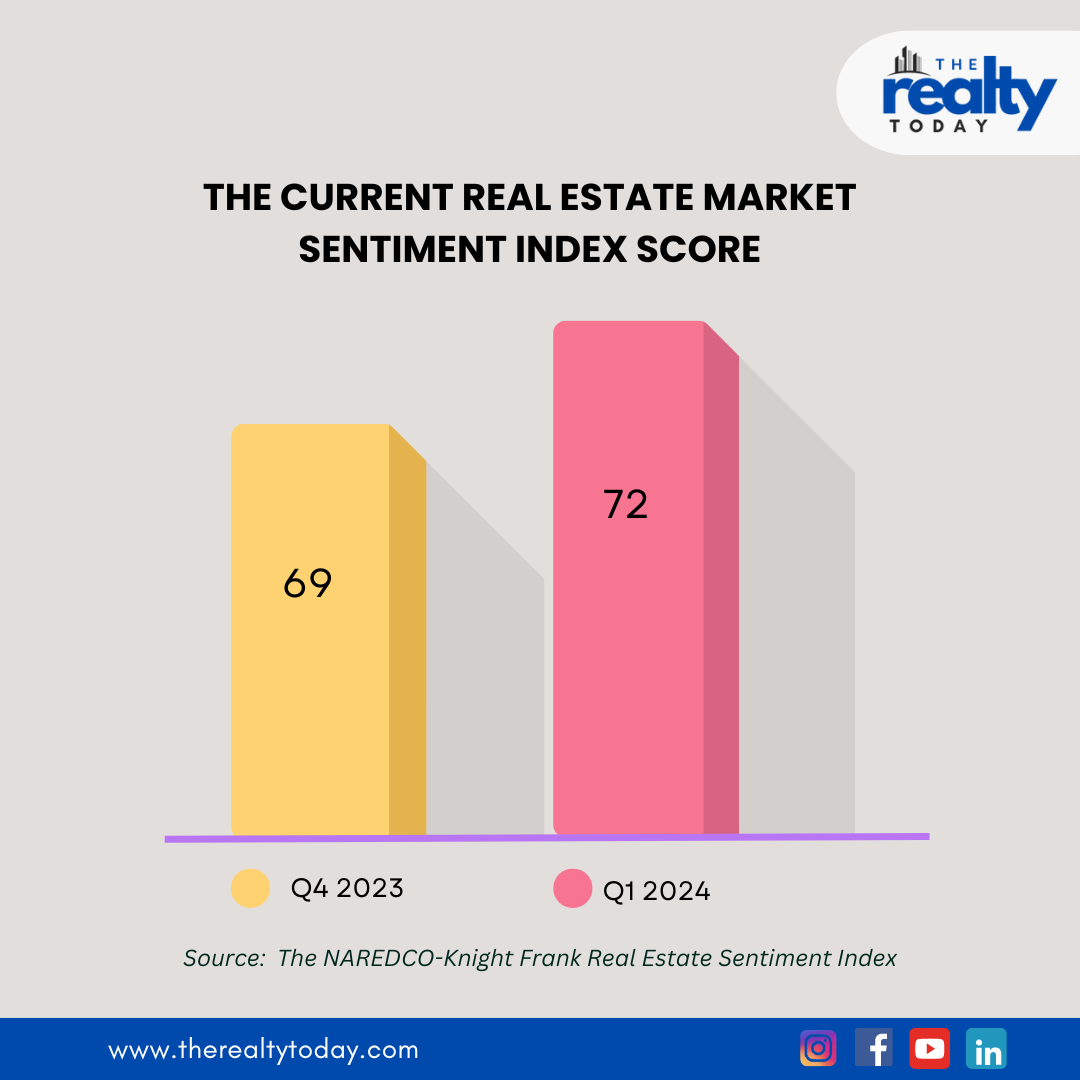

The Current Sentiment Index Score soared to 72 in Q1 2024, up from 69 in the previous quarter. This positive shift reflects the increasing confidence among developers, financial institutions, and other stakeholders in the real estate sector. The Future Sentiment Score also saw an uplift, climbing from 70 in Q4 2023 to 73 in Q1 2024. This upward trend indicates sustained optimism regarding the Indian economy and the enduring demand in the real estate market.

The NAREDCO-Knight Frank Real Estate Sentiment Index is a comprehensive analysis based on a primary survey of current and future sentiments in the real estate sector. It considers the economic climate and funding availability as perceived by supply-side stakeholders and financial institutions. A score of 50 indicates neutrality, scores above 50 signal positive sentiment, and scores below 50 denote negative sentiment.

Residential Market Outlook

One of the standout findings in the report is the bullish outlook for the residential market. An impressive 82% of respondents anticipate a rise in residential prices. This optimism is driven by several factors, including strong economic growth, stable interest rates, and increasing urbanization. The robust demand for residential properties is expected to continue, supported by favorable demographics and government policies aimed at promoting affordable housing.

The report highlights significant upsurges in new launches, sales, and prices in the residential segment. Developers are increasingly confident about launching new projects, buoyed by strong buyer interest and the Reserve Bank of India's (RBI) consistent policy on the repo rate. This stability in monetary policy has provided a conducive environment for both developers and buyers, fostering growth in the residential real estate market.

Regional Performance

Regional markets across India have shown varied performances, reflecting local economic conditions and development activities. Metropolitan cities like Mumbai, Delhi, and Bengaluru continue to lead in terms of demand and price appreciation. For instance, Mumbai's residential market saw a 10% increase in prices year-on-year, driven by high demand and limited supply. Similarly, Bengaluru's tech-driven economy has fueled a 12% rise in residential prices, with significant new launches catering to the growing IT workforce.

In contrast, tier-2 and tier-3 cities are also witnessing a surge in real estate activities. Cities like Pune, Ahmedabad, and Kochi are seeing increased interest from buyers and investors due to improved infrastructure and connectivity. These cities are becoming attractive destinations for both residential and commercial real estate investments, reflecting a broader trend of urbanization beyond the major metropolitan areas.

Office Market Dynamics

The office market outlook remains buoyant, with stakeholders expressing confidence in the performance across leasing, supply, and rent over the next six months. The demand for office spaces is being driven by the growth of the IT sector, the expansion of multinational companies, and the increasing trend of hybrid work models. Despite the challenges posed by the COVID-19 pandemic, the office segment has shown resilience and adaptability, with many organizations opting for flexible office spaces to accommodate changing work patterns.

The report notes that the increase in leasing activity and the steady demand for premium office spaces are positive indicators of a recovering market. The strong economic fundamentals and the government's focus on infrastructure development are expected to further support the growth of the office real estate sector. In particular, the growth of business districts in cities like Hyderabad, Pune, and Chennai has contributed to a steady increase in office space absorption.

Retail and Industrial Real Estate

The retail real estate sector is also showing signs of recovery, driven by increased consumer spending and the resurgence of the retail industry post-pandemic. Major cities are witnessing a rise in retail space leasing, with shopping malls and high streets attracting both international and domestic brands. The report highlights a 15% increase in retail leasing activities compared to the previous year, indicating a strong revival in this segment.

Meanwhile, the industrial and logistics real estate sector continues to benefit from the growth of e-commerce and the push for infrastructure development. The demand for warehousing and logistics spaces is on the rise, particularly in key industrial hubs such as Mumbai, Delhi-NCR, and Bengaluru. The government's focus on initiatives like "Make in India" and the development of industrial corridors is expected to further boost this segment.

Economic Context and Stakeholder Confidence

The surge in real estate market confidence is underpinned by a strong domestic economy. India's GDP growth of 8.4% in Q4 2023 exceeded expectations, solidifying the country’s position as the fastest-growing major economy globally. This robust economic performance has bolstered stakeholder confidence, with enterprises across various sectors, including real estate, anticipating gains from the flourishing domestic economy.

Hari Babu, President of NAREDCO, emphasized the positive impact of the government's commitment to aggressive economic growth. He stated, "The Knight Frank NAREDCO Real Estate Sentiment Index for Q1 2024 paints a buoyant outlook for the Indian real estate sector. With the Current Sentiment Index rising from 69 to 72 and the Future Sentiment Score climbing from 70 to 73, stakeholders demonstrate unwavering optimism, driven by the government’s commitment to aggressive economic growth. India maintains stability and offers fertile ground for real estate growth."

Shishir Baijal, Chairman and Managing Director of Knight Frank India, attributed the rise in the Current Sentiment Index to India's robust economic landscape. He noted, "The significant rise of the Current Sentiment Index Score within the optimistic territory is driven by India’s robust economic landscape. Confidence among stakeholders has surged, with Indian enterprises, including those in the real estate sector, anticipating gains from a flourishing domestic economy."

Investment Trends and Future Prospects

Investment trends in the real estate sector also reflect the positive sentiment. Both domestic and foreign investors are showing increased interest in Indian real estate, driven by the strong economic fundamentals and growth prospects. The report indicates a 20% rise in real estate investments in Q1 2024 compared to the same period last year. This includes investments in residential, commercial, and industrial properties, highlighting the sector's attractiveness as a long-term investment avenue.

Private equity investments in real estate have also seen a significant increase. The report highlights that institutional investors, including private equity funds and pension funds, are increasingly looking at Indian real estate as a viable investment option. The stability in non-developer sentiment, with a Future Sentiment Score of 73, underscores the confidence of financial stakeholders in the sector.

Policy Support and Government Initiatives

The positive sentiment is further supported by various government initiatives aimed at promoting the real estate sector. Policies such as the Pradhan Mantri Awas Yojana (PMAY) for affordable housing, the Real Estate (Regulation and Development) Act (RERA) for enhancing transparency and accountability, and tax incentives for real estate investment trusts (REITs) have contributed to the sector's growth.

The government's focus on infrastructure development, including the creation of smart cities and the development of industrial corridors, is expected to provide further impetus to the real estate market. These initiatives not only improve connectivity and livability but also attract investments and boost economic activities in the regions they cover.

Trends and Future Prospects

The highest recorded Current Sentiment Index within the past decade underscores notable trends in the residential and office segments. These include significant upsurges in new launches, sales, and prices, which are indicative of a thriving market. The report also highlights the importance of sustainable and inclusive development, with NAREDCO committing to driving the real estate sector towards a path of prosperity.

The sustained optimism and economic growth offer ample opportunities for investment, expansion, and prosperity in the real estate sector. As India continues to maintain economic stability and growth, the real estate market is expected to remain a key driver of economic development. The positive sentiment among stakeholders, supported by strong economic fundamentals, sets a promising tone for the future of the real estate sector in India.

Conclusion

NAREDCO-Knight Frank Real Estate Sentiment Index for Q1 2024 reflects a robust and optimistic outlook for the Indian real estate market. Driven by a strong domestic economy, stable monetary policies, and increasing demand in both residential and office segments, the sector is poised for continued growth and investment. With stakeholders expressing heightened confidence and optimism, the real estate market in India is set to thrive, contributing significantly to the country's economic prosperity.

Cover image- moneycontrol.com

.png)