Shopping malls in India have become an essential platform for driving the growth of retail brands. With the total built stock of shopping malls in the top six cities including Delhi-NCR, Mumbai Metropolitan Region, Bengaluru, Hyderabad, Pune and Chennai surpassing 100 million square feet in the first half of 2024, we are entering an exciting new phase of expansion.

Looking back, India’s journey began with its first shopping mall in 1991, taking 22 years to reach 50 million square feet by 2013. During this period, Delhi-NCR, the Mumbai Metropolitan Region (MMR), and Bengaluru were the primary contributors, accounting for three-fourth quarters of the total stock. The subsequent growth to 100 million square feet, achieved within just 10 years (2014-2024), saw NCR and Bengaluru continue to lead, contributing nearly 60% of this expansion. Emerging cities like Pune and Hyderabad also played a significant role, adding 25% to this growth narrative.

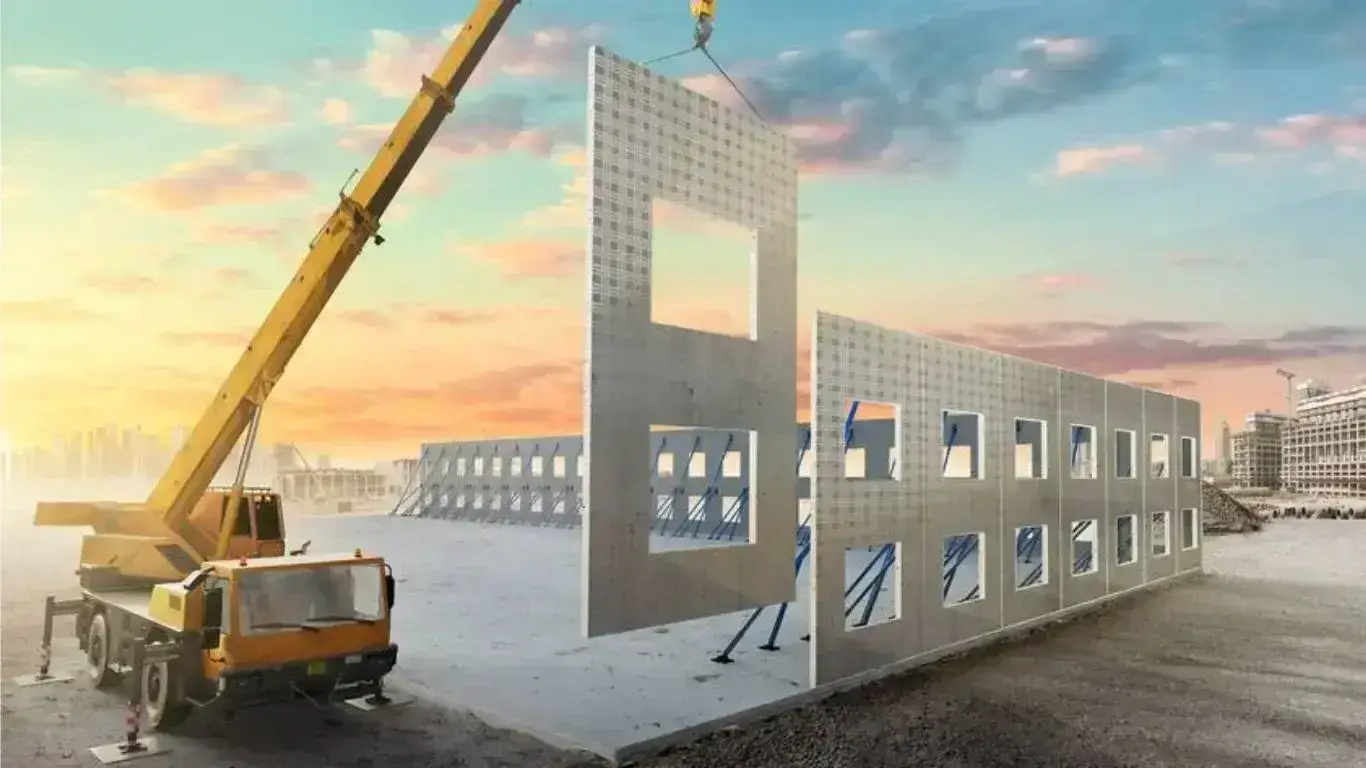

As we look ahead, India is set to add an impressive 30 million square feet of shopping mall space by the end of 2027, effectively doubling the pace of construction compared to the previous decade. This acceleration will pave the way for reaching the ambitious target of 200 million square feet by 2036, with younger cities expected to make an even larger contribution in this next phase of development, a report by real estate data analytics platform CRE Matrix said.

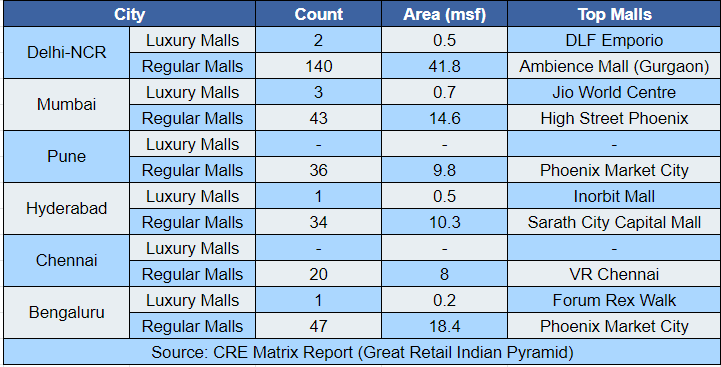

Shopping malls in India have generally offered a wide range of options without specializing. However, cities like Delhi-NCR, MMR, and Bengaluru have introduced luxury-themed malls, setting a trend that other cities are likely to follow. The success of premium outlet malls, such as Pacific Jasola in Delhi-NCR, demonstrates the potential for more theme-based retail developments across the country, creating ample opportunities for specialized retail spaces.

A Comparative Analysis of Luxury Malls and Regular Malls in the Top Six Cities

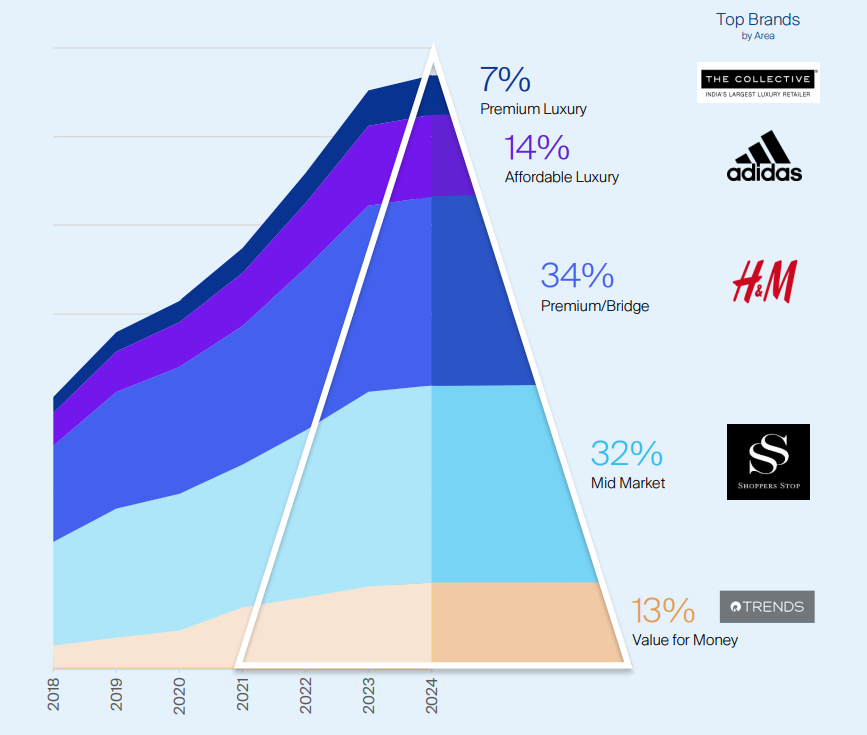

Shifting Demand Patterns in Retail

The report highlights a significant shift in consumer demand from 2018 to 2024, with premium and luxury brands such as Victoria Secret, Michael Kors and Ralph Lauren emerging as the leading occupiers in the market. The mid-market segment, including brands like Domino’s, Subway, Big Bazaar which once dominated with a 38% share in 2018, has transitioned towards value-for-money and affordable luxury offerings. Currently, the contribution from luxury brands has increased from 16% to 21%, while value-for-money brands like Trends, Max and Reliance Fresh have risen from 8% to 13%.

Our extensive roster of over 7,300 brands in India is poised to take advantage of this upcoming growth. It is essential for malls, high streets, and brands to align with evolving demand patterns and shifting shopping preferences. The brand landscape of 2030 will differ significantly from what we see today, with the upper half of the market experiencing the most substantial growth momentum.

The Retail Brand Pyramid

Analysis covers Delhi-NCR, MMR, Bengaluru, Hyderabad, Pune & Chennai (Graph Source: CRE Matrix Report Great Retail Indian Pyramid)

Consumer durables and apparel have emerged as the largest category in the Indian retail market, accounting for 36% of the overall business across the top six cities. Following closely is the consumer staples category, which contributes 25% to the business value. Successful retail assets have aligned their brand mix accordingly, ensuring higher footfalls through careful curation of brands.

From a business value standpoint, the non-ethnic unisex category has been the dominant force in the Indian retail landscape since 2018.

Reflecting changing consumption patterns, the jewelry and precious stones segment, along with sportswear and bars/breweries, has experienced remarkable growth over the past five years, with their contributions doubling to 11%.

India's retail sector has not been examined through the lens of retail brand segments and categories. This strategic alignment with demand trends is crucial for sustaining growth in India’s evolving real estate industry. The report seeks to provide developers and retailers throughout India with valuable insights that define the current retail landscape and are likely to influence the sector's future development.

.png)