CareEdge Analytics has introduced ReitsInfraEdge, a new data platform aimed at simplifying how investors engage with Real Estate Investment Trusts (REITs) in India. This web-based platform is designed to provide investors with comprehensive information on listed REITs, helping them make more informed investment decisions. Supported by the Securities and Exchange Board of India (SEBI), ReitsInfraEdge aims to streamline access to essential REITs data, providing useful tools for retail and institutional investors alike.

Centralizing REITs Information

ReitsInfraEdge offers a centralized hub for accessing key data on Indian REITs, including information about their underlying properties. By consolidating this information, the platform allows investors to view and compare performance metrics across multiple REITs, making it easier to evaluate and analyze their investments. The platform is user-friendly, ensuring that both seasoned and novice investors can navigate through the data easily. Investors can analyze REITs based on a wide array of metrics and gain a complete understanding of the properties involved, including their location and market value.

Advanced Valuation Tools

One of the core features of ReitsInfraEdge is its interactive valuation tools, designed to help investors explore how various market conditions and assumptions affect the valuation of REITs. These tools allow users to make adjustments based on their own assumptions, such as changes in growth projections, interest rates, or market demand, helping them understand the factors driving property values.

These flexible tools give investors more control over their decision-making process, enabling them to experiment with different scenarios before making an investment. The platform also simplifies how investors can benchmark and assess the financial performance of their chosen REITs.

Addressing Data Gaps in the Market

India’s REITs market has been growing steadily, but investors have often faced challenges due to the lack of structured data. ReitsInfraEdge addresses this issue by organizing and presenting relevant information in a clear, standardized manner, helping investors better understand their investment opportunities.

This platform brings together important data points, allowing investors to evaluate REITs more efficiently and make decisions based on solid information. By offering better access to REITs data, ReitsInfraEdge encourages more participation in the sector and promotes orderly growth.

Real-Time Data Access

ReitsInfraEdge also provides real-time data, allowing investors to stay updated on the latest market trends and changes. Having up-to-date information is critical for investors to respond to evolving market conditions, and this platform ensures that users have access to timely data. The web-based platform is accessible anytime, anywhere, making it convenient for investors who need to monitor their portfolios on the go. This feature is especially useful for institutional investors who require continuous access to data for portfolio management.

Looking Ahead

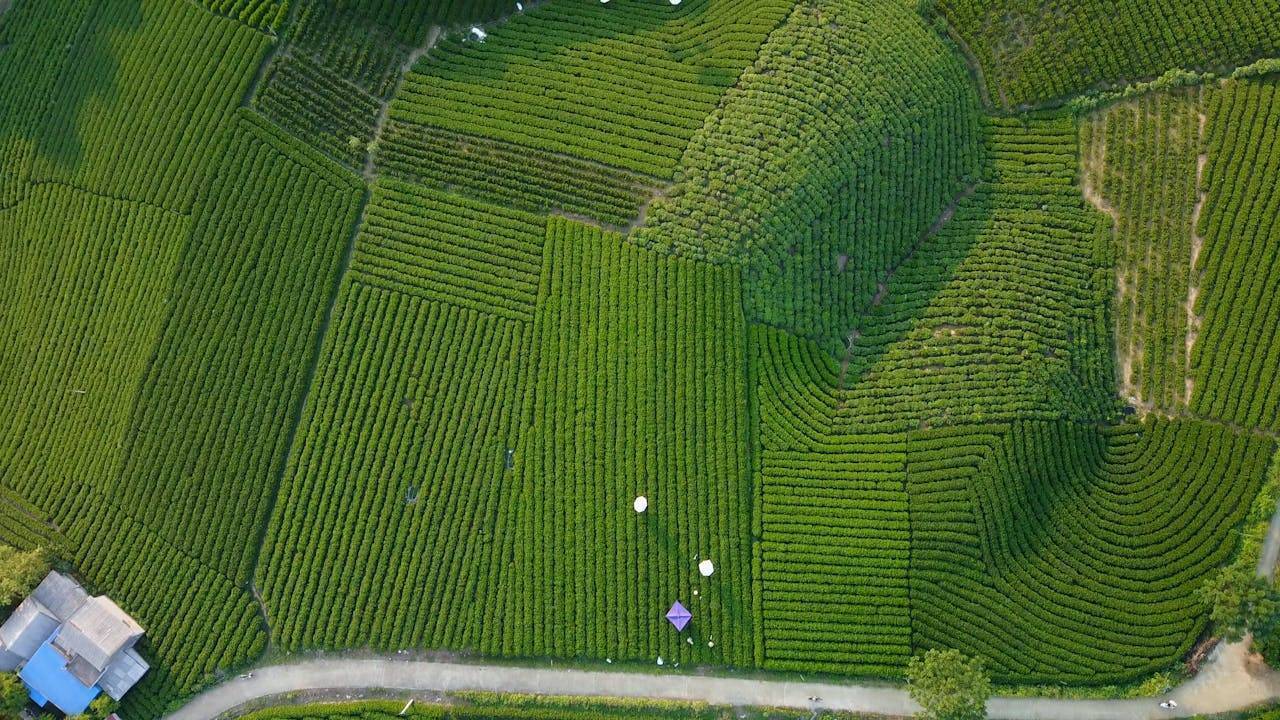

The introduction of ReitsInfraEdge comes at a time when India’s real estate and infrastructure sectors are poised for growth. With more REITs expected to be listed in the coming years, this platform will likely become a valuable resource for investors who are looking to gain a better understanding of their investment options.

By offering comprehensive data, interactive tools, and real-time insights, ReitsInfraEdge is set to provide investors with the resources they need to make better investment decisions. As the platform continues to evolve, it is expected to help drive more interest and investment into India's growing REITs market, contributing to the development of the country's real estate and infrastructure sectors.

Image source- careedgeanalytics

.png)