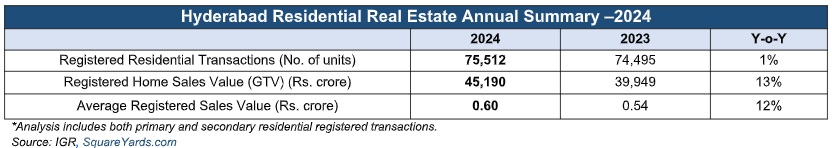

The Hyderabad residential market maintained its strength in 2024, with 75,512 residential transactions across apartments, plots, and villas, compared to 74,495 in 2023, according to Square Yards data. While transaction volume saw a slight rise, the total value of registered home sales grew by 13% to ₹45,190 crore.

The relatively slower growth in registered transactions can be attributed to the heightened scrutiny by homebuyers of project compliances post establishment of the Hyderabad Disaster Response and Asset Protection Agency (HYDRAA) in July 2024. Buyers are now evaluating projects more meticulously to ensure adherence to these standards, resulting in a more cautious approach to decision-making. This has contributed to a slowdown in transaction closures, reflected in the 12% year-on-year decline in registered residential transactions during the October-December 2024 quarter, with 15,941 units recorded.

Debayan Bhattacharya, Principal Partner & Sales Director, Square Yards said, “Hyderabad property market has demonstrated significant resilience and growth post-pandemic, with sustained momentum continuing through 2024. While the fourth quarter witnessed a decline in transactions due to the impact of HYDRAA on consumer sentiment, the yearly performance tells a more positive story, with total registrations surpassing 2023 levels. Also, the government’s clarifications, ensuring projects with prior approvals remain unaffected, alongside developers recalibrating their customer outreach strategies, are steadily restoring consumer confidence. We believe the impact on sentiment will be short-lived, and in the long run, these developments will foster sustainable growth, curb illegal encroachments, and promote compliance. Moreover, as Hyderabad rapidly establishes itself as a leading IT and GCC hub, we anticipate residential demand to remain robust, driven by premium properties. The city’s evolving infrastructure and economic opportunities will continue reinforce its position as a key residential market in India.”

In October-December 2024, the sales value dropped by 5%, amounting to Rs. 9,617 crore compared to Rs. 10,114 crore recorded in the October-December quarter of the previous year. Notably, the average home sales value rose by 8% annually, with the current figure standing at Rs. 60 lakh. This trend highlights a strong homebuyer preference for mid-to-high segment properties in Hyderabad.

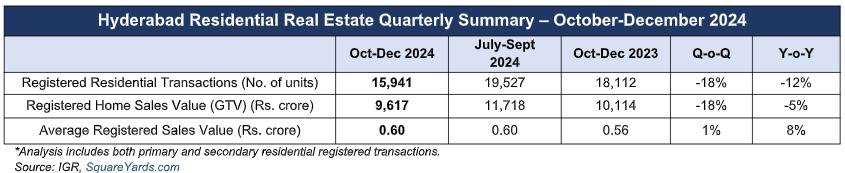

Market Leaders and Key Projects

Aparna Constructions and Estates maintained its leadership in Hyderabad’s residential market during the October-December 2024 quarter, topping both registered sales value and residential transactions. The developer recorded a sales value of Rs. 563 crore across 627 units, with its flagship project, Aparna Zenon in Khajaguda, emerging as the standout performer. Brigade secured the second position with a sales value of Rs. 264 crore from 217 transactions, driven by their project Brigade Citadel. Developers such as Prestige Group and K Raheja Corp also retained their stronghold within the top 10 developers with highest registered home sales value of Rs. 125 crore and Rs. 114 crore, respectively in October-December 2024.

The city’s appeal continues to rise as global IT giants such as Microsoft amongst others expand their operations in Hyderabad, further solidifying its position on the global map. This commercial expansion is feeding into the residential market, with increasing demand from local buyers and working professionals. Additionally, major developers like Godrej Properties and Brigade Enterprises are actively entering the Hyderabad market, further strengthening its residential sector

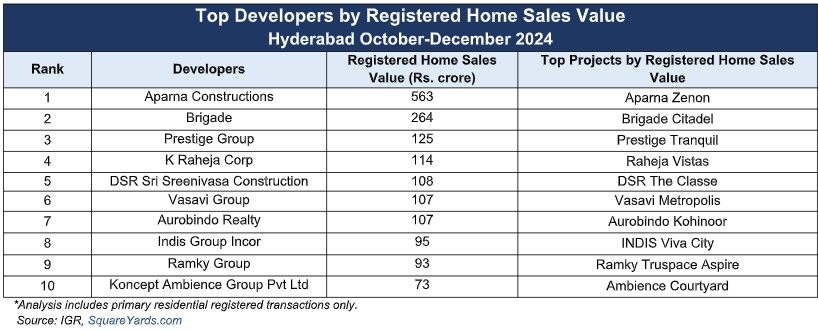

Area-wise and Budget-wise Trends

Hyderabad's residential market continued its steady shift toward mid-to-high price segments during the October-December 2024 quarter, reflecting an evolving buyer preference observed over recent years. Transactions priced below Rs. 50 lakh accounted for the largest share at 59%; however, this segment's market share moderated from 63% in the same period the previous year.

Conversely, the premium segment, comprising properties priced above Rs. 1 crore, demonstrated growth with share rising to 13% in October-December 2024 as compared to 11% in same period previous year. A total of 2,153 transactions were recorded in this segment during October-December 2024, compared to 1,981 in the same period of 2023. This growth in the Rs. 1 crore segment comes despite a decline in the overall number of registered transactions during the same period. This trend aligns with the sustained demand for mid-to-large residential spaces, as properties in the 1,000–1,500 sq. ft. range accounted for 71% of total transactions.

Micro Market Performance

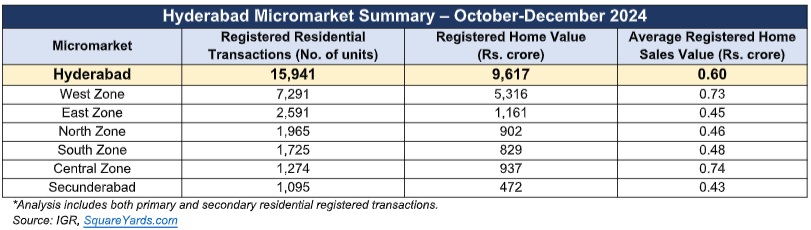

During the October-December 2024 quarter, Hyderabad's residential market witnessed concentrated activity in Western Hyderabad, particularly in areas with seamless connectivity to the Outer Ring Road (ORR). The West Zone dominated the market, accounting for 46% of total number of transactions, and commanding a 55% share of the overall sales value. This strong demand was driven by key localities such as Puppalguda, Bachupally, Kukatpally, Kondapur and Miyapur. Trailing behind, though distantly, was the East Zone, which captured a 16% share in transaction volume and a 12% share of overall sales value during the same period. In terms of average sales value, the Western micro-market is rapidly closing the gap with Hyderabad’s central areas. The average sales value in the Western micro-market stands at Rs. 73 lakh, compared to Rs. 74 lakh in the central areas. Within the Western zone, amongst the top localities by registered home sales value, Pokkulwada and Kokapet had the highest average sales values of Rs. 1.32 crore and Rs. 1.29 crore, respectively in October-December 2024.

While Hyderabad's residential market witnessed a slight slowdown in the last quarter of 2024, largely due to the impacts of HYDRAA, recent clarifications—such as assurances that projects with existing approvals will remain unaffected—have begun to restore buyer confidence. Furthermore, major infrastructure initiatives like the Musi River rejuvenation project, investments in IT parks, data centres and Global Capability Centres (GCCs) are expected to significantly bolster the city’s appeal, driving employment growth and subsequent residential demand in the coming period.

Additionally, the government’s decision to merge 24 municipalities into the Greater Hyderabad Municipal Corporation (GHMC) is set to streamline governance and enhance infrastructure development across the region. Collectively, these factors will continue to reinforcing Hyderabad’s status as a key destination for both homebuyers and investors amongst India’s top cities.

.png)