India’s commercial office real estate segment is on the threshold of a landmark achievement, with the total office stock projected to surpass 1 billion square feet by Q3 of FY26. This development would make India the fourth-largest office market globally, trailing only the United States, China, and Japan, according to the latest report titled “A Billion sq ft and Counting – India Office Supply Growth Story” by property consultancy Knight Frank India.

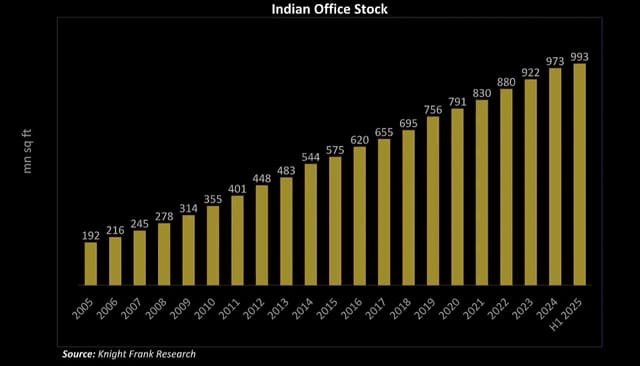

From 192 Million to 993 Million sq ft: A Two-Decade Transformation

India’s office market has expanded rapidly over the past 20 years. In 2005, the country had approximately 192 million square feet of office stock. As of June 2025, this number has grown more than five-fold to 993 million sq ft, representing a Compound Annual Growth Rate (CAGR) of 8.6%. This steady growth has been underpinned by demand from sectors like IT/ITeS, BFSI, consulting, and, more recently, Global Capability Centres (GCCs).

What began as a market dominated by tech parks supporting domestic and offshore IT services in cities like Bengaluru and Hyderabad has evolved into a broader, more globally integrated ecosystem. This shift has been driven by urban infrastructure investments, an increasingly skilled workforce, regulatory reforms, and India’s growing relevance in global corporate operations.

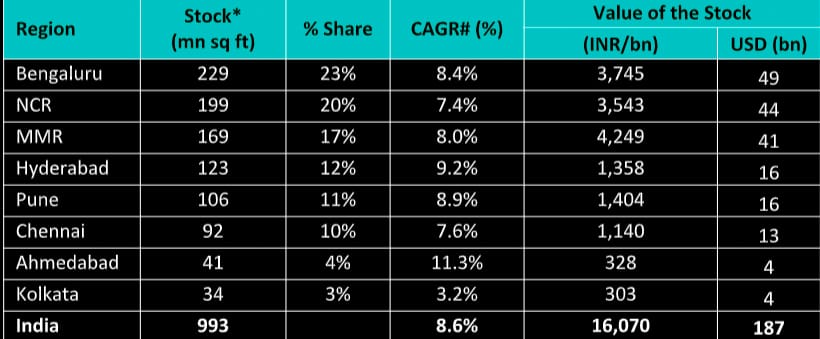

City-Wise Contributions: Dominance of Six Metros

The office supply is highly concentrated in India’s top six metropolitan cities. These markets account for over 93% of total Grade A supply, highlighting the preference of occupiers for business-friendly cities with robust physical and digital infrastructure.

Top 3 Office Markets:

Bengaluru:

The city continues to lead with 229 million sq ft, or 23% of India’s total office stock. It remains the primary hub for IT services, GCCs, and startups, and commands the highest share of Grade A stock (70%).

National Capital Region (NCR):

With 199 million sq ft (20%), NCR is the second-largest contributor. The market includes Noida, Gurugram, and Delhi, with Noida emerging as a preferred location for electronics and IT/ITES players due to its policy support and infrastructure pipeline.

Mumbai Metropolitan Region (MMR):

MMR’s contribution stands at 169 million sq ft (17%). While it is home to a diverse mix of industries, the region’s high land prices and complex approvals have kept supply moderate compared to its demand potential.

Next Tier Contributors:

- Hyderabad: 123 million sq ft (12%)

- Pune: 106 million sq ft (11%)

- Chennai: 92 million sq ft (10%)

These three southern cities have rapidly gained prominence due to government-backed industrial corridors, SEZ policies, and availability of talent.

Emerging Cities:

Ahmedabad: 41 million sq ft (4%)

Kolkata: 34 million sq ft (3%)

Ahmedabad’s expansion is largely SEZ- and manufacturing-driven, while Kolkata has historically faced constraints in supply due to fewer developers and lower institutional interest.

Cost Efficiency: India’s ‘Sub-Dollar’ Rental Advantage

A key differentiator for India in the global office space ecosystem is cost efficiency. As of mid-2025, average office rentals across top Indian markets stand at $0.96 per sq ft/month, placing India in the coveted “sub-dollar” category.

By comparison:

- Office rentals in central business districts (CBDs) in New York or London range between $8–$12 per sq ft/month.

- Even emerging hubs like Vietnam and the Philippines quote above $1.20 per sq ft/month in core locations.

This price-performance equation is a significant magnet for multinational corporations (MNCs) establishing or expanding their presence through back offices, GCCs, and R&D hubs in India.

Viral Desai, Senior Executive Director at Knight Frank India, noted that India’s sub-dollar rental rates serve as a key differentiator in the global office market. He observed that occupiers are increasingly prioritizing quality, ESG compliance, and flexibility , areas where India continues to show strong progress.

Grade-Wise Segmentation: Growing Institutionalisation

The report highlights an improving grade mix, with 53% of office stock now classified as Grade A. This marks a critical shift toward institutionalised and international-grade workspaces, reflecting rising occupier expectations and investor scrutiny.

Grade-wise composition (Pan-India):

- Grade A: 53%

- Grade B: 43%

- Grade C: 4%

Among the cities:

- Bengaluru leads with 70% of its office space in Grade A.

- Hyderabad follows at 68%, with Chennai at 64%.

- Mumbai and NCR offer a mixed supply due to legacy buildings and redevelopment challenges.

The increase in Grade A share is particularly attractive to foreign institutional investors and REIT sponsors, contributing to the success of India’s publicly listed REITs.

ESG, Green Buildings & Flex Space Push

Post-2020, occupiers and developers alike have prioritized environmental and social governance (ESG) parameters. As a result, green-certified office spaces have surged 65% across the top seven cities since 2019, according to Knight Frank.

Simultaneously, flex spaces (co-working and managed offices) now account for over 10% of active leasing annually, a sharp rise from under 3% in 2017. Demand is concentrated in Bengaluru, NCR, and Pune, with companies preferring hybrid models.

India’s Journey: From Volume to Value

India’s office market has evolved through seven phases of transformation, beginning in the 1990s. These include:

- Software park establishment (1995–2000)

- SEZ policy implementation (2005 onwards)

- Private equity inflows (post-2007)

- Global GCC expansion (post-2010)

- REIT era (2019–present)

- ESG and flexible workspace boom (2020s)

- Digital, AI-driven smart office integrations (2024 onwards)

From being a cost arbitrage destination, India is now a value and innovation hub for several Fortune 500 companies.

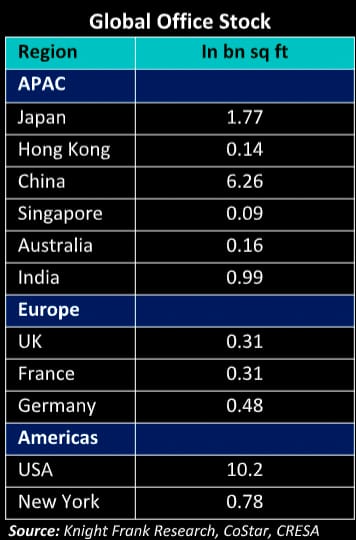

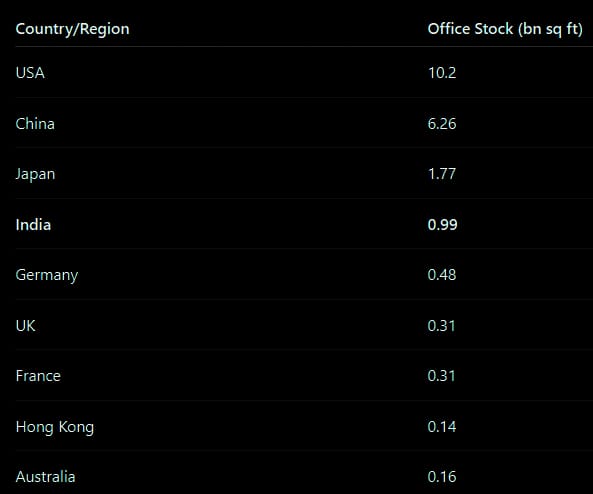

Global Benchmarking and Forward Outlook

As per the report, the global office stock ranking (as of 2025) is:

- United States – 10.2 billion sq ft

- China – 6.26 billion sq ft

- Japan – 1.77 billion sq ft

- India – Projected to cross 1 billion sq ft by Q3 FY26

If India’s office stock continues to expand at a compound annual growth rate (CAGR) of 12.7%, it is projected to reach 2 billion square feet by 2036, effectively doubling its current footprint. Even at a slightly lower CAGR of 10.9%, the same milestone could be achieved by 2041, underscoring the robustness of the country’s commercial real estate trajectory. This forward-looking scenario is anchored in several macroeconomic and structural factors, including consistent GDP growth, the decentralization of business activity from Tier-1 to Tier-2 and Tier-3 cities, a maturing REIT ecosystem that is attracting institutional investment, and the increasing volume of corporate offshoring and global capability centers being established in India. As global businesses seek cost efficiency, talent access, and resilient markets, India is emerging as a long-term hub for commercial office expansion.

Way Forward

India’s near-term transition to the fourth-largest office market in the world reflects more than just numbers. It signals the structural maturity of its real estate sector, enhanced developer and tenant transparency, a robust legal and REIT framework, and the country’s evolving position in global business operations.

The journey from 192 million sq ft to nearly 1 billion has been shaped by consistent policy support, infrastructure buildout, and occupier trust. With over 500 million sq ft of institutional-grade office space added in just two decades, India is poised for another phase of scalable, sustainable, and globally benchmarked growth in the decade ahead.

.png)