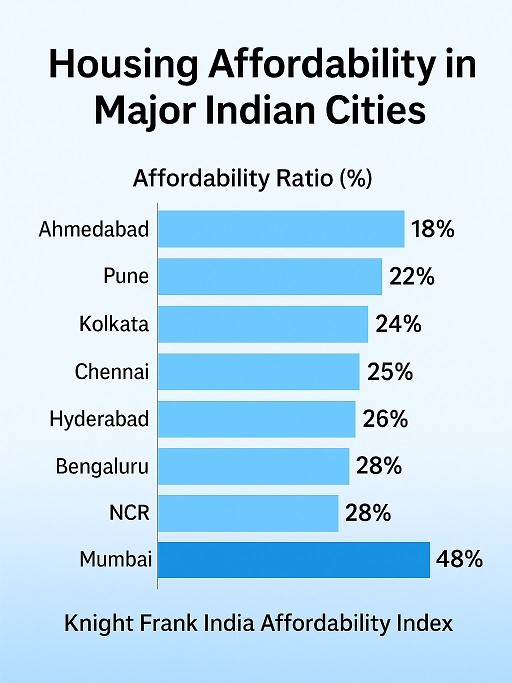

The first half of 2025 has brought measurable relief to homebuyers in many Indian cities, with the Reserve Bank of India's (RBI) recent repo rate cut helping to improve housing affordability across most major urban centres. According to Knight Frank India's latest Affordability Index report, Ahmedabad, Pune, and Kolkata have emerged as the most affordable housing markets among eight cities tracked, while Mumbai, long considered the costliest city for homeownership, showed signs of modest improvement.

Ahmedabad topped the affordability charts with an index level of 18%, followed by Pune at 22% and Kolkata at 23%. The Affordability Index measures the proportion of income that a household requires to fund the Equated Monthly Instalment (EMI) of a home loan for an average housing unit. A lower index score indicates better affordability. In contrast, an EMI-to-income ratio above 50% is regarded as financially unsustainable by lenders.

Mumbai, although still the least affordable among the cities surveyed, registered a notable improvement. The index fell from 50% in 2024 to 48% in the first half of 2025, slipping below the symbolic 50% threshold for the first time in the history of the index. According to Knight Frank, the drop has been driven primarily by lower home loan interest rates resulting from the RBI’s cumulative 100 basis point reduction in the repo rate since February 2025.

The RBI had previously raised the repo rate by 250 basis points between May 2022 and early 2023 to curb inflation, a move that negatively affected housing affordability across the country. With inflation pressures subsiding, the central bank shifted its stance to support economic growth, providing relief to both developers and homebuyers.

The National Capital Region (NCR) experienced a marginal decline in affordability, with its index worsening from 27% in 2023 to 28% in H1 2025. This was largely attributed to a sharp increase in residential prices, which outweighed the benefits of cheaper credit. Other cities covered in the Affordability Index include Bengaluru, Hyderabad, Chennai, and Mumbai, of which all except NCR witnessed improvements.

According to Knight Frank, affordability is a key determinant in sustaining homebuyer interest, and the RBI's current policy stance has provided a temporary boost to sentiment. Shishir Baijal, chairman and managing director of Knight Frank India, noted that, "Affordability plays a critical role in maintaining homebuyer demand and sustaining sales momentum, both of which are vital contributors to the broader economy. As incomes grow and the economy gains strength, financial confidence among end-users improves, motivating them to commit to long-term investments such as home ownership."

The firm added that India’s GDP is expected to grow at 6.5% in FY2026, and that a stable and supportive interest rate environment will help maintain housing affordability in the near term. Developers are also expected to respond to improving affordability by launching mid-income housing projects, particularly in tier-1 cities where price escalation had previously discouraged entry-level homebuyers.

Since 2010, the index has shown gradual improvement in affordability across most Indian cities. Notably, during the pandemic, record-low interest rates enabled more families to afford homes, leading to a temporary spike in residential sales across metros and smaller cities. Post-pandemic, while housing prices have been on the rise due to higher construction and land costs, the affordability index continues to reflect improving trends wherever financing costs remain under check.

Analysts caution, however, that this trend could reverse if inflationary pressures return, prompting a fresh cycle of rate hikes. They also point to rising input costs and urban infrastructure bottlenecks as variables that could affect both supply and pricing in the coming quarters.

Overall, the Affordability Index provides a valuable pulse-check for India’s urban housing markets and their accessibility to the average salaried homebuyer. While affordability in cities like Ahmedabad and Pune remains healthy, continued vigilance on economic indicators and borrowing costs will be crucial to sustaining this momentum through 2025 and beyond.

.png)