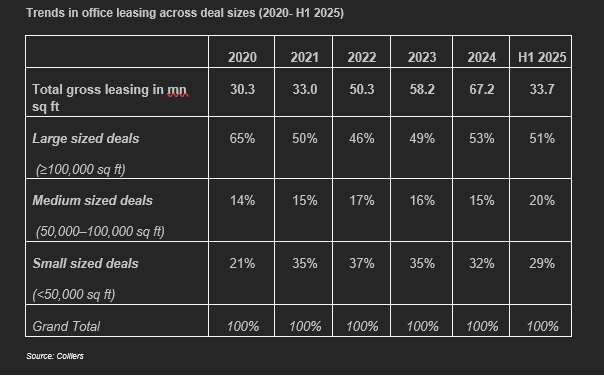

According to Colliers Report, large-sized deals (≥100,000 sq. ft.), continue to drive India’s commercial office market, consistently accounting for bulk of the Grade A office space uptake in the last 5 years. In H1 2025 too, 51% of the total leasing across the top 7 cities was through large-sized deals at 17.2 million sq feet, reflecting occupiers’ sustained appetite for high-quality office spaces to support growth strategies.

Note: Percentages represent the share of total annual leasing activity in each deal size category in the respective year. Data includes leasing across conventional space as well as flex space

Data pertains to Grade A buildings only.

Data pertains to top 7 cities – Bengaluru, Chennai, Delhi-NCR, Hyderabad, Kolkata, Mumbai, and Pune | Kolkata data limited for 2020-23 period

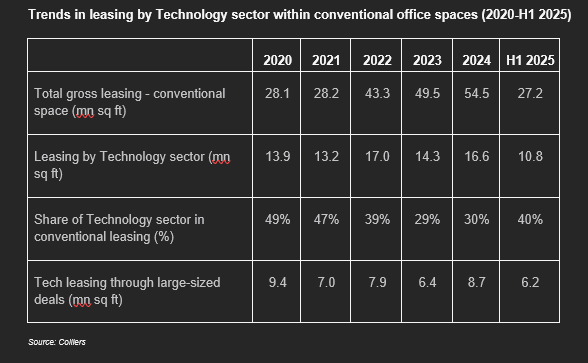

Technology sector continues to drive large-sized transactions across conventional space

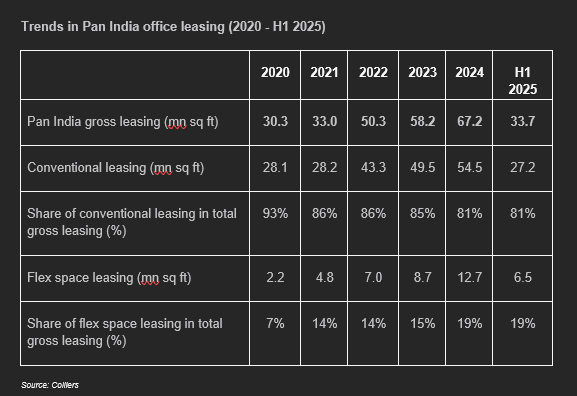

Note: Data pertains to Grade A buildings only.

Data pertains to top 7 cities – Bengaluru, Chennai, Delhi-NCR, Hyderabad, Kolkata, Mumbai, and Pune | Kolkata data limited for 2020-23 period

Gross absorption does not include lease renewals, pre-commitments and deals where only a letter of Intent has been signed.

Note: Data pertains to Grade A buildings only

Gross absorption does not include lease renewals, pre-commitments and deals where only a letter of Intent has been signed.

Technology firms continue to anchor India’s flex space demand as well

The technology sector also remains a dominant occupier within flex spaces, as leading tech firms continue to adopt agile workspace strategies to support hybrid work models. The sector currently accounts for 40-50% of the total flex space demand across the top 7 cities of the country. This trend is particularly pronounced in key IT hubs such as Bengaluru, Hyderabad and Pune, where flexible work arrangements enable companies to optimize costs, enhance scalability, and attract skilled talent. While the occupier base for flex spaces is steadily diversifying, the technology sector is expected to retain its prominence, driving sustained flex space demand in the next few years.

“The technology sector continues to demonstrate remarkable resilience, even amid global uncertainties and workforce adjustments. Since 2020, tech occupiers have leased close to 85 million sq. ft. of conventional office space across the top seven cities and accounted for bulk of the large-sized transactions. In H1 2025 alone, the sector drove 43% of the large -sized transactions of 100,000 sq. ft or above. Despite current headwinds, we expect technology occupiers to maintain the leasing momentum throughout 2025 and fuel commercial real estate in India, mainly supported by expansion of GCCs. Meanwhile, strong IT talent pool and cost arbitrage will continue to be the differentiating factors for Indian office market,” said Arpit Mehrotra, Managing Director, Office Services, Colliers India.

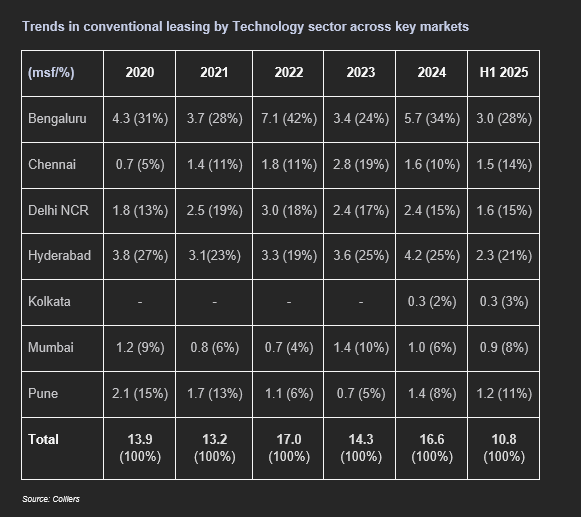

Bengaluru and Hyderabad continue to drive ~50% of the Tech demand in India

Bengaluru remains the epicenter of India’s technology sector and has established itself in the top 5 global tech destinations, supported by its deep talent pool, mature IT ecosystem, and robust office infrastructure. Hyderabad, meanwhile, continues to strengthen its position as a major technology center both in India and globally, driven by competitive costs, supportive government initiatives, and availability of high-quality office developments. Together, Bengaluru and Hyderabad account for nearly half of the country’s tech leasing over the last five years, underscoring their dominance as preferred markets for technology occupiers. The two cities are followed by Pune, Chennai, and Delhi-NCR with sustained demand from technology firms.

Noe: Data pertains to Grade A buildings only | Kolkata data limited for 2020-23 period.

Gross absorption does not include lease renewals, pre-commitments and deals where only a letter of Intent has been signed.

Percentage indicates share of the respective city in the total Tech leasing in conventional spaces during the period

Top 5 Micro-markets drive nearly 50% of the Tech leasing at Pan India level

Majority of leading technology micro-markets in the country are concentrated in South India, which has established IT hubs such as ORR & Whitefield in Bengaluru, SBD & Off-SBD in Hyderabad, and OMR Zone in Chennai. These micro markets have consistently witnessed strong traction in technology leasing, driven by an established IT/ITeS ecosystem, well-developed social & physical connectivity and availability of skilled talent in residential catchment areas. Competitive rentals and availability of relatively larger floor plates in office developments have added to the forward-looking IT policies of these states in southern India.

"India’s technology leasing continues to be dominated by select high-performing IT hubs. In H1 2025, the top micro-markets - ORR & Whitefield in Bengaluru, SBD and Off-SBD in Hyderabad, and OMR Zone in Chennai, accounted for nearly half of India’s total tech leasing, a clear testament to their unmatched pull amongst IT occupiers. These hubs have not only weathered market shifts but have set the pace for India’s office sector. The Indian technology sector is experiencing significant growth and transformation, driven by trends like AI adoption, cloud computing and cybersecurity. Ongoing innovation and global servicing capabilities are likely to remain unmatched, with the sector potentially accounting for 40-50% of the office space uptake in 2025,” said Vimal Nadar, National Director and Head of Research, Colliers India

The Indian IT industry is at the cusp of a structural change where global tech companies are increasingly expanding their India operations by setting knowledge & innovation hubs, thereby accelerating the digital revolution in India. In fact, as per NASSCOM, GCCs in India are projected to increase from around 1,800 currently to over 2,400 with revenues exceeding USD 100 billion by 2030. The role of domestic IT firms is also undergoing a steady shift as artificial intelligence, generative learning, machine learning and cloud computing permeate further into the fabric of Indian IT industry. Overall, the next few years are likely to be crucial for technology sector in India, driven by evolving contours between domestic and global tech companies in the country. Real estate requirements by the tech sector, thus will also continue to undergo a gradual structural transformation over the next few years.

.png)