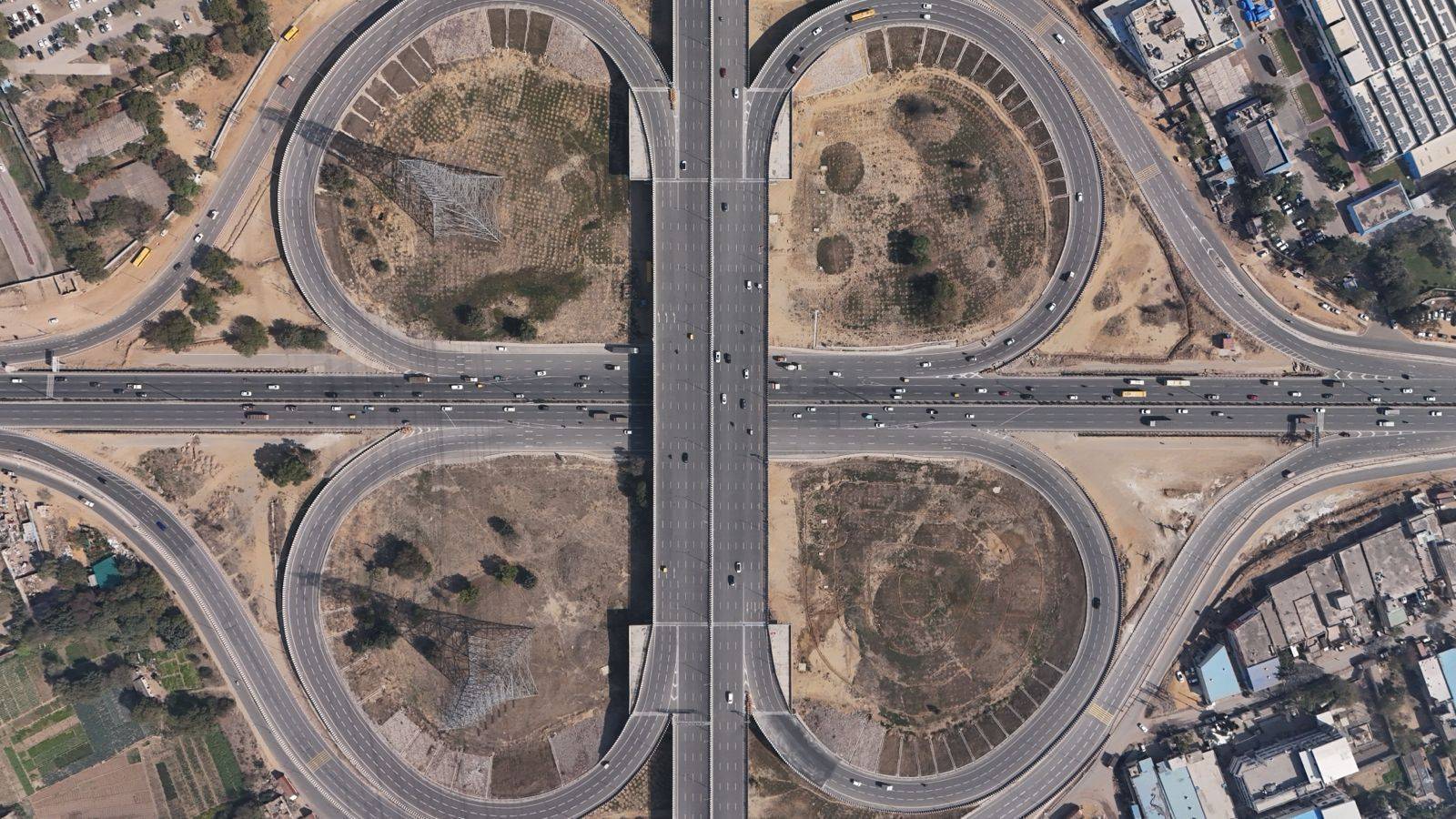

Greater Noida has experienced a remarkable transformation over the past decade, evolving from a suburban outpost to a bustling urban center. The region has benefited from strategic infrastructure investments, including the Noida-Greater Noida Expressway and the Yamuna Expressway, which have significantly improved connectivity and attracted businesses and residents. The recent approval by the Greater Noida Industrial Development Authority (GNIDA) to increase land allocation rates by 5.3% for the 2024-25 fiscal year marks another pivotal moment in this development trajectory. This decision, influenced by upcoming infrastructure projects, is set to impact real estate prices in Greater Noida and Noida Extension, shaping the region's future growth. The new rates have been effective from April 1, 2024, spanning industrial, residential, commercial, institutional, and builder plots.

Reasoning Behind the Land Rate Hike

GNIDA's decision to raise land rates is underpinned by several ambitious projects. The Greater Noida West Metro, a key component of the region's transportation strategy, promises to enhance connectivity between Greater Noida and Delhi, easing commuter traffic and attracting businesses. The Multimodal Logistics Hub, designed to streamline goods transportation and storage, will position Greater Noida as a central logistics node. The dedicated Transport Hub will further integrate various modes of transport, facilitating smoother transit and boosting commercial activity. By aligning land rates with these anticipated developments, GNIDA aims to reflect the enhanced value these projects will bring to the region.

Implementation and Additional Charges

The new land rates will be detailed in an official order from GNIDA's finance department. Historical data shows that similar rate hikes in the past have led to increased property values, encouraging both residential and commercial investments. While the current 5.3% hike is described as modest, it signals a positive market outlook and confidence in Greater Noida's growth prospects. Property buyers should anticipate higher premiums, influencing their investment decisions.

Changes to One-Time Lease Rent

GNIDA's revision of the one-time lease rent payment scheme aims to standardize fees with the Noida Authority, increasing the multiplier from 11 to 15 times the annual lease rent. This change, effective three months post-announcement, provides a brief window for current allottees to benefit from the old rates. This adjustment brings Greater Noida's policies in line with broader regional practices, ensuring consistency and predictability for investors. The financial implications for businesses and investors are significant, as upfront payments now require a larger capital outlay, impacting their cash flow and investment strategies.

Increased FAR for Proposed Metro Route

An additional Floor Area Ratio (FAR) has been introduced for plots within 500 meters of the proposed metro route from Noida to Knowledge Park-5 in Greater Noida West. The increased FAR allowances are:

- Residential: 0.5

- Commercial: 0.2

- Institutional: 0.2 to 0.5

- Entertainment/Greenery: 0.2

- IT/ITES: 0.5

Increased FAR permits more construction on a plot, promoting denser development around the metro corridor, which is likely to boost real estate values and attract more investors to these areas.

Relief for Allottees Facing Delays

The extension of deadlines for executing lease deeds and obtaining completion certificates offers much-needed relief to property owners facing bureaucratic delays or financial constraints. These extensions, now until October 30, 2024, for lease deeds and June 30, 2026, for completion certificates, provide a buffer for allottees to comply with regulatory requirements without the immediate threat of allotment cancellation. This move is particularly beneficial for areas like Alpha, Beta, Gamma, Delta, and Swarn Nagri, where construction delays have been common. By addressing these delays, GNIDA demonstrates a commitment to supporting investors and maintaining confidence in the real estate market.

Addressing Land Allocation Issues

GNIDA's establishment of rates for plot size discrepancies under the farmer category addresses a longstanding issue. In the past, the absence of clear guidelines led to disputes and allocation challenges. The new policy, which bases prices on the nearest residential sector's rates, provides a transparent and consistent framework for resolving these issues. This move not only resolves allocation discrepancies but also fosters trust among stakeholders, ensuring a fair and equitable approach to land distribution.

Implications for Greater Noida’s Real Estate Market

The combined impact of GNIDA's recent decisions is likely to significantly shape Greater Noida's real estate landscape. The land rate hike, driven by infrastructure developments like the metro extension and logistics hub, is expected to enhance property values and attract a diverse range of investors. Increased FAR near the metro route encourages high-density development, potentially transforming these areas into dynamic urban centers. The revised lease rent scheme and extended deadlines provide flexibility for investors, ensuring continued interest in the market.

Investor sentiment remains positive, with real estate analysts predicting increased demand for properties in Greater Noida. The economic impact of these changes extends beyond real estate, potentially boosting local businesses, creating jobs, and driving overall economic growth. Comparatively, Greater Noida's proactive approach positions it favorably against other rapidly developing regions in India, such as Gurgaon and Hyderabad, which have also benefited from strategic infrastructure investments.

Conclusion

Greater Noida's real estate market stands on the brink of significant transformation, driven by GNIDA's strategic decisions and robust infrastructure development plans. The 5.3% land rate increase, coupled with new projects and policy adjustments, reflects a forward-looking vision for the region. As these changes take effect, stakeholders in the real estate sector must navigate the evolving landscape, leveraging new opportunities while adapting to regulatory adjustments. The future of Greater Noida appears promising, with enhanced connectivity, improved infrastructure, and a dynamic real estate market on the horizon. By fostering a conducive environment for investment and development, Greater Noida is poised to emerge as a leading urban center in the National Capital Region (NCR).

Image source- expertbricks.com