In a significant move to alleviate the tax burden on home buyers, the Indian government has amended the Long-Term Capital Gains (LTCG) regime for real estate. The recent changes allow taxpayers to choose between a lower tax rate of 12.5% without indexation or a higher rate of 20% with indexation for properties acquired before July 23, 2024. This dual-option approach offers substantial relief by enabling individuals and Hindu Undivided Families (HUFs) to compute their taxes under both schemes and pay the lower amount. The amendment was introduced through the Finance Bill 2024, representing a noteworthy shift in the country's tax policy on real estate.

Understanding the New LTCG Regime

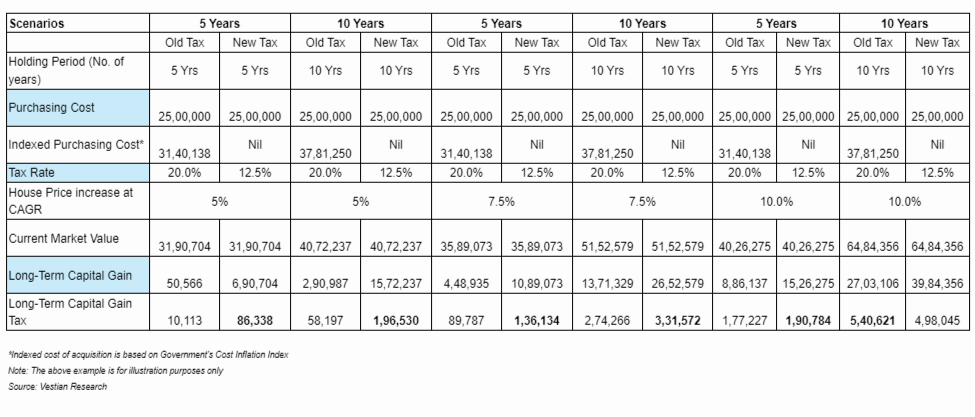

The revised LTCG regime for real estate marks a departure from the previous tax structure, which primarily relied on indexation to provide relief. Indexation adjusts the purchase price of an asset to account for inflation, thereby reducing the taxable capital gain. Under the new regime, taxpayers can choose between the traditional method of 20% with indexation or a simplified flat rate of 12.5% without indexation. This flexibility in the exempting provision applies to all property transactions finalized before the budget presentation on July 23, 2024.

"In the case of transfer of a long-term capital asset, being land or building or both, by an individual or HUF, which is acquired before the 23rd day of July, 2024, the taxpayer can compute his taxes under the new scheme [@12.5% without indexation] and old scheme [@20% with indexation] and pay such tax which is lower of the two," states the amendment.

Implications for Property Transactions

The amendment offers substantial relief on long-term capital gains for immovable property, especially for transactions finalized before the cut-off date. By allowing taxpayers to choose the lower of the two tax liabilities, the government aims to reduce the financial burden on home buyers and stimulate the real estate market. Properties acquired before 2001 will continue to benefit from indexation, ensuring that only recent acquisitions are subject to the new rules.

Before the Budget 2024, indexation benefits played a crucial role in helping homeowners reduce their tax liabilities. By increasing the property's cost basis to account for inflation, homeowners could effectively lower their net profit and the associated tax obligations. The recent changes, while offering a lower tax rate, also eliminate the complexity of calculating indexation for recent property transactions.

Broader Tax Reforms in Union Budget 2024

Finance Minister Nirmala Sitharaman's Union Budget 2024 introduced several significant tax-related announcements, of which the LTCG regime for real estate was a key highlight. Alongside this, the Budget made notable changes to the New Tax Regime, including an increase in the Standard Deduction to Rs 75,000 and revisions to the tax slabs.

Another major change was the increase in the securities transaction tax (STT) applicable to futures and options. The rates for the sale of options in securities rose from 0.0625% to 0.1% of the option premium, while the rates for futures increased from 0.0125% to 0.02%. These changes are expected to impact the trading volumes in the derivatives market, potentially leading to higher costs for traders.

Expert Opinion on New LTCG Regime

By Dharmendra Raichura – VP & Head of Finance at Ashar Group

"The government's decision to allow flexibility in LTCG tax calculation is a positive move for the real estate sector. Reinstating indexation is expected to have a significant impact, including increasing real estate investment by 20-25% according to Knight Frank, contributing to a 0.5-1% increase in GDP growth, and benefiting investors by adjusting the purchase price for inflation, reducing capital gains tax payable, and resulting in lower tax liabilities. The new LTCG regime offers a choice between a 12.5% tax rate and the previous 20% rate with indexation advantages, addressing concerns and providing stability. This amendment will mitigate the impact of potential tax hikes on older properties, support sustained growth in the real estate sector, with a reported 31% year-on-year increase in sales according to Anarock Group, and boost investment and growth, with over 10,000 monthly property registrations expected to continue. A stable and consumer-friendly tax regime increases confidence, leading to more investment in the real estate sector."

Shrinivas Rao, FRICS, CEO, Vestian

"Post removal of indexation benefits in the Union Budget 2024-25, investors adopted a wait-and-watch approach to reassess their investment strategies. However, the government's recent announcement to restore the indexation benefit is expected to boost supply in the secondary market and stabilize demand-supply dynamics by attracting investors. The investors now have two options to optimize their returns. They can evaluate the value of their assets at the time of sale to secure best returns on their investments.”

Vimal Nadar, Senior Director & Head of Research, Colliers India

“The government’s amendment to not enforce the revised taxation rules on long term capital gains arising out of sale of land & buildings retrospectively is expected to boost investors’ & homeowners’ sentiment and thus the real estate sector at large. The discretion to opt between higher tax rate with indexation and lower tax rate without indexation, whichever results in lower tax liability in property sales, aims to avoid higher tax expense in cases where the gains are not significant to offset the indexation benefits over time. The flexibility now provided to taxpayers to compute taxable gains under both the scenarios also removes administrative inconvenience and simplifies tax computation without any potential loss to the seller on properties acquired before July 23, 2024. At a time when housing sales are stabilising at higher levels than the past average, this amendment is timely and will aid in allaying concerns around taxability of capital gains.”

Capital Gains Tax on Shares and Stocks

The Union Budget also brought about changes in the capital gains tax for shares and stocks, increasing the rate from 10% to 12.5%. This elevation translates to a reduction in post-tax returns by 2.5%, impacting investors' net gains. The move aims to rationalize the tax structure and align it with the new LTCG regime for real estate.

Impact on the Real Estate Market

The revised LTCG regime for real estate is expected to have a positive impact on the market, particularly for home buyers and investors. By offering a lower tax rate and eliminating the complexities associated with indexation, the government aims to make real estate transactions more attractive. This could lead to increased demand for property, providing a much-needed boost to the sector.

Furthermore, the exempting provision ensures that transactions finalized before the cut-off date are not adversely affected by the new rules. This provision is particularly beneficial for individuals and HUFs who were in the process of acquiring property or finalizing transactions before the Budget announcement.

Conclusion

The amendments to the LTCG regime for real estate represent a significant step towards providing relief to home buyers and stimulating the real estate market. By offering a dual-option approach, the government has ensured that taxpayers can choose the most beneficial tax structure for their needs. The changes, coupled with broader tax reforms in the Union Budget 2024, reflect the government's commitment to creating a more streamlined and equitable tax system.

.png)