In a significant move to promote ease of doing business, the Securities and Exchange Board of India (SEBI) has updated the regulatory framework for Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs). The changes, effective immediately, address the nomination rights of unitholders in appointing directors to the boards of REITs and InvITs managers. This initiative is expected to enhance clarity and operational flexibility within these investment structures, which play a crucial role in the Indian real estate and infrastructure sectors.

Background and Current Framework

Under the existing regulations, unitholders who exceed a specified ownership threshold are entitled to nominate one director to the board of the REIT’s or InvIT’s manager. However, this nomination right has certain restrictions. Specifically, if an entity already has the right to nominate directors due to its status as a shareholder or lender, it cannot use its unitholder status to nominate directors.

This framework aimed to prevent conflicts of interest and ensure a balanced governance structure within REITs and InvITs. However, it also led to some ambiguities and operational challenges, particularly for entities with multiple roles within these investment structures.

New SEBI Guidelines

Responding to feedback from market participants, SEBI has introduced an exception to the current rules. According to the latest circulars issued by the regulator, if the right to appoint a nominee director arises from specific conditions outlined in the SEBI (Debenture Trustees) Regulations, 1993—such as defaults on payments or issues related to the creation of security—the restriction on unitholders nominating directors does not apply.

This amendment allows for greater flexibility and addresses concerns about the availability of nomination rights for unitholders who also have lender rights. By clarifying these provisions, SEBI aims to streamline the governance processes of REITs and InvITs, making it easier for these entities to operate and attract investment.

Implications for the Real Estate and Infrastructure Sectors

Enhanced Governance and Clarity

The updated guidelines provide much-needed clarity on the nomination rights of unitholders, particularly those who hold multiple roles within REITs and InvITs. By allowing unitholders to nominate directors based on their lender rights, SEBI ensures that these entities can maintain effective governance structures even in complex investment scenarios.

This change is expected to enhance the confidence of investors and other stakeholders in the governance mechanisms of REITs and InvITs. Improved transparency and operational clarity can attract more investments, fostering growth and development in the real estate and infrastructure sectors.

Impact on Investment Strategies

For investors, the ability to nominate directors based on lender rights can significantly impact their investment strategies. This flexibility allows investors to have a more active role in the management and oversight of REITs and InvITs, ensuring that their interests are adequately represented.

Moreover, the updated guidelines can lead to more dynamic and responsive governance structures. Investors who are also lenders can leverage their dual roles to influence strategic decisions, drive performance improvements, and mitigate risks more effectively.

Broader Market Impact

The real estate and infrastructure sectors are critical components of India's economy, contributing significantly to employment and GDP growth. By promoting ease of doing business within REITs and InvITs, SEBI's regulatory updates can have a broader positive impact on these sectors.

Enhanced governance and operational clarity can lead to increased investor confidence, driving more capital into real estate and infrastructure projects. This influx of investment can stimulate economic activity, create jobs, and support the development of vital infrastructure across the country.

Challenges and Considerations

Balancing Interests

While the updated guidelines offer greater flexibility, they also necessitate careful balancing of interests among various stakeholders. Ensuring that the nomination rights of unitholders do not lead to conflicts of interest or disproportionate influence is crucial for maintaining the integrity and fairness of governance structures.

REITs and InvITs managers will need to implement robust governance frameworks to manage the complexities arising from the dual roles of unitholders. This includes clear policies and procedures for director nominations, conflict resolution mechanisms, and ongoing monitoring of governance practices.

Adapting to Regulatory Changes

For market participants, adapting to the new regulatory landscape will require a thorough understanding of the updated guidelines and their implications. Legal and compliance teams will need to review and update internal policies, training programs, and governance frameworks to ensure full compliance with SEBI’s requirements.

Ongoing communication and engagement with SEBI and other regulatory bodies will also be essential for staying abreast of any further changes or clarifications. By proactively managing these regulatory adjustments, REITs and InvITs can minimize disruptions and continue to operate effectively.

Conclusion

SEBI's decision to tweak the guidelines for REITs and InvITs reflects its commitment to promoting ease of doing business and fostering a transparent and efficient investment environment. By addressing the nomination rights of unitholders and providing greater clarity on governance issues, SEBI aims to enhance the attractiveness of these investment structures and support the growth of the real estate and infrastructure sectors.

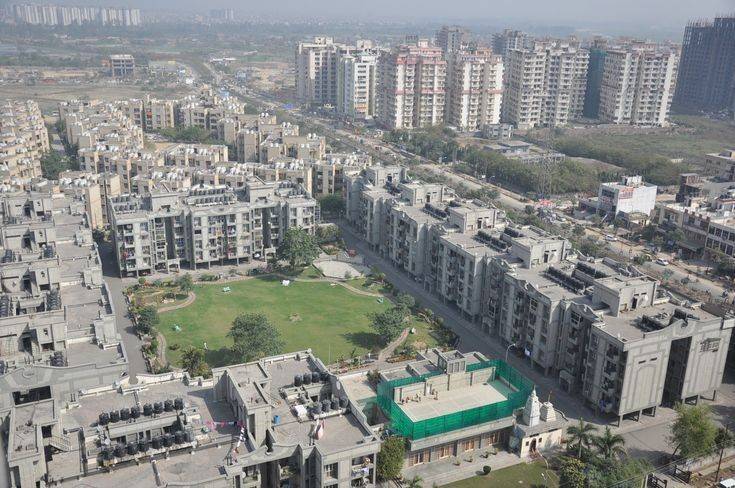

Image source- Pinterest

.png)