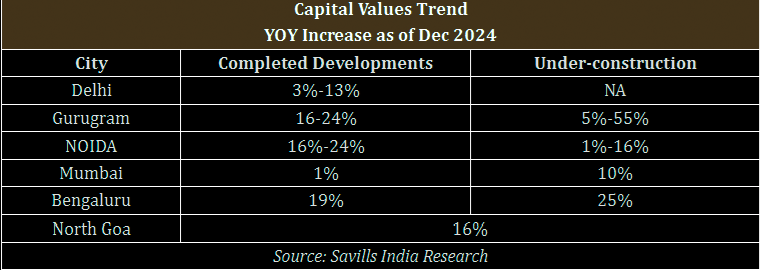

According to recent data by Savills India, residential projects in major cities have seen an average price increase of 55% in the under-construction segment, with several cities like Gurugram, Mumbai, and Bengaluru leading this price surge. These price trends, influenced by new developments and evolving buyer preferences, reflect the resilience and transformation of the Indian real estate market in 2024.

Gurugram and Mumbai Lead the Price Surge

Gurugram, often seen as one of the most dynamic real estate markets in India, has experienced the most significant appreciation in property values. Under-construction properties in Gurugram have surged by up to 55%, making it the frontrunner in this trend. This increase can largely be attributed to the city’s rising demand for high-end amenities and luxury residential spaces, which are becoming increasingly popular among investors and homebuyers. Key areas like Golf Course Road and Dwarka Expressway have shown consistent growth, with significant capital appreciation in both under-construction and ready-to-move-in properties.

Mumbai, too, has witnessed substantial growth in its under-construction property market, with an average 10% increase in prices over the past year. Despite Mumbai’s generally high property prices, the demand for larger, more luxurious homes continues to increase, driven by changing lifestyles such as the shift toward hybrid working models. The luxury market, in particular, is seeing robust growth, fueled by a combination of factors, including economic growth, growing affluence, and the need for spaces that align with modern, upscale lifestyles.

Bengaluru and North Goa: Emerging Property Hotspots

Bengaluru, known for its thriving tech industry, is experiencing an upswing in its premium residential sector. Under-construction properties have shown a 25% year-on-year price increase, signaling a robust market for luxury and high-end homes. The East and Central regions of Bengaluru are the main drivers of this growth, with areas like Central Bengaluru seeing remarkable increases of up to 31% in property values. Additionally, the completion of new metro routes and the rising demand for ready-to-move-in properties are further contributing to the appreciation in capital values. Bengaluru’s property market has gained momentum, particularly due to its role as a global tech hub and the influx of high-net-worth individuals (HNIs) seeking modern, convenient living spaces.

Meanwhile, North Goa, a prime location for luxury villas and second homes, has also seen a price hike of 16%. The appeal of Goa as a second home destination has grown significantly in recent years, with many affluent buyers from cities like Delhi, Mumbai, and Bengaluru investing in properties there. The appeal is not just limited to the lifestyle benefits of owning a property in a scenic, vacation-friendly location but also the potential for high rental yields. Moreover, the demand for modern, eco-friendly living has increased in Goa, particularly in gated communities with a focus on sustainability and green living, attracting buyers with a preference for eco-conscious luxury.

Delhi: A Stable Growth Market

In Delhi, the property market is seeing more moderate yet consistent growth. While under-construction properties have experienced a 9% increase in capital values, the market for ready-to-move-in properties has seen more notable growth, particularly in luxury independent floors, which have risen by 13%. The South-Central region has led the charge, with a significant rise in prices driven by high demand for spacious, premium homes. However, the overall growth pattern in Delhi is more stabilized compared to other cities, suggesting a more mature market that is not experiencing the same level of volatility.

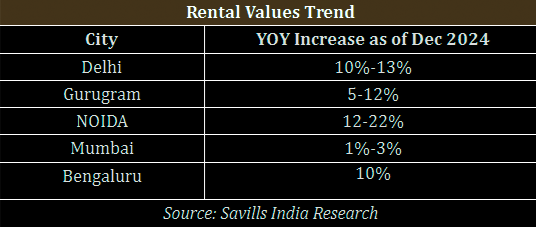

The rental market in Delhi also exhibited steady growth, with an average 9% increase in rental values. The South-East and Central areas have been the prime beneficiaries of this rise, particularly in terms of rental demand from professionals seeking well-located, upscale properties with modern amenities.

Noida: Growth and Promising Returns

Noida, in the National Capital Region (NCR), has also been on an upward trajectory, with a notable increase in property values, both for under-construction and completed properties. While the increase in capital values for completed properties ranged from 1% to 24%, the under-construction segment saw more substantial growth. Areas like the NOIDA-Greater NOIDA Expressway saw a 24% year-on-year rise in property prices. In particular, the NOIDA-Greater NOIDA Expressway micromarket, which benefits from proximity to key business hubs and improving infrastructure, has emerged as one of the top performers in terms of both capital appreciation and rental growth.

The rental market in Noida also experienced a notable uptick, with the NOIDA-Greater NOIDA Expressway seeing a 22% increase in rental values. This is attributed to high demand for residential properties in the region, driven by the growth of business districts and improved connectivity. With the availability of modern, amenity-rich homes, Noida continues to attract both buyers and renters, making it a promising destination for real estate investments.

Key Drivers Behind the Surge in Property Prices

Several factors have contributed to the surge in property prices across these regions, with the most significant being the growing demand for high-end residential properties. As India’s economy continues to show resilience, a larger segment of the population, particularly high-net-worth individuals, are investing in luxury properties that offer superior amenities, convenience, and quality.

The trend of hybrid working, which allows professionals to work remotely or in flexible office spaces, has further fueled the demand for larger homes in prime locations. In cities like Bengaluru, Mumbai, and Delhi, homebuyers are looking for properties that provide ample space for home offices, along with other luxury amenities such as gyms, swimming pools, and high-tech home automation systems.

Another key driver has been the increasing demand for ready-to-move-in properties. The preference for ready homes has grown significantly, particularly in Bengaluru, where the new metro routes and well-established infrastructure are making central locations more attractive. For many buyers, the appeal lies in the certainty of moving into a finished property rather than waiting for an under-construction project to be completed.

Additionally, the rise in construction costs has played a role in price hikes. The increased cost of materials and labor has led developers to increase prices for new projects to maintain profitability, contributing to the overall upward trend in property prices.

The Future Outlook for India’s Real Estate Market

The real estate market in India is expected to maintain its upward trajectory in the coming years, driven by continued demand for premium residential properties and luxury homes. The increase in the number of affluent buyers and the growing appeal of modern, well-equipped homes is likely to continue to shape the market. With several cities witnessing significant infrastructural development, such as new metro lines, expressways, and business districts, the real estate market in both completed and under-construction segments is poised for further growth.

.png)