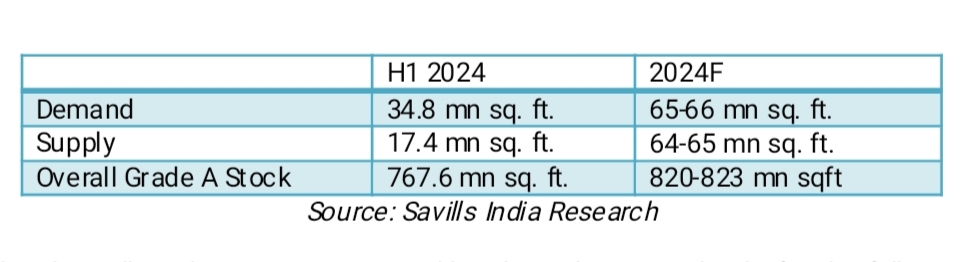

Office space absorption in India's six major cities reached a record high of 34.8 million square feet in the first half (H1) of 2024, according to international real estate advisor Savills India. This marks the strongest H1 ever recorded, representing a significant 29% increase compared to H1 2023.

Meanwhile, new office space supply witnessed a sharp decline of 32% year-over-year (YOY), with only 17.4 million square feet completed in H1 2024. This limited supply, coupled with increased transaction activity, led to a decrease in the overall vacancy rate. By the end of June, the vacancy rate had dropped to 15.9%, down from 18.0% in the previous year.

“India's office market saw record-high absorption in the first half of 2024, indicating positive business sentiment among occupiers. The return of employees to physical offices has spurred office demand across all occupier segments, including tech. The demand momentum is expected to continue through the second half, with the year anticipated to see new record absorption levels of 65-66 million square feet in 2024. We expect strong leasing activity from the tech, BFSI, flexible workspace, and manufacturing sectors," said Naveen Nandwani, MD, Commercial Advisory and Transactions, Savills India.

Looking ahead, Savills India anticipates record-breaking absorption levels for the full year, reaching approximately 65-66 million square feet. This would be the highest annual total ever recorded. However, new supply is expected to lag behind demand, potentially leading to an intensified competition for high-quality office spaces.

Looking ahead, Savills India anticipates record-breaking absorption levels for the full year, reaching approximately 65-66 million square feet. This would be the highest annual total ever recorded. However, new supply is expected to lag behind demand, potentially leading to an intensified competition for high-quality office spaces.

Key Highlights of H1 2024 for India office market

- Leasing activity in Q2 2024 reached 17.2 million square feet, reflecting a slight decrease of 2.0% compared to the previous quarter. However, new office space supply surged by 64% quarter-on-quarter to 10.8 million square feet.

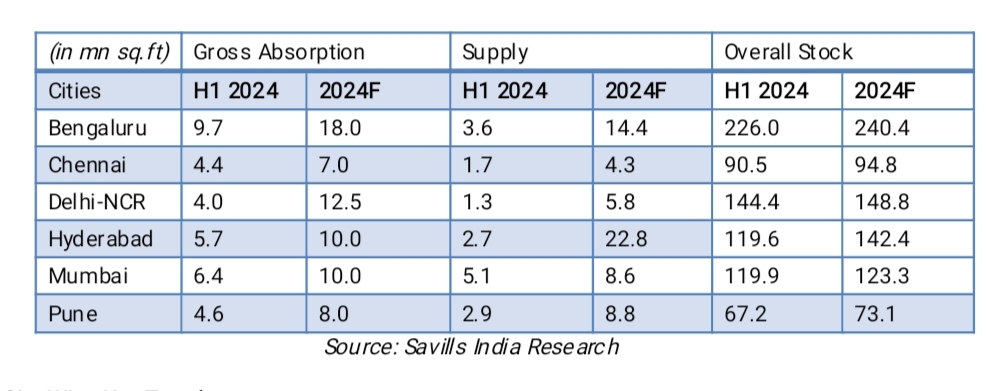

- Bengaluru maintained its position as the top contributor to national leasing activity in the first half of 2024, accounting for 28% of the market. Mumbai and Hyderabad followed closely behind with shares of 18% and 16%, respectively

- Mumbai's office market has shown a remarkable revival since the second half of 2023, with significant growth. The technology sector led the leasing activity, taking up 39.3% of the total space absorbed. The banking, financial services, and insurance (BFSI) sector followed at 16.9%, and flexible workspaces captured 13.9%.

- Mumbai stands out as the only city to witness a YoY increase in new office space supply during the first half of 2024. All other cities saw a decrease in new supply compared to the same period last year

- Year-over-year (YoY), leasing by the tech sector grew significantly by 61%, and the BFSI sector saw a 51% increase. However, the flexible workspace segment experienced a 16% decline in space take-up.

- Large deals (over 100,000 square feet) remained dominant in overall leasing activity this quarter, contributing 43.5% of all transactions.

City-Wise Key Trends

Mumbai: Gained market share to become the second-largest market in terms of total leased space (gross absorption). The financial services sector (BFSI) remained the dominant driver of demand (35%), followed by technology (tech) at 17%. Notably, smaller deals (<25,000 sq. ft.) accounted for the largest share (39%), followed by mid-sized deals (25,000-99,999 sq. ft.) at 36%.

Hyderabad: Maintained its position among the top 3 cities for office leasing. Large deals constituted a significant portion (62%) of the total absorption. The tech and healthcare & pharmaceutical sectors were the leading demand drivers (31% and 25% respectively), followed by flexible workspace providers and tech companies (18%).

Pune: Witnessed a remarkable 37% year-on-year (YoY) increase in gross absorption, securing the fourth position. This growth was primarily driven by increased space take-up by BFSI, IT-BPM, and engineering & manufacturing sectors.

Chennai: Experienced a slight decline (3% YoY) in leasing activity, with a total absorption of 4.4 million sq. ft. Tech companies were the primary driver (50%), followed by BFSI (15%).

Delhi-NCR: The tech sector, previously the main contributor to leasing activity, has been overtaken by the flexible workspace segment, which now holds a 32% share of gross absorption. Mid-sized deals (25,000-99,999 sq. ft.) dominated the leasing activity in the first half of 2024 (H1 2024).

Conclusion:

In the first half of 2024, India's office space market experienced unprecedented growth with a record absorption of 34.8 million square feet, a 29% increase from the previous year. Despite a significant decline in new office space supply, strong demand from sectors like technology, BFSI, and flexible workspaces has driven a decrease in vacancy rates. Looking ahead, Savills India projects that the year will end with record-high total absorption of 65-66 million square feet, although supply constraints may lead to heightened competition for high-quality office spaces. Major cities like Mumbai, Bengaluru, and Hyderabad continue to lead in leasing activity, with large deals and sector-specific demands shaping the market dynamics.

Cover image- pixabay.com

.png)