The Indian real estate market has witnessed a significant surge in under-construction property prices, as revealed by the latest Magicbricks PropIndex Report for April-June 2024. Across India's top 13 cities, prices rose sharply by 15.2% quarter-on-quarter, driven by dynamic shifts in demand and supply dynamics. This increase marks the highest in the past 24 months, reflecting robust consumer confidence and evolving market conditions.

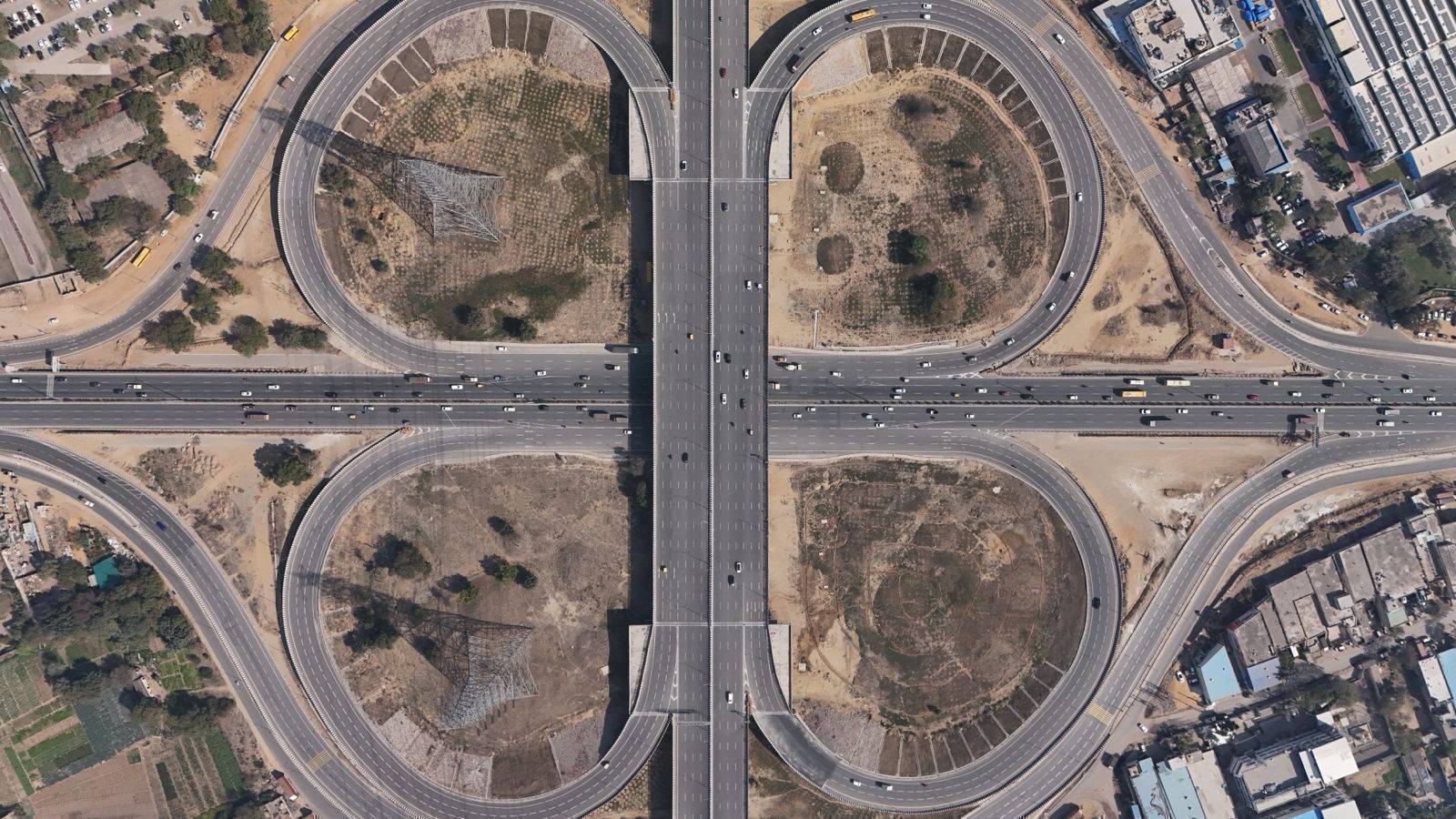

The report highlights varying growth patterns among cities like Gurugram, Noida, Mumbai, and Delhi, where infrastructure development and economic activities have propelled substantial price hikes. Conversely, cities such as Ahmedabad and Thane show more moderate growth despite steady demand-supply dynamics. As the market heads towards equilibrium with expanding supply, the role of economic indicators and policy changes will be pivotal in shaping future trends in India's residential real estate sector.

Demand and Supply Dynamics

The report indicates that this notable price increase reflects dynamic changes in demand and supply within the residential real estate market. From April to June 2024, the supply of under-construction properties rose by 11.72 per cent QoQ, marking the highest growth rate in residential supply over the past two years. This surge in availability has resulted in under-construction property prices surpassing those of ready-to-move properties in key cities such as Gurugram, Mumbai, Noida, and Thane.

Abhishek Bhadra, Head of Research at Magicbricks, commented on these trends, stating, “As we navigate through 2024, the Indian real estate market has entered its third year of a robust bull run. With a projected steady increase in supply and a more measured pace of demand growth, we expect the market to progress towards an equilibrium.”

Continued customer confidence in under-construction properties suggests a promising outlook for the residential real estate market in the long run. The report is based on the preferences of over 20 million customers on the Magicbricks platform and observed a consistent uptick in aggregate residential demand across the top 13 cities, registering a robust growth of 4.6 per cent QoQ.

Price Surge Across Cities

1. Ahmedabad

Ahmedabad experienced moderate market activity with a 3.5 percent QoQ increase in demand and a 6.3 percent QoQ rise in supply. Despite these changes, property prices saw only a slight uptick of 0.2 percent QoQ, indicating a relatively balanced market with stable growth patterns.

2. Bengaluru

Bengaluru’s real estate market presented a complex scenario with an 8 percent QoQ drop in demand. However, supply increased by 4.8 percent QoQ, and prices rose by 3 percent QoQ. This juxtaposition suggests that despite falling demand, the market remains robust, possibly due to continued infrastructure development and economic activities.

3. Chennai

Chennai noted significant demand growth of 11.9 percent QoQ, paired with a modest supply increase of 2.5 percent QoQ. Property prices in Chennai rose by 2.9 percent QoQ, reflecting healthy market conditions driven by strong consumer interest and limited supply expansion.

4. Delhi

Delhi witnessed a substantial 17 percent QoQ surge in demand, although supply declined by 3.9 percent QoQ. This discrepancy led to a price increase of 4.3 percent QoQ, highlighting the impact of supply constraints on property values in the capital city.

5. Greater Noida

Greater Noida’s real estate market showed robust performance with a 15.5 percent QoQ increase in demand and a 13.8 percent QoQ rise in supply. Prices climbed by 5.9 percent QoQ, indicating a well-balanced growth trajectory supported by both demand and supply dynamics.

6. Noida

Noida continued to exhibit strong demand growth of 16.4 percent QoQ, with a 7.3 percent QoQ increase in supply. Property prices in Noida saw the highest hike at 7 percent QoQ, driven by the city's rapid infrastructure development and increasing commercial activity.

7. Gurugram

Gurugram experienced the highest demand increase among all cities at 19.6 percent QoQ. Supply also rose by 5.3 percent QoQ, driving property prices up by 6.8 percent QoQ. The city’s strong infrastructure and commercial development continue to attract significant real estate investment.

8. Hyderabad

Hyderabad saw a slight demand increase of 1.5 percent QoQ, with supply and prices rising by 5.3 percent QoQ and 2.3 percent QoQ, respectively. The steady growth in both demand and supply suggests a stable market environment with moderate price appreciation.

9. Kolkata

Kolkata witnessed a 9.8 percent QoQ increase in demand, despite a slight supply decline of 0.9 percent QoQ. Property prices rose by 3.5 percent QoQ, indicating strong market demand outpacing the available inventory and driving up prices.

10. Mumbai

Mumbai recorded a 6.7 percent QoQ increase in demand, coupled with a 5.3 percent QoQ rise in supply. Prices increased by 6.5 percent QoQ, reflecting the city’s continued status as a prime real estate hotspot driven by robust economic activities and infrastructure development.

11. Navi Mumbai

Navi Mumbai noted a slight demand rise of 1.4 percent QoQ, despite a 4.2 percent QoQ supply decline. Prices increased by 1.7 percent QoQ, suggesting that limited supply has contributed to modest price appreciation in this satellite city.

12. Pune

Pune experienced a minimal demand increase of 3.2 percent QoQ and a negligible supply decrease of 0.1 percent QoQ. Despite these modest changes, prices rose by 2.1 percent QoQ, indicating a steady market with stable demand-supply dynamics.

13. Thane

Thane exhibited moderate demand growth of 2.1 percent QoQ, with supply surging by 15 percent QoQ. Despite the significant increase in supply, prices saw a slight rise of 0.7 percent QoQ, suggesting that the market is adjusting to the influx of new properties.

Conclusion

The Magicbricks PropIndex Report for April-June 2024 paints a dynamic picture of India's real estate market across its major cities. The key findings highlight a robust quarter-on-quarter increase of 15.2% in under-construction property prices, reflecting strong demand-supply dynamics. Several cities, including Gurugram, Noida, Mumbai, and Delhi, have seen substantial price hikes driven by significant demand and infrastructure developments. This contrasts with cities like Ahmedabad and Thane, where growth has been more moderate despite varying demand and supply dynamics.

Looking ahead, the market is expected to move towards equilibrium as supply continues to expand, potentially stabilizing price growth. Factors such as economic indicators and monetary policies will play crucial roles in shaping the future trajectory of India's residential real estate market. Overall, the report underscores the resilience and evolution of the sector amid changing economic landscapes and consumer preferences.

Image source- pixabay.com

.png)