In recent years, the landscape of real estate investment has been undergoing a profound transformation with the advent of real estate crowdfunding platforms. These online platforms have democratized access to real estate investments, allowing individuals to participate in lucrative projects with lower capital requirements. This article explores the emergence of real estate crowdfunding platforms, their inner workings, and the implications for both investors and the real estate market.

Understanding Real Estate Crowdfunding Platforms:

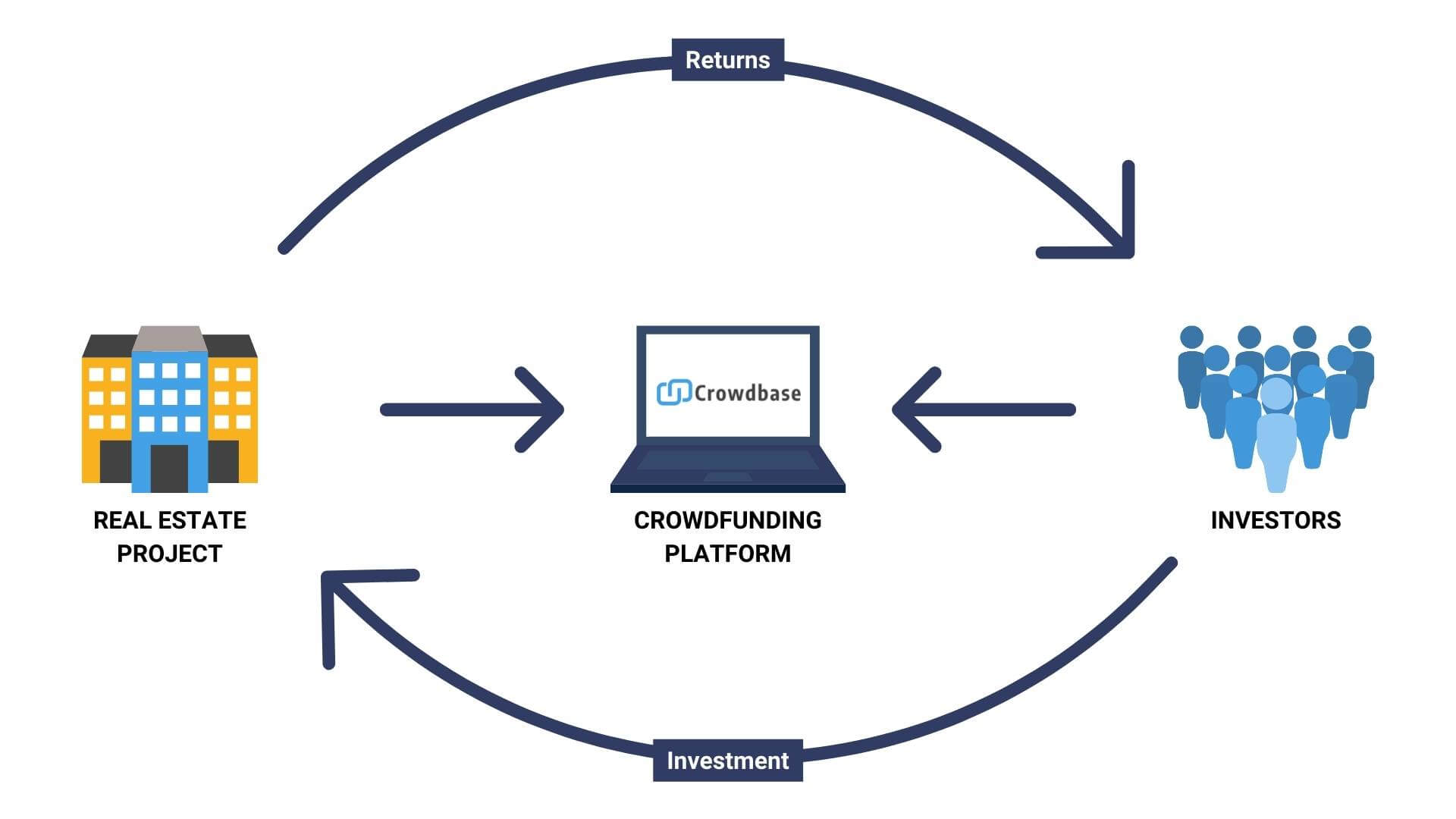

Real estate crowdfunding platforms serve as intermediaries, connecting investors with real estate developers and property owners seeking funding for their projects. Through these platforms, investors can browse a variety of investment opportunities, ranging from residential developments to commercial properties. Each project typically has a specified funding target and timeline, offering investors the opportunity to contribute capital in exchange for an equity stake or fixed returns.

These platforms leverage the power of technology to streamline the investment process, offering investors access to a diverse range of real estate projects with just a few clicks. By pooling funds from numerous investors, real estate crowdfunding platforms enable individuals to participate in projects that would traditionally be out of reach due to high capital requirements.

For real estate developers and property owners, crowdfunding platforms offer an alternative source of financing that bypasses traditional lending institutions. By tapping into a larger pool of potential investors, developers can access capital more quickly and at potentially lower costs, accelerating the pace of project development.

Who Are the Key Players?

In India, commercial real estate crowdfunding typically involves three key players: the developer, the investors, and the crowdfunding platform. The developer proposes a real estate project and lists it on a crowdfunding platform, outlining the project’s details, expected returns, and required minimum investment. Interested investors can then browse the available projects on the platform and choose the one that best fits their investment objectives.

Advantages of Real Estate Crowdfunding Platforms

1. Access to Diverse Investment Opportunities: Crowdfunding platforms provide investors with access to a wide range of real estate projects, including residential, commercial, and mixed-use properties. This diversification allows investors to spread their risk across multiple assets and markets.

2. Lower Barrier to Entry: Crowdfunding platforms enable investors to participate in real estate investments with lower capital requirements compared to traditional methods like direct property ownership. This accessibility opens up real estate investment opportunities to a broader range of individuals.

3. Transparency and Due Diligence: Many crowdfunding platforms offer transparency in the form of detailed project information, financial projections, and risk assessments. Investors can conduct thorough due diligence before making investment decisions, thereby reducing uncertainty and mitigating risks.

4. Easier Portfolio Management: Crowdfunding platforms often provide tools and features for easy portfolio management, allowing investors to track their investments, monitor performance, and receive regular updates. This convenience simplifies the process of managing real estate investments, especially for those with smaller portfolios.

5. Potential for Higher Returns: Real estate crowdfunding can offer attractive returns compared to traditional investment options like stocks or bonds. Investors may benefit from rental income, property appreciation, and other profit-sharing mechanisms, depending on the investment structure.

6. Diversification: By investing in multiple properties or projects through crowdfunding platforms, investors can achieve greater diversification within their investment portfolios. Diversification helps spread risk and reduce the impact of any single investment underperforming.

7. Flexibility and Control: Crowdfunding platforms give investors the flexibility to choose which projects to invest in and how much to invest. Investors have control over their investment decisions and can tailor their portfolio to align with their financial goals and risk tolerance.

8. Support for Real Estate Developers: For real estate developers, crowdfunding platforms offer an alternative source of financing that bypasses traditional lending institutions. Developers can access capital more quickly and at potentially lower costs, accelerating project timelines and increasing efficiency.

Different Real Estate Crowdfunding Platforms in India

1. Property Share:

Property Share is a pioneering real estate crowdfunding platform in India that allows investors to invest in high-quality properties across major cities like Mumbai, Bangalore, and Delhi NCR. The platform offers fractional ownership, enabling investors to participate in properties with relatively smaller investments compared to direct ownership. Property Share focuses on income-generating assets such as commercial properties and rental residential properties, providing investors with regular rental income and potential capital appreciation.

2. RealX:

RealX is a digital platform that facilitates fractional ownership and trading of real estate assets. It connects property owners, developers, and investors, allowing them to buy, sell, and trade fractional ownership stakes in properties. RealX offers liquidity to real estate investors by enabling them to exit their investments through secondary market transactions. The platform caters to both individual investors and institutional players, providing a transparent and efficient marketplace for real estate transactions.

3. Strata:

Strata is an innovative real estate investment platform that allows investors to buy fractional ownership stakes in properties. The platform focuses on residential properties in high-demand locations, offering investors the opportunity to participate in the Indian real estate market with lower capital requirements. Strata emphasizes transparency and asset quality, providing detailed information and due diligence reports for each investment opportunity.

4. PropertyCrowd:

PropertyCrowd is a real estate crowdfunding platform that enables investors to pool their funds to invest in curated real estate projects across India. The platform offers a range of investment opportunities, including residential developments, commercial properties, and mixed-use projects. PropertyCrowd conducts thorough due diligence on each project and provides investors with regular updates on their investments' performance. The platform aims to democratize real estate investment in India and provide investors with access to high-potential opportunities.

5. Assetmonk:

Assetmonk is a real estate investment platform that focuses on curated investment opportunities in emerging markets across India. The platform offers fractional ownership of properties in sectors such as residential, student housing, and co-living spaces. Assetmonk employs a data-driven approach to select investment opportunities with strong growth potential and attractive returns. The platform also provides investors with comprehensive support and assistance throughout the investment process.

These Indian real estate crowdfunding platforms leverage technology and innovative business models to democratize access to real estate investment opportunities in the country. By offering fractional ownership, transparent due diligence, and efficient transaction processes, these platforms empower investors to build diversified real estate portfolios and participate in India's dynamic real estate market.

Global Market Potential and Growing Demand in India

The global real estate crowdfunding market is poised for significant growth, with projections estimating its size to reach around USD 1,743.13 billion by 2030, at a remarkable compound annual growth rate (CAGR) of approximately 58.10% between 2023 and 2030. Real estate crowdfunding involves pooling funds from multiple investors through online platforms to finance real estate projects, offering a diversified investment avenue. This market expansion is attributed to several factors:

According to a KPMG report, the Indian real estate sector has seen a significant shift toward the use of technology, with the introduction of real estate crowdfunding platforms serving as a key driver of this transformation. According to the report, the Indian real estate crowdfunding market is expected to be worth $2.5 billion by 2025, with a compound annual growth rate (CAGR) of more than 20%.

The Prospects of Real Estate Crowdfunding in India

Fueled by government initiatives promoting affordable housing and the digital economy's rise, crowdfunding offers an appealing investment avenue for both investors and developers.

Diversification of Investment Portfolios:

Real estate crowdfunding facilitates portfolio diversification by allowing individuals with limited capital to access real estate investments. Previously, high capital requirements restricted real estate investment accessibility, but crowdfunding now enables broader participation, aligning with diverse financial goals.

Transparency and Accountability:

The transparency inherent in real estate crowdfunding processes fosters investor confidence. Investors can monitor project progress and receive regular updates, enhancing accountability for both investors and developers. This transparency builds trust and ensures alignment of interests among stakeholders.

Efficient Funding Mechanisms:

Crowdfunding enables developers to access funding from a larger investor pool, reducing borrowing costs compared to traditional bank loans. Leveraging technology in the crowdfunding process streamlines funding procedures, minimizing time, costs, and paperwork. As India embraces a digital economy, technological advancements further enhance crowdfunding efficiency.

Conclusion:

Real estate crowdfunding platforms represent a paradigm shift in the world of real estate investment. These platforms have democratized access to lucrative real estate opportunities, allowing individuals to diversify their investment portfolios and participate in projects previously reserved for institutional investors. As the popularity of real estate crowdfunding continues to grow, it is poised to reshape the dynamics of the real estate market, fostering innovation, transparency, and inclusivity in the investment landscape. Investors and developers alike stand to benefit from the myriad opportunities presented by this emerging trend in real estate finance.

Images- mckissock.com,bizjournals.com, crowdbase, jeangalea

.png)