Embassy Developments’ Mumbai Luxury Push: Key Highlights

- ₹7,000 Crore Investment Plan: Embassy Developments Ltd (EDL) plans to invest over ₹7,000 crore in the Mumbai Metropolitan Region, including ₹4,500+ crore for three new luxury residential projects and ₹2,500 crore to complete existing developments.

- Three High-Value New Projects: New launches in Worli, Juhu, and Alibaug will together span 1.58 million sq ft with a combined GDV exceeding ₹12,000 crore, targeting HNW and ultra-HNW buyers from Q4 FY26 onwards.

- Worli as the Flagship Bet: The Embassy Citadel, Worli, is an ultra-luxury project with a GDV of ₹8,800+ crore, featuring large-format residences, triplex mansions, and expansive amenities—positioned in India’s most dominant ultra-luxury micro-market.

- Disciplined Expansion Strategy: EDL’s Mumbai entry reflects a selective, execution-led growth approach, backed by a strengthened balance sheet, completion of delayed legacy projects, and a long-term vision to build a pan-India premium residential platform.

Bengaluru-based realty firm, Embassy Developments Ltd (EDL), plans to invest more than ₹4,500 crores in three prime residential projects in Worli, Juhu, and Alibaug in the Mumbai Metropolitan Region (MMR), as announced by the company on Jan 20. Meanwhile, ₹2,500 crores will also be infused in MMR for completion of existing projects.

These three new projects are expected to have a gross development value of over ₹12,000 crores, spread over 1.58 million square feet. The company plans to launch these projects from Q4 of FY26 and expects to target HNWs looking for luxury and lifestyle-oriented residential properties.

Details of projects:

- Worli – Embassy Citadel: Ultra-luxury project with a GDV value of over ₹8,800 crore. Spread over 1 million sq ft of RERA carpet area, this development will come up with one tower offering three-, four-, and five-bedroom units and two triplex mansion homes. Annual amenities space is over 1 lakh sq ft. The property is located in close proximity to the Four Seasons hotel.

- Juhu project: 0.33 million sq ft of RERA carpet area, and the estimated gross developable value is set to be ₹3,000 crores. This project includes the development of approximately 50 units of dwelling units catering to multi-generational family units. This is yet to receive government approvals.

- Alibaug Development: This project consists of a lifestyle development and a second home project for people who would like to have a resort living closer to Mumbai. This low-rise project has 0.2 million sq ft of RERA carpet area and a GDV of approximately ₹400 crores, pending approvals.

Besides these, EDL is planning to invest in completion of three old projects in MMR, totaling about 5,000 homes. This comes after they completed and delivered six very delayed projects in the residential segment, including three in Mumbai, namely Worli, Lower Parel, and Thane, impacting more than 3,300 families.

Commenting on the expansion, Jitu Virwani, Chairman of Embassy Developments Ltd, said, “For over three decades, the Embassy has focused on creating developments that endure, both in quality and in the way they shape neighbourhoods. Bringing this legacy to Mumbai marks an important step in building a strong pan-India residential presence, grounded in the confidence we have built through consistent execution.”

Aditya Virwani, Managing Director, added, “Mumbai represents the country’s most mature residential market, where discerning buyers place a premium on execution quality, credibility and long-term commitment. Our approach is measured, with a focus on a limited set of high-conviction projects rather than volume-driven growth. With a strengthened balance sheet and clearer development visibility, Mumbai will form a central pillar of EDL’s next phase of expansion.”

The investment is quite timely. Worli has emerged as the capital of India’s ultra-luxury housing market, outpacing every metropolitan pocket from Bengaluru’s tech corridors to Delhi’s high-power diplomatic zones. According to new data from ANAROCK and 360 One Wealth, the Mumbai neighbourhood has single-handedly rewritten the country’s premium real estate hierarchy, accounting for nearly half of all Indian residential transactions above ₹40 crore.

Over the past two years alone, Worli has witnessed the sale of more than 30 ultra-premium homes, each priced above ₹40 crore, cumulatively generating over ₹5,500 crore. In a market where luxury sales are usually spread across several metros, Worli’s dominance signals a profound shift in wealth clustering, investor sentiment and the geography of Indian affluence.

A Micro-Market of Record-Breaking Deals

Across India’s luxury real estate landscape, no neighbourhood has demonstrated the consistency or velocity of Worli’s high-value transactions. The locality has also recorded more than 20 residential deals exceeding ₹100 crore in the past three years—a benchmark typically seen only in global real estate capitals.

One of 2025’s costliest deals also unfolded here: two super-luxury duplexes sold for over ₹700 crore, reaffirming Worli’s status as India’s most preferred address for the ultra-wealthy, including industrialists, fund managers, startup founders, and next-gen family office heads.

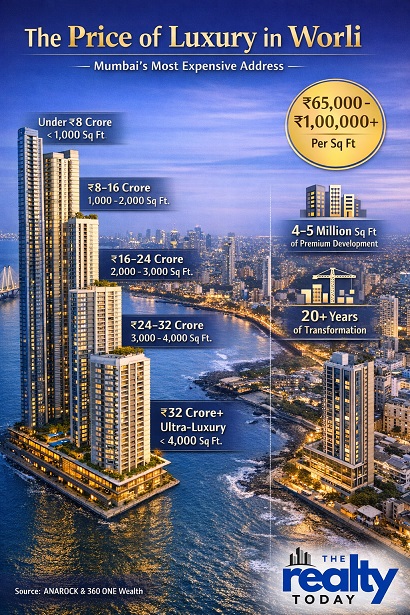

Premium high-rise residences in Worli today command between ₹65,000 and ₹1,00,000+ per sq ft, placing the locality in the same league as international hotspots such as New York’s Lower Manhattan or London’s Mayfair.

The submarket is characterized by a very steep price-to-size gradient of the houses. Properties worth less than ₹8 crore are, in all probability, less than 1,000 sq ft in area, while the area of the ₹8–16 crore range is 1,000–2,000 sq ft. The value of the rich homes is typically around ₹16–24 crore with roughly 2,000–3,000 sq ft, and those from ₹24 to 32 crore are further elongated to 3,000–4,000 sq ft.

Besides that, ultra-luxury homes that are priced at over ₹32 crore are less than 4,000 sq ft. The division here shows not only the vertical land scarcity but also the high price that buyers are willing to pay to live in this very popular micro-market. Two decades of infrastructure and residential transformation—from erstwhile industrial clusters to curated lifestyle zones—have resulted in 4–5 million sq ft of premium residential and retail space currently under development.

EDL has forecast pre-sales of approximately ₹5,000 crores for FY26 due to launch plans and a land bank of over 3,000 acres. So far, it has delivered over 75 million sq ft of commercial space for sale across 22 locations, including Bengaluru, MMR, Delhi-NCR, Chennai, and Indore.

The move marks a substantial foray into Mumbai’s luxury residential space and reflects not only an increased desire for such property in prime locations, but also a strategy for disciplined growth on the part of EDL. Experts state that instead of targeting broad audiences in saturated markets such as Mumbai, adopting a more refined approach can also allow developers to retain pricing power for their products.

.png)