The Reserve Bank of India (RBI) has decided to keep the repo rate at 6.5% in its fifth bi-monthly Monetary Policy Committee (MPC) meeting of the current financial year. This is the 11th consecutive time since February 2023 that the central bank has maintained the benchmark interest rate, signaling its focus on financial stability amid changing economic conditions.

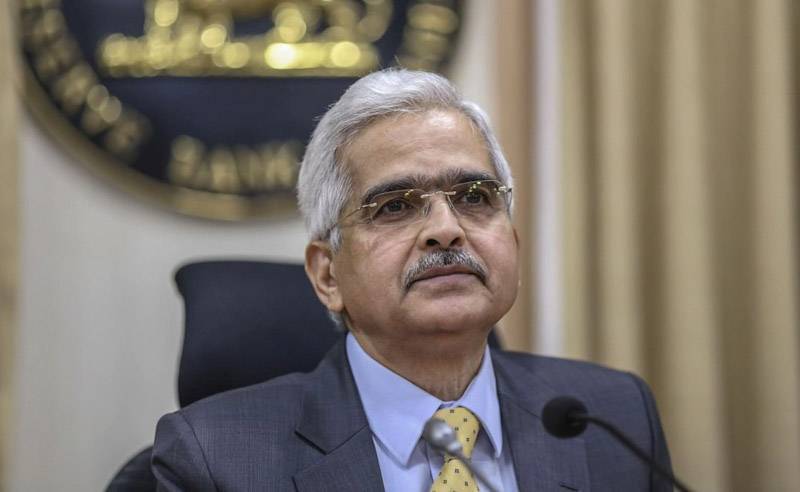

RBI Governor Shaktikanta Das, in his statement after the three-day meeting, highlighted the need to balance inflation control with economic growth. The unchanged repo rate provides stability to borrowers, helping sectors like housing and consumer credit. This meeting also included inputs from three new external MPC members — Ram Singh, Saugata Bhattacharya, and Nagesh Kumar. Their perspectives contribute to the monetary policy process, addressing both global uncertainties and domestic challenges.

By keeping the repo rate steady, the RBI aims to manage inflation while supporting economic recovery. The decision to maintain the rate since early 2023 shows the central bank's focus on maintaining macroeconomic stability and promoting growth.

Industry Expert Opinions

Mr. Pradeep Aggarwal, Founder & Chairman, Signature Global (India) Ltd

“The Apex Bank’s decision to maintain the repo rate at 6.5% while reducing cash reserve requirement by 50 basis points, reflects a balanced and prudent approach to sustaining economic stability while fostering growth. This continuity provides a stable environment for the real estate sector, enabling developers to plan with confidence and homebuyers to benefit from favorable borrowing costs. However, a rate cut in the future could infuse much-needed liquidity into the real estate sector, accelerating growth and enhancing accessibility for buyers. As India continues to experience robust economic activity, this stable monetary stance will act as a catalyst for long-term growth and investment across industries.”

Mr. Mohit Malhotra, Founder & CEO, NeoLiv

"The RBI's decision to hold the repo rate at 6.5% is a positive sign for the real estate sector. This continued stability in interest rates will make owning a dream home possible. We expect this to translate into increased buyer confidence and a positive impact on home-buying decisions. This, in turn, will encourage new age funds and development companies to fuel further investment in the real estate sector, contributing to its overall health and India's economic well-being."

Mr. Varun Sharma, Founder and Managing Director, MVN Infrastructure

"The RBI’s prudent decision to keep the repo rate unchanged will instill confidence in homebuyers and investors, providing a significant boost to the real estate market by fostering a climate of growth and stability. This move will especially benefit the luxury housing segment, where demand for exclusive high-end properties is set to soar, driving growth not only in metro cities but also in emerging luxury markets across India."

Mr. Sanjay Kumar Sinha, Founder and Managing Director, Chaitanya Projects Consultancy

"The RBI's decision to maintain the repo rate at 6.5% with a neutral stance reflects a strategic approach to balancing inflation management with economic stability. While a rate cut could have further bolstered economic activity, this policy in stills confidence among infrastructure, EPC (engineering, procurement, and construction), and real estate sectors that rely heavily on debt financing. By signaling a stable economic environment, it encourages private investment in infrastructure, complementing sustained government support and fostering long-term growth opportunities."

Mr. Madhur Gupta CEO Hero Realty

"With the repo rate remaining unchanged at 6.5%, the real estate sector stands to benefit from continued stability. For developers, this means sustained demand for residential properties, particularly in the premium segment, as home loan rates stay attractive. This stability fosters confidence in the market, allowing developers to plan and execute projects that align with buyer preferences the unchanged repo rate provides the assurance needed to drive more investment and development, ensuring the sector remains on a steady growth trajectory. As India’s economy expands, the real estate sector is playing a bigger role, with the unchanged repo rate helping to maintain demand and support the country’s economic progress."

Mr. Ashwin Chadha, CEO, India Sotheby's International Realty

"RBI's decision to keep the repo rate unchanged is a balanced step in managing inflation. For the real estate sector, this stability ensures unchanged mortgage rates and supports the robust demand we've been witnessing in housing sales, particularly in the premium and luxury segments. With inflationary pressures under check and buyer confidence holding steady, we remain optimistic about continued momentum in the market, driving long-term growth."

Mr. Shrinivas Rao, FRICS, CEO, Vestian

“As expected, RBI kept the repo rate unchanged at 6.5% for the 11th consecutive time, keeping the investor sentiment stable for real estate. This decision could be attributed to global macroeconomic uncertainty, escalating geopolitical conflicts, and headline inflation in October 2024 crossing the RBI’s upper tolerance limit of six percent. However, the central bank eased the monetary policy by reducing the CRR (Cash Reserve Ratio) by 50 bps to 4% as GDP slowed down to 5.4% in Q2 FY25. This may boost the liquidity in the market and help the GDP grow.”

Mr. Yashank Wason, Managing Director, Royal Green Realty

“We welcome the MPC’s decision to keep repo rates unchanged. This reflects a strong commitment towards economic stability. The move is a positive note for the housing segment, which has lately showcased a robust performance. By keeping repo rates unchanged, the confidence among homebuyers continues to be stable, further encouraging a strong environment for potential home loan borrowers. This will further contribute to the real estate sector’s growth, positively influencing the country’s GDP and the economy."

Mr. Viren Mehta, Director, ElitePro Infra

"The real estate industry applauds the RBI's decision to keep the repo rate steady. Lending rate stability guarantees purchasers' affordability, which in turn boosts the residential demand. Additionally, this consistency gives developers the assurance they need to plan projects without worrying about growing funding expenses. A stable repo rate encourages investments in residential and commercial real estate and supports the sector's recovery and growth trajectory. As real estate consultants, we see this as a chance to increase momentum and fortify the market's ability to withstand economic uncertainty."

Mr. Sudeep Bhatt, Director Strategy, Whiteland Corporation

“The RBI’s decision to keep repo rates unchanged is a positive development for the real estate sector. It reflects the RBI’s commitment to fostering national growth through an expansionary policy. Stable home loan rates are expected to create a favourable environment for increased housing demand. In Gurugram’s luxury housing market, this decision is likely to drive substantial growth. Homebuyers now have an ideal opportunity to take advantage of the steady interest rates and turn their dream of owning a home into reality.”

Mr. Vimal Nadar, Head of Research at Colliers India

"The RBI, in its last MPC meeting of 2024, has maintained a neutral stance keeping repo rate unchanged at 6.5%. The Central Bank taking note of recent aberrations in inflation and growth, has toned down FY 25 projections, revising GDP growth forecast downwards and inflation forecast upwards to 6.6% and 4.8% respectively. Stable repo rate translates into stability in interest rates and augurs well for the Indian real estate sector. Housing sales across major cities of the country are likely to end on a strong note in 2024. Additionally, developer confidence in residential and commercial segments will continue to reflect in healthy launches of residential units and Grade A office completions in the near term."

Mr. Ashish Sharma, AVP Operations, Brahma Group

“We welcome the RBI's decision to maintain the repo rate at 6.5% for the eleventh consecutive time. This continued stability in interest rates instills confidence in the real estate sector, ensuring that loan interest rates remain steady for both residential and commercial properties. Furthermore, the RBI’s stance will help both developers and homebuyers plan their financial commitments with certainty. We believe this will further drive momentum in the real estate market, stimulating investments and contributing to overall economic growth. Moreover, with a stable macroeconomic environment, we remain optimistic about the continued growth prospects for the real estate industry.”

Mr. Manik Malik, CFO, BPTP

"The RBI's decision to maintain the repo rate at its current level is a welcome move for the real estate sector, offering much-needed relief to both developers and homebuyers. Stable rates are likely to keep home loan interest rates steady, ensuring affordability for buyers and sustaining consistent demand across housing segments. This decision not only builds customer confidence, encouraging more investments in real estate, but also helps developers manage financial costs more effectively, enabling smoother project execution. Overall, it enhances market stability, fostering an environment that supports homeownership aspirations and drives long-term growth for the industry."

Way Forward

The RBI's decision to maintain the repo rate at 6.5% is expected to continue supporting economic stability and growth across key sectors, especially real estate. By providing a predictable borrowing environment, the policy will help developers and homebuyers plan with confidence, encouraging investment and fostering long-term growth. The sustained stability in interest rates is likely to drive demand, particularly in the housing market, including luxury segments, and boost investor sentiment.

As inflation remains under control and growth momentum is maintained, the real estate sector is poised to benefit from this stability. Developers can expect improved project execution, while homebuyers will find an opportunity to secure affordable financing. In the coming months, this consistent policy stance will contribute to a favorable market environment, supporting the continued expansion of the real estate sector and the broader Indian economy.

Cover Image- ndtvprofit.com

.png)