A recent report highlights a steady surge in residential project completions across India’s top nine cities, with over 10 lakh homes delivered between FY23 and FY25. This delivery boom is attributed to improved regulatory compliance under RERA and the catalytic impact of the SWAMIH fund, which has supported the completion of several delayed housing projects.

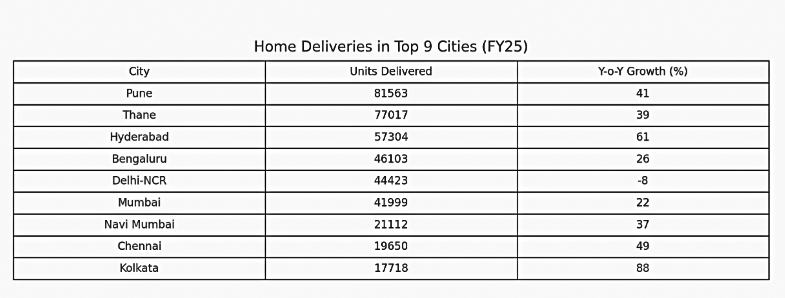

According to data shared by PropEquity, housing deliveries jumped 33% in FY25, reaching 4,06,889 units. Among the cities, Kolkata registered the highest year-on-year growth at 88%, while Delhi-NCR witnessed an 8% decline. The delivery of homes launched in 2018–19, whose construction timelines were impacted by the pandemic, has now gained momentum, contributing to this uptrend.

Samir Jasuja, Founder and CEO of PropEquity, noted, “The cause of this surge is due to the delivery of homes launched in 2018/19, the construction of which experienced some slowdown due to the pandemic and other factors. The deliveries have also been expedited due to government’s SWAMIH (Special Window for Affordable and Mid-Income Housing) Fund. The strict compliance and implementation under RERA have also played a major role in developers adhering to project delivery timelines.”

The southern cities of Bengaluru, Chennai, and Hyderabad accounted for a combined 30% of the total deliveries, up from 28% in the previous fiscal year. In particular, Bengaluru saw a 26% increase, delivering 46,103 units. Umesh Gowda HA, Chairman and Founder of Sanjeevini Group, highlighted the momentum in the city, stating “With over 80k homes being delivered in the last two financial years in Bengaluru shows the growing focus of city developers on construction and delivery. Game-changing reforms like RERA and SWAMIH fund have accelerated the delivery of homes amidst soaring demand from growing corporate presence and employment. Micro-markets in the periphery like Varthur and Gunjur are amongst the top priority markets for residential demand as developers focus on expediting construction, ensuring quicker delivery and enhancing brand equity.”

Meanwhile, Delhi-NCR was the only metro to record a decline, with 44,423 homes delivered in FY25 compared to 48,356 units in FY24, reducing its share to 11% from 16%. However, industry experts see this as a temporary dip rather than a slowdown in market sentiment. Vijay Harsh Jha, Founder and CEO of VS Realtors, observed, “Delhi-NCR, despite seeing some decline in FY25, saw an unprecedented number of homes being delivered. This signals the growing certainty and confidence in the real estate sector which will help attract more capital from both domestic and global investors.”

Pune led all cities in terms of volumes with 81,563 homes delivered, marking a 41% year-on-year growth. It was followed by Thane with 77,017 units (39% growth), Hyderabad with 57,304 units (61% growth), and Mumbai with 41,999 units (22% growth). Other notable performers included Navi Mumbai (21,112 units, 37% growth), Chennai (19,650 units, 49% growth), and Kolkata (17,718 units, 88% growth).

The ongoing improvement in project execution is also being fueled by healthy cash flows and the growing dominance of branded developers. As consumer sentiment remains positive and institutional funding becomes more accessible, housing delivery momentum is expected to remain strong in the near future. Jasuja added that the upcoming SWAMIH 2.0 fund will likely enhance this trend by targeting stalled projects and driving them to completion.

.png)