Buying a home is a significant decision, yet the complexities of the process can be overwhelming. Delays, incomplete projects, and financial uncertainties are common challenges faced by homebuyers. To address these issues and enhance buyer protection, the Maharashtra Real Estate Regulatory Authority (MahaRERA) has drafted a three-level scrutiny process for housing project registrations.

Understanding the Three-Level Scrutiny

MahaRERA's three-level scrutiny process is a comprehensive review system designed to safeguard the interests of homebuyers and developers, enhancing the credibility of housing projects. This process involves a thorough examination of legal, financial, and technical aspects before a project is granted registration. Each level of scrutiny serves a distinct purpose, creating a robust framework that aims to ensure transparency, reliability, and safety in the real estate sector.

# Legal Scrutiny

Legal scrutiny is the first and foundational layer of MahaRERA's three-level scrutiny process. This stage involves a meticulous examination of the legal aspects surrounding a housing project. Key components of legal scrutiny include:

1. Land Ownership Verification: MahaRERA investigates the ownership of the land on which the project is planned. This includes checking for any disputes, encumbrances, and litigations related to the property. The goal is to ensure that the land title is clear and free from legal complications that could affect the project's progress or legality.

2. Director and Developer Credentials: The regulatory authority validates the Directors Identification Number (DIN) of both the developer and its directors. This involves cross-referencing their involvement in other projects and checking for any legal issues or past misconduct. This step adds an extra layer of transparency and ensures that only credible developers with a clean track record are allowed to proceed.

3. Legal Title Report: MahaRERA reviews the legal title report, which provides detailed information about the land's legal status. This report includes data on past ownership, any existing liens or mortgages, and other legal encumbrances. Ensuring a clear legal title helps prevent future disputes and assures homebuyers of the project's legitimacy.

# Financial Assessment

The financial assessment is the second layer of scrutiny, focusing on the project's economic viability and the developer's financial health. Key aspects of financial scrutiny include:

1. Financial Encumbrance Status: Developers are required to provide a detailed statement of the financial encumbrance status of the project. This includes any existing loans, mortgages, or other financial obligations tied to the project. The aim is to assess the project's financial stability and ensure that the developer can meet all financial commitments.

2. Project Financial Specifics: Developers must submit comprehensive financial details of the project, including budget allocations, projected costs, and funding sources. This information helps MahaRERA evaluate whether the project is financially sound and capable of being completed without running into financial difficulties.

3. CERSAI Report: As part of the financial scrutiny, developers must submit a report from the Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI). This report provides information on any securitized assets and helps verify the project's financial encumbrance status. It ensures that the project is not over-leveraged and that there are sufficient financial resources to complete the construction.

# Technical Scrutiny

Technical scrutiny is the final layer of the review process, focusing on the structural and construction-related aspects of the project. Key components of technical scrutiny include:

1. Layout and Building Approval Plans: MahaRERA examines the project's layout and building approval plans to ensure they comply with all relevant regulations and standards. This includes checking for proper zoning, adherence to building codes, and compliance with safety regulations.

2. Commencement Certificates: The authority reviews the Commencement Certificates issued by local authorities. These certificates confirm that the project has received the necessary approvals to begin construction. Ensuring that these certificates are in place helps prevent illegal or unauthorized construction activities.

3. Project Specifications: Technical scrutiny involves a detailed review of the project's specifications, including the number of approved floors, flats, and the total construction area. This helps ensure that the project aligns with its approved plans and that any deviations are addressed before they become significant issues.

4. Self-Declarations: Developers are required to submit various self-declarations regarding the project's technical aspects. These declarations provide additional transparency and hold developers accountable for the accuracy of the information provided. This step helps build trust and ensures that developers adhere to the highest standards of integrity.

Benefits for Homebuyers

1. Reduced Risk of Project Delays:

One of the primary concerns for homebuyers is the risk of project delays, which can lead to increased costs and prolonged uncertainty. MahaRERA’s financial scrutiny requires developers to demonstrate adequate funding and financial health, significantly reducing the risk of the project stalling due to financial shortfalls. By ensuring developers have robust financial backing and a clear plan for funding the project, MahaRERA helps protect homebuyers from the disruptions and financial burdens associated with delayed project completions.

2. Greater Confidence and Peace of Mind:

The three-level scrutiny process provides homebuyers with a greater sense of security. Legal scrutiny ensures that the property has a clear title and is free from legal disputes, reducing the risk of future ownership challenges. Financial scrutiny confirms that the developer is financially stable and capable of completing the project, while technical scrutiny ensures that the project is structurally sound and adheres to approved plans and regulatory standards. This comprehensive vetting process means that homebuyers can trust that their investment is secure, and they are less likely to encounter unpleasant surprises during or after the construction phase.

3. Increased Transparency and Better Project Management:

MahaRERA’s requirements for transparency and accountability mean that developers must maintain open and honest communication about project status, timelines, and any potential issues. Homebuyers benefit from this increased transparency, as it provides them with reliable information and clear expectations about their investment. Better project management practices, encouraged by the regulatory scrutiny, ensure that developers adhere to promised timelines and quality standards. This not only enhances the overall buying experience but also builds trust and reduces the likelihood of disputes between developers and buyers.

Benefits for Developers

1. Faster Approvals:

MahaRERA’s structured three-level scrutiny process accelerates the approval timeline for developers. By clearly outlining the legal, financial, and technical requirements for project registration, MahaRERA helps developers prepare comprehensive and accurate submissions from the outset. This clarity reduces back-and-forth with regulatory authorities and avoids delays caused by incomplete or incorrect documentation. Faster approvals mean developers can initiate marketing and sales efforts sooner, align project timelines more efficiently, and commence construction without unnecessary holdups, ultimately enhancing their operational efficiency and profitability.

2. Reduced Risk:

The stringent scrutiny process minimizes the risk of unforeseen legal, financial, and technical issues that can derail a project. Legal scrutiny ensures that the project land is free from encumbrances, disputes, and has a clear title, which protects developers from future litigation. Financial scrutiny ensures developers are financially capable of completing the project, reducing the likelihood of mid-project financial crises. Technical scrutiny verifies that the project plans are sound and comply with all regulatory standards, preventing structural or compliance issues that could arise later. By addressing these risks upfront, developers can proceed with greater confidence and avoid costly project interruptions.

3. Enhanced Buyer Confidence:

A project that passes MahaRERA’s rigorous scrutiny gains a significant trust advantage in the market. Buyers are more likely to invest in projects that are legally clear, financially stable, and technically sound. This increased trust can lead to higher sales volumes and faster sell-outs, as buyers feel assured that their investment is secure. Additionally, a reputation for transparency and adherence to regulatory standards enhances the developer's brand, attracting more buyers and potentially allowing for premium pricing. Enhanced buyer confidence also means fewer disputes and complaints, leading to a smoother project execution and better customer relationships.

Conclusion

MahaRERA’s three-level scrutiny process is a significant step towards creating a more secure and transparent real estate market. For developers, it means faster approvals, reduced risks, and enhanced buyer confidence, all of which contribute to a smoother, more profitable project execution. For homebuyers, it offers reduced risks of delays, greater confidence and peace of mind, and increased transparency and accountability from developers. By setting higher standards for project registration, MahaRERA is helping to foster a more reliable and trustworthy real estate environment, benefiting all stakeholders involved.

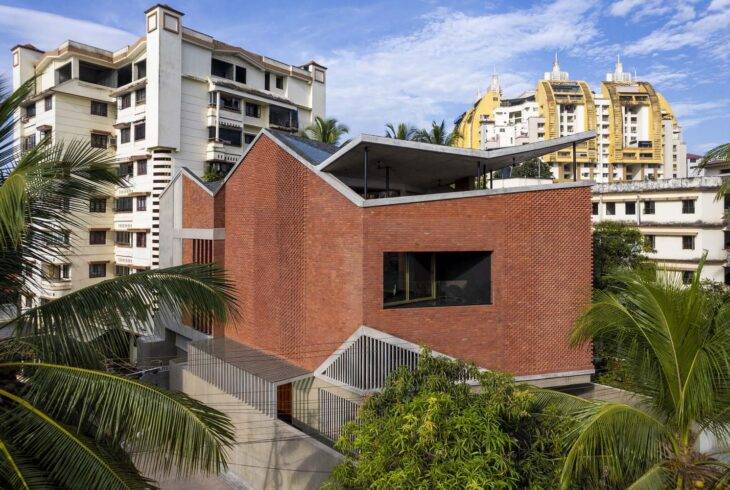

Cover image-housing.com

.png)