The luxury real estate market in India is witnessing remarkable growth, according to the latest report by Savills India. The report highlights significant year-over-year (Y-O-Y) increases in property prices across various key locations, underscoring a booming demand for premium housing.

New Gurugram's Luxury Property Market Soars

One of the standout findings of the Savills India report is the dramatic rise in property prices in New Gurugram. The area has experienced a staggering 53% increase in the prices of premium real estate projects over the past year. This surge is attributed to several factors, including the development of new infrastructure and enhanced amenities that have attracted high-net-worth individuals and investors to the region.

New Gurugram's performance is complemented by the growth in the Dwarka Expressway micro-market, which has also seen a notable increase in property values. The average capital values for both completed and under-construction properties in Gurugram have risen by 37% and 30% Y-O-Y, respectively. The Dwarka Expressway has been a particularly high-performing area with a 34% increase in the average capital values of under-construction properties.

Noida's Sector 150: The Highest Price Growth in the National Capital Region

The report also highlights Sector 150 in Noida as a significant player in the luxury real estate market. This sector has recorded the highest price growth in the National Capital Region (NCR), with a remarkable 43% increase in the capital values of under-construction properties over the past year. The increase in property values in Sector 150 reflects the growing appeal of Noida's emerging real estate market, driven by the development of new residential and commercial projects.

Overall, Noida's property market has seen a Y-O-Y increase of 30% in the capital values of completed properties and 29% for under-construction projects. The rental market in Noida's Sector 150 and other micro-markets has also witnessed a 12% Y-O-Y growth.

North Goa Villas and Mumbai Real Estate Trends

In addition to developments in New Gurugram and Noida, the report points out that North Goa has experienced a 28% increase in the capital values of villas. This rise is driven by the region’s growing popularity among homebuyers looking for second homes and high rental yields.

In Mumbai, there has been a sharper increase in the capital values of under-construction properties compared to ready properties. The average capital values for under-construction properties have risen by 5% Y-O-Y, compared to a 3% increase for completed properties. Central Mumbai and Western suburbs have seen significant increases in capital values, ranging from 12% to 21% Y-O-Y.

Bengaluru and Delhi's Real Estate Markets

Bengaluru's premium residential market has also experienced growth, with capital values increasing by 5-6% Y-O-Y. The city’s under-construction projects have seen a higher growth rate of 7.2% compared to newly completed projects. In terms of rental values, South and North Bengaluru have seen a 3% Y-O-Y increase.

Delhi’s luxury real estate market has witnessed a 16% Y-O-Y rise in capital values for luxury floors. The South-East Delhi micro-market has led this growth with a 27% increase, while the South-West micro-market saw a 21% rise.

Outlook for the Future

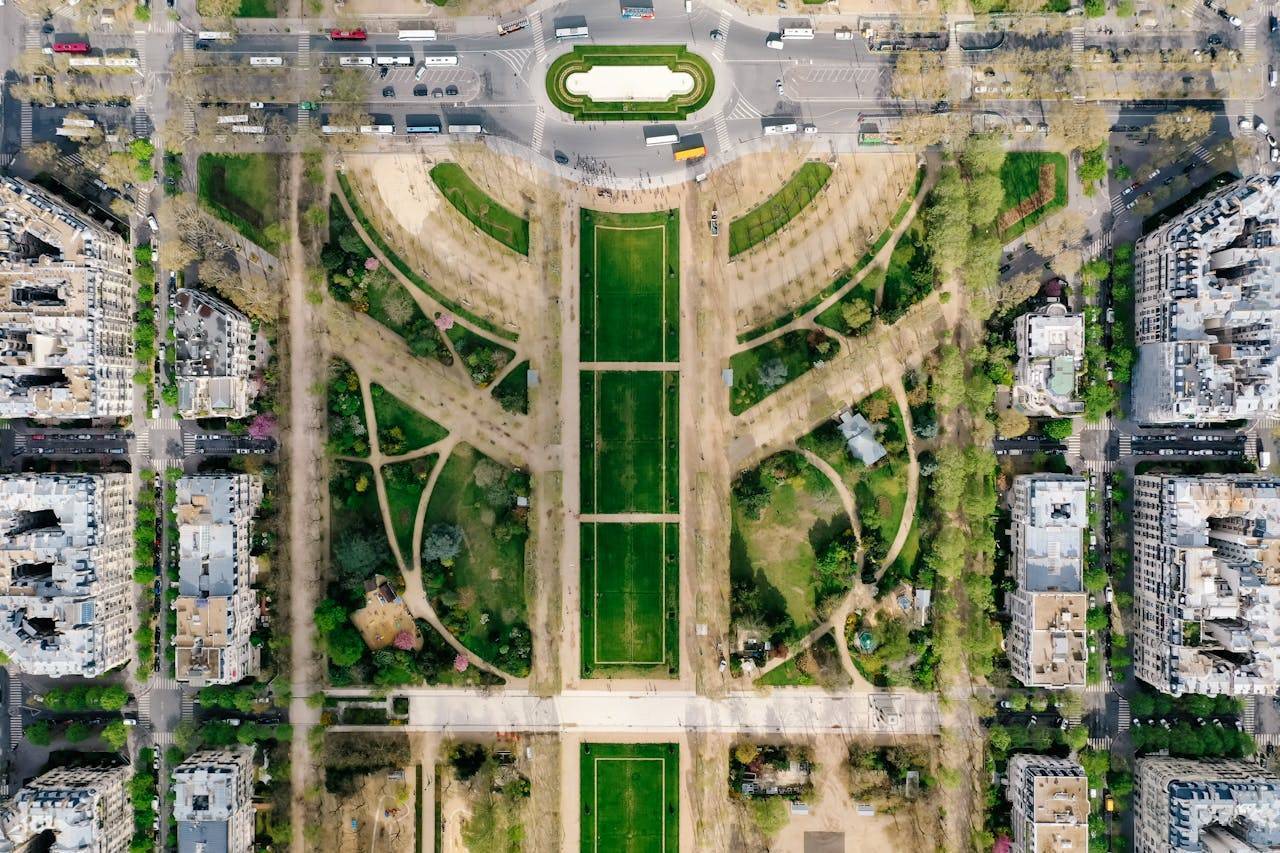

The Savills India report also notes that buyer sentiment remains positive, with strong demand for new launches and ready-to-move-in properties. There is a notable preference for properties offering large balconies and green spaces, reflecting a shift towards more spacious living environments.

Shveta Jain, Managing Director of Residential Services at Savills India, commented, “In the first half of 2024, the real estate market has been driven by both investor interest in new projects and end-user demand for ready-to-move-in homes. There has been a clear preference for developments that offer modern amenities and better living conditions.”

Conclusion

The luxury property market in India is on a robust growth trajectory, with significant price increases in key locations such as New Gurugram, Noida’s Sector 150, and North Goa. The trends observed in the report reflect a strong demand for premium real estate driven by infrastructure developments, rising investor interest, and evolving buyer preferences.

As the market continues to grow, it will be important for investors, buyers, and industry stakeholders to stay informed about these trends to make strategic decisions in the evolving real estate landscape.

Image source-pixabay.com

.png)