Units of Knowledge Realty Trust (KRT), sponsored by Sattva Group and Blackstone, debuted on the stock exchanges with a listing premium of 4% over the issue price. On the BSE, the units opened at ₹104, while on the NSE, they started trading at ₹103, representing a 3% premium from the ₹100 issue price.

The REIT raised ₹4,800 crore through its initial public offering (IPO), which was oversubscribed 12.48 times, reflecting strong investor interest. The IPO was entirely a fresh issuance, with a price band set between ₹95 and ₹100 per unit.

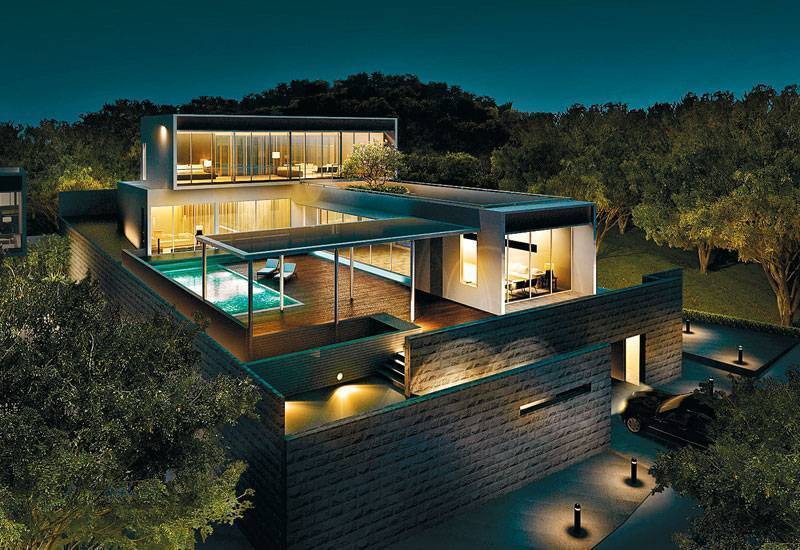

At the time of listing, KRT’s market valuation stood at ₹47,328.35 crore. The trust manages over 46 million sq. ft. of office properties across six cities, including Mumbai, Bengaluru, and Hyderabad. Key assets include One BKC and One World Center in Mumbai, Knowledge City and Knowledge Park in Hyderabad, and Cessna Business Park and Sattva Softzone in Bengaluru.

The listing adds KRT to India’s growing REIT market, which already includes Brookfield India Real Estate Trust, Embassy Office Parks REIT, Mindspace Business Parks REIT, and Nexus Select Trust. These investment vehicles provide investors access to income-generating commercial properties through tradable units.

Sattva Developers, based in Bengaluru, has completed over 74 million sq. ft. of construction across seven Indian cities, covering commercial, residential, co-living, co-working, hospitality, and data center projects. Partnering with Blackstone, the formation of KRT allows asset monetization while offering investors exposure to premium office real estate in major urban markets.

Analysts note that KRT’s strong debut signals growing confidence in India’s commercial property sector. The high subscription levels and premium listing highlight the market’s appetite for structured investment opportunities in quality office assets.

With this listing, Knowledge Realty Trust is well-positioned to generate rental income for investors while leveraging its high-quality portfolio across key metropolitan areas, contributing to the continued growth of the REIT sector in India.

.png)