Global brokerage firm Jefferies has identified DLF, Godrej Properties, and Macrotech Developers as its top investment picks in the Indian real estate sector. Despite a notable rebound in the realty index in recent months, the firm maintains that select property stocks remain reasonably priced relative to their long-term valuation metrics and may benefit from favorable sectoral trends in the coming quarters.

According to Jefferies, property stocks under its coverage are currently trading in line with their five-year average premium to net asset values (NAVs), which were observed during previous upcycles. The brokerage believes this valuation range leaves room for potential rerating, especially if sales momentum continues and the interest rate environment turns more supportive.

The real estate sector has witnessed a partial recovery since the lows seen in March-April 2025. The realty index has risen by over 25% since that period but still remains 11% below its recent peak. On Thursday, however, the index saw a minor decline of 0.47%, with all ten of its constituents ending in the red. Among them, DLF shares were down 0.59%, Godrej Properties dropped by 0.47%, and Macrotech Developers fell by 0.57%.

Jefferies emphasized that the recent rally has not yet led to excessive valuations. Instead, it expects the start of a rate cut cycle by the Reserve Bank of India (RBI) to improve affordability and support valuation expansion, particularly for developers targeting the mid-income and affordable housing categories. These segments, often more price-sensitive, are expected to benefit as borrowing costs reduce.

During the 2022-23 monetary tightening period, developers with a greater focus on lower-ticket-size housing were more adversely impacted. Godrej Properties, Macrotech Developers, and Prestige Estates were among the worst-performing stocks during this phase, primarily due to their exposure to price-sensitive markets that showed slower response to demand-side stimuli. However, Jefferies believes the trend may reverse in the current financial year, driven by improved funding conditions and stronger demand from end-users.

The brokerage projects that pre-sales for real estate developers may grow by over 5 percentage points year-on-year, potentially exceeding the 20% growth mark in FY26. The optimistic forecast is backed by several large-scale project launches in the first quarter of FY26, which have helped build confidence in forward-looking sales estimates. In contrast, FY25 was marked by uneven performance across regions and developers, partly due to delayed launches and fluctuating interest in key markets.

Jefferies also pointed out that anticipated rate cuts may improve the affordability of housing, especially in the ₹50 lakh to ₹1 crore range, which continues to see consistent demand in urban and semi-urban areas. The brokerage expects this demand to reflect positively in the earnings and valuations of developers with strong execution track records and diversified portfolios across multiple price categories.

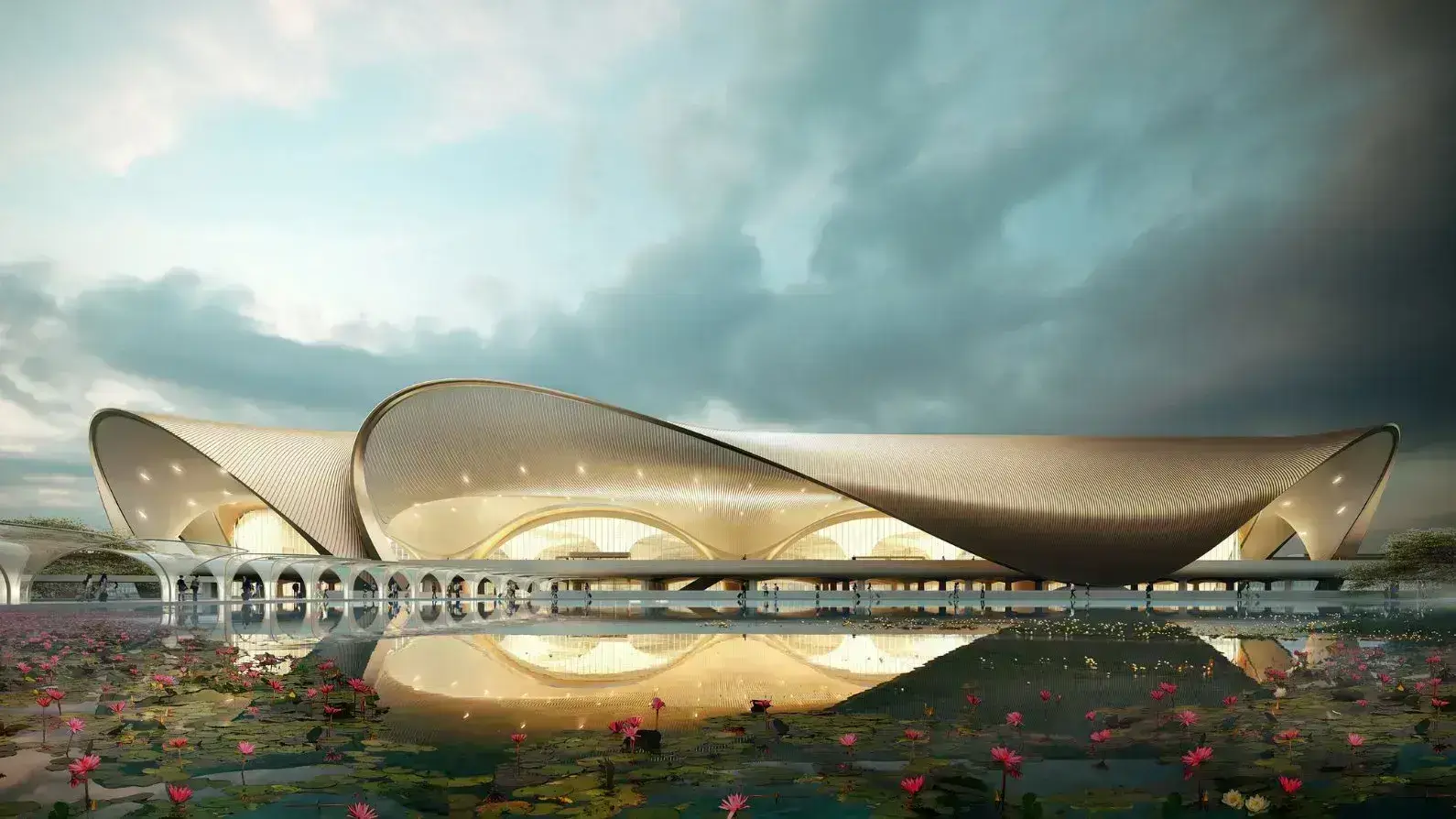

While high-end luxury housing has shown resilience in top metro cities, the firm sees better near-term risk-reward in companies that have exposure to mid-income buyers. Developers like DLF and Macrotech have recently announced new launches in high-demand micro-markets, while Godrej Properties has continued to expand its portfolio in Tier 1 and select Tier 2 cities.

.png)