Navi Mumbai International Airport (NMIA) was officially inaugurated by Prime Minister Narendra Modi, nearly 28 years after its initial planning commenced. The completion of this landmark project marks a pivotal development for the Mumbai Metropolitan Region (MMR), aimed at easing congestion at the existing Mumbai airport, which currently handles around 1,000 flights daily using a single operational runway. While commercial operations are slated to begin in phases starting December 2025, the real estate sector has already responded with heightened optimism, anticipating significant growth in both residential and commercial properties across the region.

Developed by Adani Airport Holdings Ltd in collaboration with the City Industrial Development Corporation (CIDCO), NMIA is designed to strengthen aviation infrastructure and accommodate increasing passenger and cargo traffic. Phase 1 of the airport, constructed at a cost of ₹19,650 crore, spans 1,160 hectares and will ultimately have the capacity to handle 90 million passengers annually, along with 3.25 million metric tonnes of cargo. The project is India’s largest greenfield airport undertaken under a Public–Private Partnership (PPP) model. The fully automated, AI-enabled terminal integrates advanced digital systems while reflecting traditional architectural elements, including lotus motifs, providing a modern yet culturally grounded design.

The inauguration is expected to influence property appreciation across Navi Mumbai, with areas such as Panvel, Ulwe, Taloja, Belapur, Kharghar, Dronagiri, Karjat, and Alibaug poised to benefit from improved connectivity and infrastructure development. Real estate experts project a 10–15% rise in property prices over the next two to three years. Ritesh Mehta, Senior Director at JLL India, stated that the airport represents a “real game-changer” due to underdeveloped land and upcoming infrastructure projects, emphasizing that further appreciation could occur once a central business district develops in Navi Mumbai similar to BKC in Mumbai.

As per, Mr Vimal Nadar, National Director & Head of Research, Colliers India, "The opening of the Navi Mumbai International Airport signifies more than just a milestone in air travel. It marks a pivotal transformation in the region's real estate landscape, particularly within the residential and commercial sectors. The announcement of this upcoming airport had already triggered a substantial rise in property values across key areas in the vicinity including Uran-Ulwe, Kharghar, Dronagiri, Taloja, and Panvel. This greenfield airport will further accelerate the growth, driving sustained demand and significant price appreciation, presenting lucrative long-term investment opportunities. Further, Navi Mumbai's strategic positioning as a sub-dollar office market, coupled with enhanced connectivity and global access offered by the airport, are expected to drive heightened office leasing activity in the area over the next few years. The proposed Aerocity in the vicinity, designed to seamlessly integrate top-notch commercial, residential, and recreational spaces, will foster a new urban ecosystem that blends work and lifestyle. Additionally, with the Atal Setu enhancing connectivity and reducing travel times to Mumbai, this region will remain high on the radar for homebuyers, developers, and investors alike."

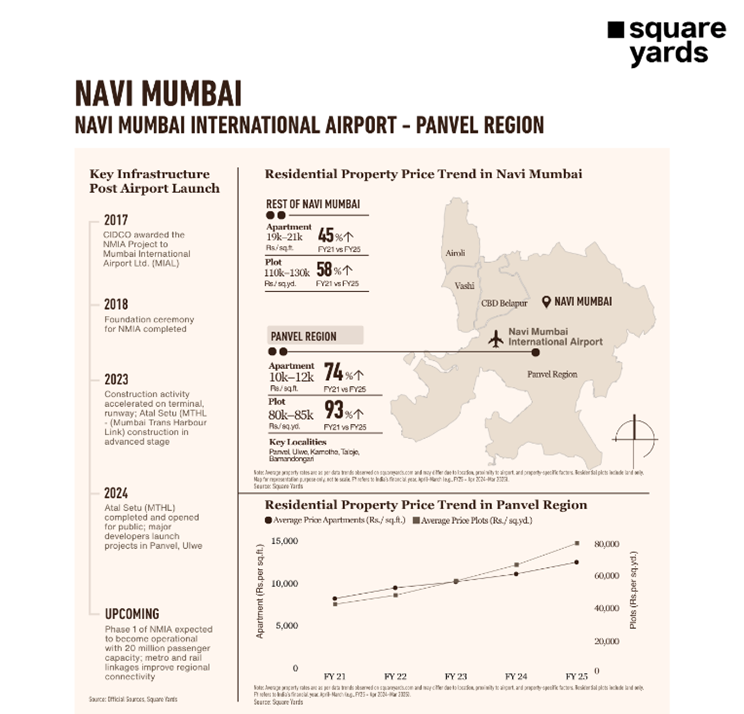

Mr Deepak Khandelwal, Principal Partner & Chief Sales Officer, Square Yards, said, “The Navi Mumbai International Airport stands as a cornerstone of the region’s broader infrastructure push, supported by major upgrades in road, rail, metro, and waterway connectivity. Its imminent operationalisation has already begun to reshape the real estate landscape, particularly across the Panvel region. Localities such as New Panvel, Old Panvel, Kharghar, Ulwe, and Taloja are witnessing a surge in development, with a growing supply of premium residential projects, gated communities, and large integrated townships. The market response has been strong, with apartment prices in the Panvel region rising by nearly 74% between FY 2021 and FY 2025, compared to 45% growth across the rest of Navi Mumbai. With the first phase to be inaugurated today and full-scale operations expected soon, the airport is set to drive the next wave of value creation, reinforcing Panvel’s position as one of the most promising growth hubs not only within the Mumbai Metropolitan Region and beyond.”

Other insights: Navi Mumbai | Navi Mumbai International Airport – Panvel Region

Apartments: Apartment prices in the Panvel region stood at Rs. 10,000–12,000 per sq.ft, growing by 74% from FY21 to FY25. Comparatively, the rest of Navi Mumbai commanded higher prices of Rs. 19,000–21,000 per sq.ft but saw only 45% growth.

Residential Plots: Panvel's plotted land rates on an average ranged from Rs. 80,000–85,000 per sq.yd, reflecting a solid 93% increase. In other parts of the city, plot prices were higher at Rs. 1,10,000–1,30,000 per sq.yd, but with a relatively slower growth of 58% over the same

With the inauguration of NMIA, the region is poised for a transformative phase in real estate development. Both residential and commercial sectors are likely to experience sustained growth, driven by infrastructure enhancements, increased connectivity, and long-term investment confidence. The airport’s operationalization is expected to generate over two lakh jobs across sectors including aviation, logistics, IT, and real estate, creating a multiplier effect that reinforces the city’s economic and developmental prospects.

Image - architecturaldigest.in, x.com

.png)