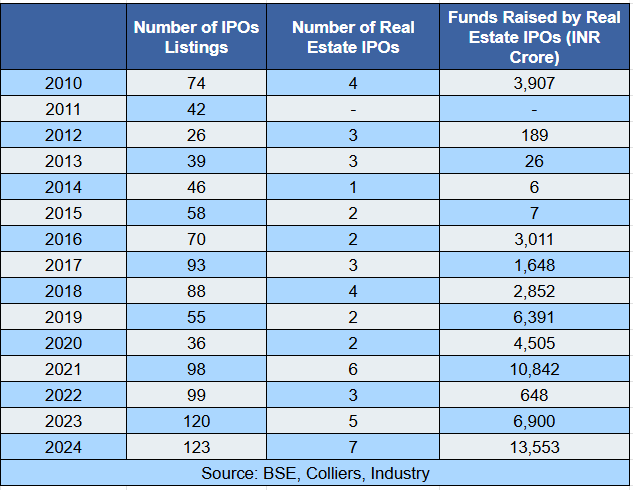

India’s real estate IPO market is thriving like never before. Since 2010, the country has seen 47 real estate IPOs that have collectively raised more than INR 300 billion. The pace of growth has picked up significantly in recent years, with 2024 proving to be a landmark year. By October 2024, real estate IPOs alone have raised an impressive INR 135 billion, nearly double the amount raised in 2023.

This strong performance is part of a broader IPO boom in India, as 2024 has recorded 123 IPOs across various sectors, surpassing the total number of IPOs in 2023. This surge reflects India’s strong economic growth, higher corporate earnings, and active participation from retail and institutional investors, all supported by ample market liquidity.

Housing Finance Companies and REITs Drive the Momentum

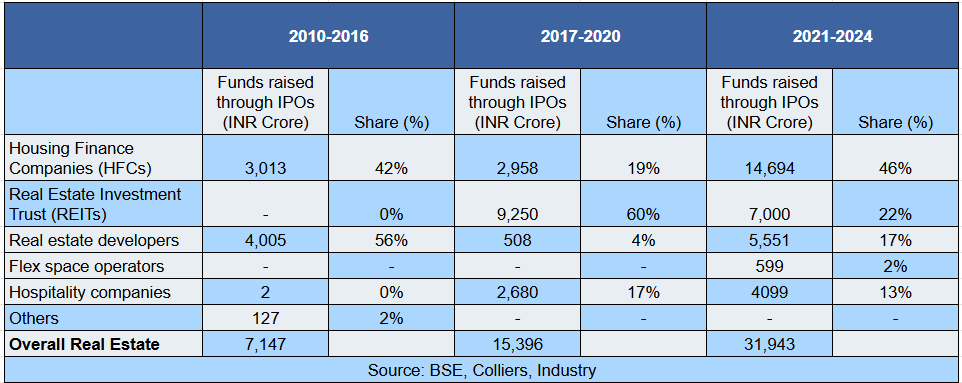

The post-pandemic years have been transformative for the real estate IPO market in India. From 2021 to 2024, there were 21 real estate IPOs, raising INR 319 billion, more than twice the INR 132 billion raised during the previous four-year period (2017–2020).

IPO trend: Heightened activity in recent years

Housing Finance Companies (HFCs) such as Aadhar Housing Finance Limited IPO, India Shelter Finance Corporation Limited IPO, Aptus Value Housing Finance India Ltd IPO, Home First Finance Company India Ltd. IPO, Aavas Financiers Limited IPO, PNB Housing Finance Ltd IPO and Akme Star Housing Finance Ltd IPO led the way, raising 46% of the total funds from real estate IPOs in this period. REITs accounted for 22% of the capital raised, indicating strong investor interest in stable, income-generating assets like Grade A commercial spaces and malls. Residential developers also performed exceptionally well, raising over INR 55 billion, ten times the amount raised during 2017–2020.

Trend in real estate IPOs and category-wise break-up

Adding to the market’s diversity, newer categories like flex-space operators and Small and Medium REITs (SM-REITs) have entered the IPO landscape. This marks a significant step in the evolution and maturity of India’s real estate sector.

Market Performance Reflects Investor Confidence

The stock market has mirrored this enthusiasm. The BSE Realty Index has delivered over 30% year-to-date gains, significantly outperforming the Sensex. Impressively, nearly one-fifth of all real estate IPOs since 2010 have outperformed the Realty Index in 2024.

Additionally, over 90% of the real estate IPOs listed this year have been oversubscribed, a clear sign of strong investor confidence and optimism about the sector’s future prospects.

What Lies Ahead?

The future looks bright for India’s real estate market. The demand for residential, commercial, and retail properties is expected to remain strong, and a potential reduction in lending rates could further boost activity. Housing Finance Companies and Real Estate Investment Trusts like Brookfield India Real Estate Trust REIT, Mindspace Business Parks REIT and Embassy Office Parks REITs are likely to play a key role in financing this growth, helping to meet the rising demand for high-quality developments.

Moreover, the market is set to benefit from significant infrastructure investments, favorable demographics, and higher consumer spending. A supportive regulatory framework also adds to the positive outlook.

With many real estate companies, including flex-space operators, SM-REITs, and major developers, already preparing for their IPOs, the sector is expected to maintain its growth trajectory. The record-breaking performance of 2024 could very well set the stage for even greater achievements in the years to come.

Image source: Freepik

.png)