The Indian office market in 2024 faced global macroeconomic uncertainty, geopolitical tensions, and persistent inflationary pressures. Despite these challenges, the sector remained resilient, with new office supply reaching its highest levels. Vestian’s office market report states that total new office space supply in 2024 stood at 515 lakh square feet, marking a 7% year-on-year increase. Strong demand for grade-A office spaces kept developers active, driving this surge in supply.

Supply and Demand Trends

A surge in demand for premium office spaces fueled strong construction activity across major cities. Hyderabad emerged as the leader in fresh supply, closely followed by Bengaluru. With new completions reaching an all-time high, the office market saw improved vacancy rates, which declined marginally from 13.98% in 2023 to 13.91% in 2024. Additionally, rental prices in key office hubs increased by 3.8% to 8.2%.

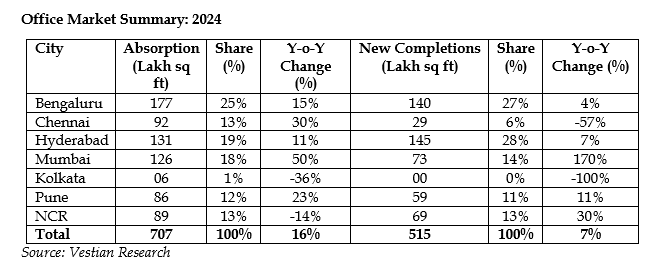

Since the pandemic, office space absorption has shown consistent growth, reflecting the sector’s ability to withstand global economic turbulence. The year 2024 set a new benchmark, with total office space absorption reaching 707 lakh square feet—a 16% annual increase. Most major cities recorded their highest-ever absorption, except for Kolkata and the National Capital Region (NCR), where demand contracted by 36% and 14%, respectively.

Shrinivas Rao, FRICS, CEO, Vestian, stated, “The IT-ITeS sector continued to dominate leasing activities during 2024 with a 36% share, up from 24% a year earlier. While the IT industry is expected to lead in 2025 on the back of strong demand from GCCs, other segments such as BFSI and Flex Spaces are also anticipated to garner traction.”

City-Wise Performance

Bengaluru maintained its position as the most dominant market, contributing 25% of the total office space absorption in India. The city recorded 177 lakh square feet of leasing activity, a 15% increase over the previous year. Mumbai also exhibited significant momentum, with its share of pan-India absorption rising from 14% in 2023 to 18% in 2024. Meanwhile, the share of NCR in total absorption declined from 17% to 13%.

The southern cities of Bengaluru, Chennai, and Hyderabad collectively accounted for 57% of the national office space absorption, reflecting a slight increase from 56% in the previous year. Hyderabad led in new office supply, adding 145 lakh square feet, followed closely by Bengaluru with 140 lakh square feet. Notably, Mumbai recorded a staggering 170% year-on-year increase in new completions, whereas Chennai saw a sharp decline of 57% in fresh supply. In contrast, Kolkata experienced a complete halt in new office space supply, compared to over 10 lakh square feet recorded in 2023.

Sectoral Trends and Sustainability

One of the key emerging trends in 2024 has been the growing emphasis on sustainability. With several multinational corporations committing to net-zero emissions, the demand for green-certified office spaces has risen significantly. In response, leading developers are prioritizing sustainable office buildings, incorporating energy-efficient designs and eco-friendly construction practices to align with corporate sustainability goals.

Mr. Rao stated, “Emphasis on sustainability has grown among occupiers as several multinational companies with offices in India have pledged to achieve net-zero emissions, leading to a rise in demand for green-certified office spaces in India. Anticipating this shift, leading developers are prioritizing the construction of sustainable office buildings.”

Future Outlook

Despite ongoing global uncertainties, India’s office market has demonstrated remarkable stability and growth potential. The sustained demand for grade-A office spaces, particularly in technology-driven cities, is expected to drive further expansion in 2025. The continued rise of flexible office spaces and increasing investments in sustainable buildings are likely to shape the next phase of office market evolution.

While geopolitical risks and macroeconomic factors remain key concerns, the strong fundamentals of India’s office market, coupled with increasing corporate confidence, indicate a positive trajectory for the sector. As businesses continue to expand and adapt to changing work environments, the Indian office market is well-positioned for sustained growth in the coming years.

.png)