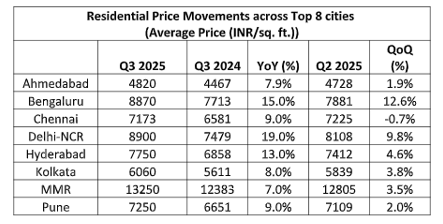

Property prices continued their unabated upward march in Q3 2025, supported by strong end-user demand in the premium segment, elevated input costs, and a limited supply of quality, ready-to-move-in inventory. These findings were published in the latest quarterly report, 'Real Insight Residential: July-September 2025', by digital real estate transaction & advisory platform PropTiger.com by Aurum Proptech. The weighted average property price across the top cities registered healthy YoY growth.

Delhi NCR led the pack with a remarkable 19% YoY and 9.8% QoQ appreciation, driven by strong demand for luxury properties and infrastructure upgrades. The weighted average price of homes in Delhi-NCR rose from Rs 7479 per sq. ft. in Q3 2024 to Rs 8900 per sq. ft. in Q3 2025.

Bengaluru recorded strong double-digit price growth of 15% YoY and 12.6% QoQ while Hyderabad recorded 13% YoY and 4.6% QoQ growth. The price in Bengaluru rose to Rs 8870 per sq. ft. in Q3 2025 from Rs 7713 per sq. ft. in the same period last year while prices in Hyderabad rose to Rs 7750 per sq. ft. in Q3 2025 from Rs 6858 per sq. ft. in Q3 2024.

According to the report, other major markets, including MMR, Pune, Chennai, and Kolkata, saw robust single-digit price growth, reflecting broad-based developer confidence and buyers' willingness to invest in appreciating assets.

Sales and Launch trends

The report highlighted that home sales across India's 8 prime residential markets stabilized in the July-September quarter, with a marginal 1% year-on-year dip in volume to 95,547 units sold. On QoQ basis, it registered 2.2% decline. In sharp contrast, the total value of properties sold during the quarter surged by 14% annually to reach INR 1.52 lakh crore, a clear indication of a market shift towards premiumization.

The report also highlighted that new supply across the top eight cities saw a 0.1% annual decline, with 91,807 units launched. However, new launches registered a 9.1% growth over the previous quarter, signalling cautious optimism among developers. This trend suggests that developers are strategically launching higher-value projects to align with the current buyer demand, which is heavily skewed towards the premium and luxury segments.

Geographically, new supply was concentrated in the western and southern markets. The Mumbai Metropolitan Region (MMR) was the largest contributor, accounting for 26.9% of all new launches, followed by Pune with 18.7% and Hyderabad with 13.6%. These three cities collectively represented 59.2% of the new inventory introduced during the quarter. The top 8 cities are Ahmedabad, Bengaluru, Chennai, Hyderabad, Kolkata, NCR (Gurugram, Noida, Greater Noida, Ghaziabad, and Faridabad), MMR (Mumbai, Navi Mumbai and Thane), and Pune.

Mr. Ashok Kapur, Chairman, Krishna Group and Krisumi Corporation, said, “The sharp rise in property prices across Delhi-NCR clearly reflects the strong and sustained demand for quality homes. Infrastructure growth in the region, including the recent inauguration of the Delhi stretch of the Dwarka Expressway and UER-II, has further improved connectivity and boosted buyer confidence. Rising disposable incomes, supported by affordable loan rates and GST reforms, have also strengthened purchasing power. Demand remains particularly robust in the premium segment, driven by the growing appetite of end users seeking better living standards. Together, these factors are not only reinforcing Delhi-NCR’s position as one of India’s most attractive real estate markets but also paving the way for continued growth and transformation in the years ahead,”.

.png)