Foreign investors continued to dominate institutional investments in 2024, commanding a significant 54% share of the market and contributing USD 3.7 billion. While their share declined from 65% in 2023, the total value of foreign investments surged by 36%, highlighting the increasing confidence and participation of international players in the Indian market. Domestic investors followed the same trend as their share reduced to 30% in 2024 from 35% in the previous year, despite an increase of 36% in value terms during the same period.

An interesting development in 2024 was the marked rise of co-investments, which accounted for 16% of total investments. This model gained traction as foreign investors sought to leverage the local expertise of domestic partners to navigate uncertainties in the macroeconomic environment. The value of co-investments experienced an extraordinary 61-fold increase, emphasizing the growing preference for collaborative approaches to reduce risks and maximize returns in a challenging investment climate.

The shift towards co-investment signals a broader trend of synergy between global capital and local knowledge, ensuring robust and targeted investment strategies despite global economic headwinds. This approach not only mitigates risks but also facilitates a deeper understanding of regional market dynamics, paving the way for sustained growth in institutional investments.

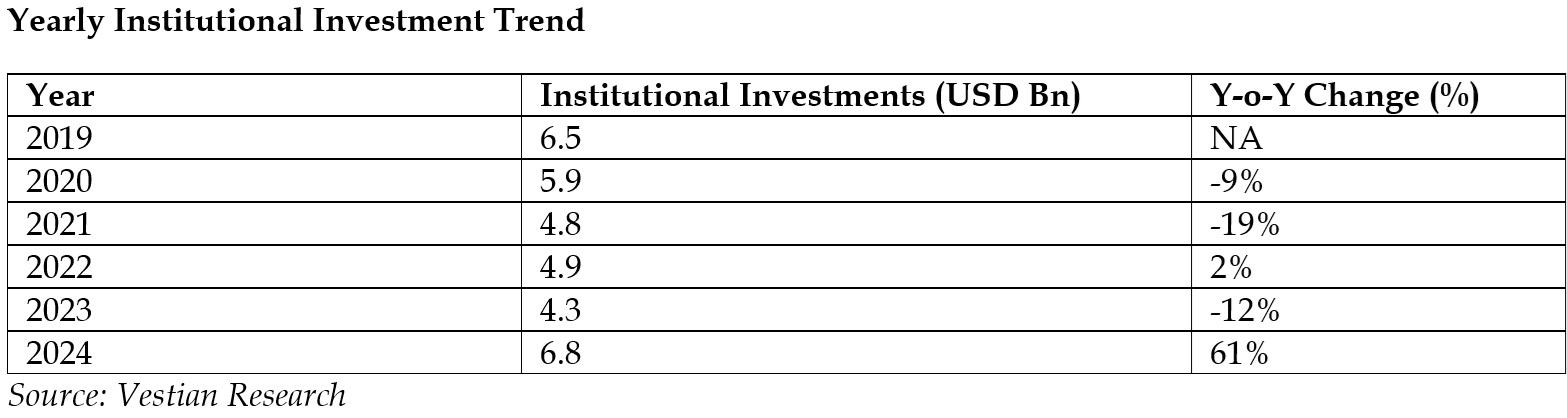

As per Vestian Research, institutional investments reached USD 6.8 Bn in 2024, registering an annual increase of 61%. However, investments have been on a downward trajectory since 2020 for four consecutive years and resurrected in 2024 owing to a significant inflow of funds in the industrial and warehousing sector on the back of robust demand for e-commerce and quick commerce across the country.

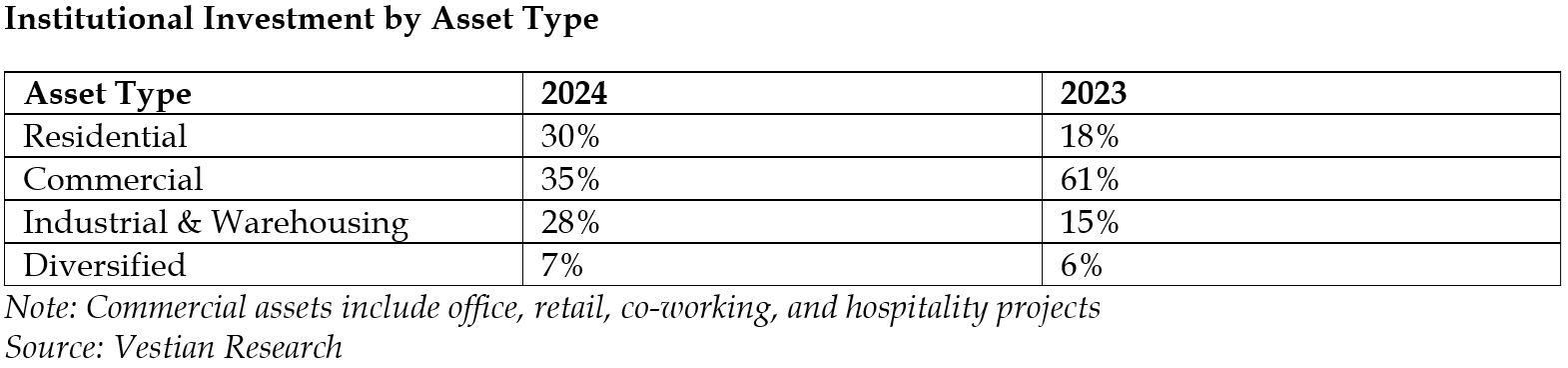

Despite significant investments in the industrial & warehousing sector, commercial assets continued to dominate with 35% share in 2024. However, the share has reduced drastically from 61% in 2023 owing to the global slowdown in IT-ITeS sector. As demand for GCCs is growing in India, office spaces are expected to witness renewed demand.

On the other hand, the residential sector reported investments worth USD 2.0 Bn, accounting for 30% of the total investments received in 2024. Investments rose by 171% in 2024 over the previous year. Similarly, the industrial and warehousing sector witnessed an annual increase of 203% with a rise in share from 15% in 2023 to 28% in 2024.

Mr. Shrinivas Rao, FRICS, CEO, Vestian said, “Despite a slow start, the real estate sector received significant institutional investments in 2024, surpassing pre-pandemic levels. However, 2025 is expected to be challenging due to increasing geopolitical friction, a slowdown in the global economy, and elevated inflation levels. On the other hand, RBI is anticipated to reduce the repo rate in 2025, providing impetus to the real estate sector. Heightened real estate activities due to low mortgage rates may attract investors.”

Factors such as return-to-office policies, government initiatives like the Production Linked Incentive (PLI) scheme, and increased focus on affordable housing are anticipated to drive real estate demand in the coming years. This may attract investors, leading to increased investor participation.

The investment landscape in 2025 will call for strategic agility, emphasizing collaborative models like co-investments to manage risks effectively. Key growth sectors such as mid-income housing, and flexible office spaces, offer promising opportunities. Investors should leverage government initiatives, closely monitor economic policies like RBI’s repo rate changes, and combine global capital with local expertise to achieve optimal results.

Image source- freepik.com

.png)