IIFL Home Finance Limited (IIFL HFL), one of the prominent players in India’s housing finance sector, has announced the launch of its public issue of redeemable non-convertible debentures (NCDs), aimed at raising up to ₹500 crore. The Tranche I Issue, which opened on December 6, 2024, and closes on December 19, 2024, with an option for early closure, will offer secured, rated, and listed NCDs to investors. These debentures are being issued with a base issue size of ₹100 crore, with an option to retain oversubscription up to ₹400 crore, allowing the total issue size to reach ₹500 crore. This issuance is part of IIFL Home Finance's broader shelf limit of ₹3,000 crore.

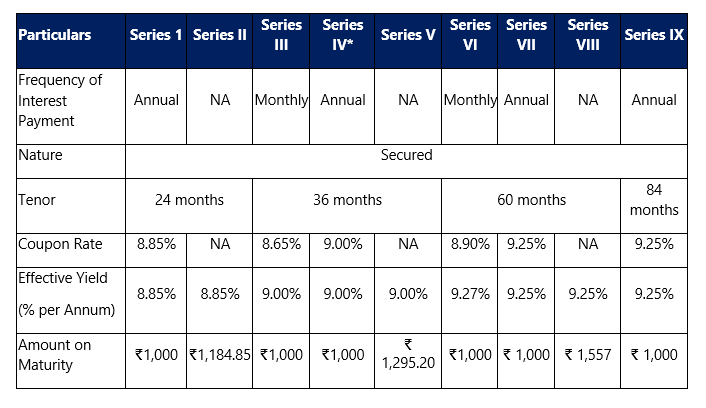

The NCDs will have a face value and issue price of ₹1,000 each, providing investors with an attractive opportunity to earn stable returns. The NCDs come with different maturity tenors, including 24 months, 36 months, 60 months, and 84 months, offering investors a variety of options depending on their investment horizon and return preferences. The coupon rates for the NCDs will range from 8.85% per annum to 9.25% per annum, depending on the series chosen by the investors. The effective yield for these NCDs ranges from 8.85% per annum to 9.27% per annum, providing investors with attractive returns relative to other fixed-income instruments in the market.

One of the key advantages of these NCDs is their flexibility in payment options. The Tranche I Issue offers monthly and annual coupon payment options across various series (Series I to IX), allowing investors to select an option that suits their income requirements. This flexibility will cater to both income-seeking investors and those looking for long-term capital appreciation.

The terms of each series of NCDs offered under the Tranche I Issue are given below:

The NCDs have received good ratings from two leading credit rating agencies. They are rated "CRISIL AA/Stable" by CRISIL Ratings Limited and "IND AA/Stable" by India Ratings and Research Private Limited. These ratings reflect the company's strong financial profile and ability to meet its debt obligations, making the NCDs an attractive investment option for risk-averse investors seeking safe, fixed returns.

The NCDs are proposed to be listed on both the Bombay Stock Exchange (BSE) and the National Stock Exchange of India (NSE), with the NSE being designated as the stock exchange for the issue. Listing on these prominent exchanges ensures liquidity for investors, who can buy and sell their NCDs on the secondary market once they are listed.

The net proceeds from this issue will be primarily used to support IIFL Home Finance’s lending operations. At least 75% of the funds raised will be directed towards onward lending, refinancing the company's existing borrowings, and servicing its debt obligations. The remaining 25% will be allocated for general corporate purposes. This indicates that the company is focusing on expanding its lending portfolio while also ensuring that it has the necessary financial flexibility to manage its debt.

The allotment of NCDs will be done on a first-come-first-serve basis, meaning that investors who apply early have a higher chance of securing the NCDs. It is essential for investors to monitor the issue closely and submit their applications within the specified dates to avoid missing out on this investment opportunity. Given the attractive coupon rates and strong backing, it is expected that the NCDs will be in high demand among institutional and retail investors alike.

.png)