India’s paints and coatings market is witnessing unprecedented growth, driven by rapid urbanization, infrastructure development, and evolving industrial needs. Estimated at USD 10.46 billion in 2025, the market is expected to surge to USD 16.37 billion by 2030, growing at a CAGR of 9.38%. Government initiatives like the Smart City Mission, coupled with rising foreign investments in the construction sector, are fueling demand for architectural coatings. Simultaneously, India's emergence as a global manufacturing hub is driving the need for industrial coatings, especially in sectors like railways, electronics, and heavy machinery.

In addition to market expansion, the industry is undergoing a technological transformation, with a growing focus on eco-friendly and high-performance coatings. The rise of electric vehicles (EVs), sustainable construction, and nanotechnology-based coatings is reshaping the sector. Manufacturers are investing in R&D for low-VOC and water-based coatings, ensuring compliance with environmental regulations while enhancing durability and performance. With supply chain optimization and localized production strategies, India’s paints and coatings industry is set to become a powerhouse of innovation and sustainability in the coming years.

The Growth Story: What’s Fueling the Rise?

India’s love for color isn’t new. Walk down any street, and you’ll see homes drenched in vibrant blues, yellows, pinks, and even the occasional neon green (because why not?). But what’s driving the explosive growth of the paint industry?

1. The Urban Makeover & Real Estate Boom

The rapid rise of urbanization has played a pivotal role in shaping the industry’s trajectory. With initiatives like the Pradhan Mantri Awas Yojana (PMAY) and the Smart Cities Mission, India is witnessing an unprecedented real estate and infrastructure boom. Considering that the real estate sector accounts for a staggering 70% of paint demand, the industry is basking in the glow of new housing developments and commercial projects.

2. A Shift in Consumer Mindset: Premium is the New Normal

Gone are the days when people just wanted a basic coat of paint to cover up cracks and stains. Today’s consumers want style, aesthetics, and sustainability—all in one bucket of paint. With rising disposable incomes, demand for premium, eco-friendly, and health-conscious products is skyrocketing. Low-VOC paints, anti-bacterial coatings, and textured luxury finishes are stealing the spotlight.

3. Repainting: Because Who Likes Boring Walls?

If you think new home construction is the biggest market driver, think again! Repainting contributes to over 75% of paint demand in India. Traditionally, people waited about 6.9 years before giving their homes a fresh coat. But now, thanks to growing hygiene awareness, the rise of rental properties, and fancy virtual painting tools, that cycle is shrinking to just 5.6 years by 2031. That means more frequent touch-ups, more colors, and more business for paint companies.

4. The Auto Paint Boom: Cars Deserve a Makeover Too

India’s automobile industry is revving up demand for high-performance automotive paints. With electric vehicles (EVs) on the rise, the demand for corrosion-resistant, UV-protected, and scratch-proof coatings has skyrocketed. Plus, consumers are obsessed with customization, think matte, metallic, and pearlescent finishes, turning cars into moving works of art.

The Tech Behind the Transformation: More Than Just Paint

The Indian paint industry is undergoing a transformation with advancements in technology and sustainability. However, consumer behavior and painter practices remain largely unchanged. The key trends shaping the industry include:

1. Architectural Industry Influence

Architectural paints dominate the market, accounting for 75% of the total share. Their demand is closely tied to infrastructure growth, urbanization, and real estate expansion, covering residential, commercial, and industrial projects.

2. Nanotechnology in Paints

Nanotechnology is enhancing paint performance by making coatings more durable, self-cleaning, and resistant to environmental factors. The use of nanoparticles allows for multifunctional coatings at lower costs, driving market growth.

3. Growth of Epoxy Resins

The epoxy segment holds the largest market share, widely used in construction, automotive, aerospace, marine, and electronics industries. Known for its durability, chemical resistance, and superior adhesion, epoxy coatings are favored for flooring, infrastructure protection, and industrial applications.

4. Surge in Decorative Paints

The decorative paints segment is growing due to rising disposable incomes, urbanization, and increasing consumer interest in aesthetic interiors. There is a shift toward premium and luxury paints with features like antibacterial properties, weather resistance, and easy maintenance. The demand for eco-friendly, low-VOC paints is also increasing as consumers prioritize health and environmental impact.

5. Sustainability & Eco-Friendly Coatings

With rising environmental awareness, eco-friendly paints are gaining traction. Government regulations and green building initiatives like LEED certifications are driving the demand for low-VOC, non-toxic, and biodegradable coatings. Paint manufacturers are focusing on water-based formulations and sustainable packaging to align with stricter environmental standards.

6. Unorganized Sector Challenges & Opportunities

The unorganized sector, which holds a 23% market share, is facing increasing competition from major players due to regulatory changes like GST and demonetization. While small-scale manufacturers cater to regional markets with lower-cost products and higher dealer margins, established brands are adopting competitive pricing to capture this segment.

With increasing urbanization, rising disposable incomes, and advancements in paint technology, India’s paint industry is set for continued growth, driven by innovation, sustainability, and evolving consumer preferences.

Key Challenges for the Indian Paint Sector

The Indian paint industry, valued at over ₹700 billion, is set for growth, but several challenges threaten its expansion.

1. Raw Material Price Fluctuations & Supply Chain Issues

The industry heavily relies on imports for key raw materials like titanium dioxide (TiO2), resins, and pigments. Global supply chain disruptions, currency fluctuations, and trade restrictions impact costs and availability, affecting profitability.

2. Environmental Regulations & Sustainability Demands

Stricter regulations on volatile organic compounds (VOCs) are pushing manufacturers toward eco-friendly, low-VOC, and water-based paints. While necessary for sustainability, this shift requires significant R&D investments, increasing production costs.

3. Titanium Dioxide (TiO2) Dependency

TiO2, a critical component in paints, faces supply constraints due to India’s ban on beach mineral mining. With 70% of TiO2 imported—mainly from China—price volatility and availability remain key concerns.

4. Rise of Water-Based Paints

Growing environmental awareness is driving demand for water-based paints, which are low in VOCs and odorless. Companies like Asian Paints are investing heavily in water-based paint manufacturing to align with market trends.

5. Seasonal & Festive Demand Fluctuations

Decorative paint sales peak during the festive and wedding seasons but dip during monsoons. Industrial paint demand is linked to automotive, engineering, and infrastructure growth, making it sensitive to economic cycles.

The Indian paint industry must navigate these challenges by improving supply chain management, investing in sustainable technologies, and adapting to changing market trends.

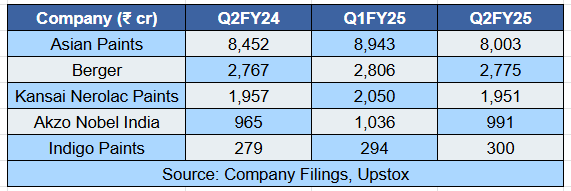

The Market Heavyweights: Who’s Leading the Game? Q2FY25 Analysis

The Q2FY25 results of major paint companies highlight the impact of heightened competition, weak volume growth, and subdued value growth. Despite being fundamentally strong, most paint sector stocks have underperformed the broader market in recent years. The latest quarterly results indicate modest revenue growth, influenced by:

- Weak demand trends

- Intensified competition

- Limited volume expansion

- Inability to implement necessary price hikes

- Extended monsoon season and flooding in key markets

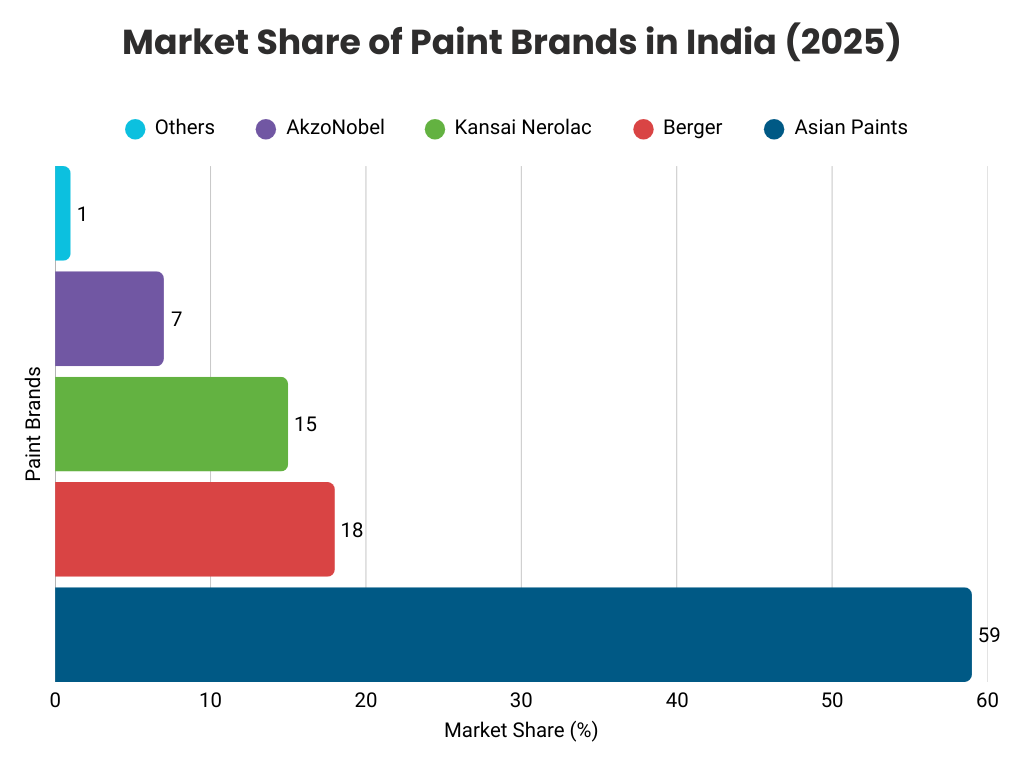

The Indian paint industry is highly competitive, with a few major brands dominating the market. As of 2023, Asian Paints is the market leader with a 59% share. Other significant players include Berger Paints (18%), Kansai Nerolac (15%), and AkzoNobel (Dulux) (7%), while smaller brands account for the remaining 1%.

Most companies experienced a decline in EBITDA on both a QoQ and YoY basis. Alongside price reductions and subdued demand, rising manpower costs linked to expansion activities also weighed on performance.

Emerging Competitors

- JSW Paints, which entered the market in 2019, generated revenue of ₹2,000 crore in FY24 and aims to reach ₹5,000 crore by FY26 by expanding its retailer network and strengthening its decorative and industrial coatings segment.

- Birla Opus, launched by the Aditya Birla Group in April 2024, has rapidly scaled up, with over 50,000 dealers in its first year closing in on Berger Paints’ 55,000 outlets and targeting Asian Paints’ 160,000-dealer network.

Top Paint Sector Stocks Analysis

1. Asian Paints

- Market Cap: ₹2,16,172 Cr.

- Current Price: ₹2,253

- 52-Week High/Low: ₹3,395 / ₹2,246

- Stock P/E: 46.0

- Book Value: ₹188

Asian Paints, a market leader established in 1942, has a strong presence across Asia, the Middle East, Africa, and the South Pacific. The company offers paints, coatings, bath fittings, and interior decor services under brands like Asian Paints, Apco Coatings, and Berger.

Financial Highlights:

- Revenue: ₹347.78 billion

- Gross Profit Margin: 42.12%

- Net Profit Margin: 13.14%

- ROCE: 29.09%

- 5-Year Revenue CAGR: 11.31%

- P/E Ratio: 47.27

- Dividend Yield: 1.35%

The company’s innovation-driven expansion and strong brand loyalty continue to support its premium valuation.

2. Berger Paints India

- Market Cap: ₹52,688 Cr.

- Current Price: ₹451

- 52-Week High/Low: ₹630 / ₹438

- Stock P/E: 46.0

- Book Value: ₹48

Established in 1923 and headquartered in Kolkata, Berger Paints is a major player in both the domestic and international markets, offering a wide range of decorative and industrial paints.

Financial Highlights:

- Revenue: ₹112.68 billion

- Gross Profit Margin: 39.35%

- Net Profit Margin: 10.16%

- ROCE: 25.1%

- 5-Year Revenue CAGR: 11.96%

- P/E Ratio: 46.87

- Dividend Yield: 0.68%

The company continues to expand its dealer network and invest in new product innovations to maintain its competitive edge.

3. Kansai Nerolac Paints

- Market Cap: ₹19,858 Cr.

- Current Price: ₹246

- 52-Week High/Low: ₹353 / ₹244

- Stock P/E: 32.5

- Book Value: ₹69.8

Established in 1920 and a subsidiary of Kansai Paint Co., Japan, Kansai Nerolac is a key player in the decorative, industrial, and automotive coatings segments.

Financial Highlights:

- Revenue: ₹82.34 billion

- Gross Profit Margin: 35.67%

- Net Profit Margin: 8.92%

- ROCE: 20.45%

- 5-Year Revenue CAGR: 11.23%

- P/E Ratio: 44.87

- Dividend Yield: 0.75%

Kansai Nerolac leverages Japanese technology and sustainability initiatives to strengthen its position in the Indian market.

4. Akzo Nobel India

- Market Cap: ₹16,852 Cr.

- Current Price: ₹3,700

- 52-Week High/Low: ₹4,674 / ₹2,265

- Stock P/E: 38.7

- Book Value: ₹313

A subsidiary of AkzoNobel N.V., headquartered in Gurugram, Akzo Nobel India is a leader in decorative paints, performance coatings, and specialty chemicals.

Financial Highlights:

- Strong revenue performance across diverse industrial applications

- Focus on innovation and sustainability

- Expanding its premium and industrial coatings portfolio

- The company’s global expertise and strong brand positioning continue to drive its growth in India.

5. Indigo Paints

- Market Cap: ₹5,952 Cr.

- Current Price: ₹1,252

- 52-Week High/Low: ₹1,720 / ₹1,245

- Stock P/E: 42.0

- Book Value: ₹200

Founded in 2000 and headquartered in Pune, Indigo Paints is one of India’s fastest-growing paint companies, known for its innovative product offerings and strong distribution network.

Financial Highlights:

- Revenue: ₹2,500 crore (FY24)

- Net Profit Margin: 10.36%

- Cash Reserves: ₹207.26 crore

- Low Debt: ₹27.35 crore

Despite a 10.6% YoY decline in earnings, the company remains profitable and growth-focused. Indigo Paints is expanding its manufacturing capacity and product portfolio to compete with larger players like Asian Paints and Berger Paints.

What’s Next? The Future of the Indian Paint Industry

As we look ahead, the industry is gearing up for another wave of disruption. Here’s what’s coming:

- Service-Oriented Model: With labor costs rising, painting is shifting from a product-based to a service-based model. Companies like Asian Paints are launching “Experience Stores” and home painting services.

- The DIY Boom: As professional labor gets pricier, DIY painting solutions will gain popularity. Expect to see easy-to-use DIY kits hitting the market.

- Beyond Paint: The Total Home Solution: Companies aren’t stopping at paints. They’re expanding into waterproofing, furniture, kitchenware, and home décor to become one-stop solutions for homeowners.

- Sustainable Paints: Expect more innovation in eco-friendly formulations, including carbon-neutral and plant-based paints.

The Indian paint industry is at a pivotal juncture, balancing between heightened competition and continued growth opportunities. While the entry of deep-pocketed players is disrupting market dynamics and intensifying price competition, the sector’s long-term prospects remain strong, driven by economic expansion, urbanization, and evolving consumer preferences. Established brands must innovate, expand dealer networks, and optimize costs to maintain their dominance, while new entrants must leverage financial strength and distribution reach to capture market share. Despite near-term challenges, the industry’s steady correlation with GDP growth, rising demand for premium and sustainable products, and increasing infrastructure investments signal a resilient and promising future.

.png)