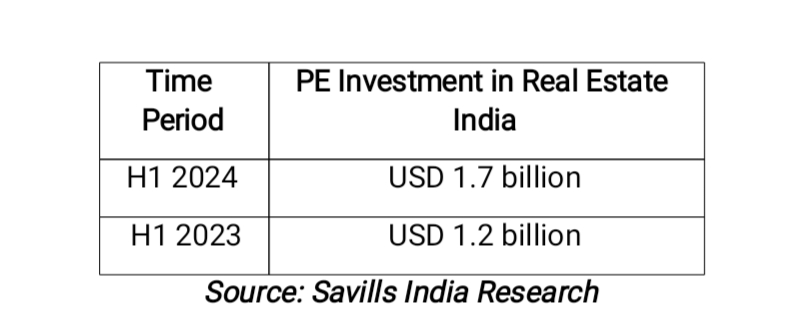

Private equity (PE) investment in Indian real estate has shown remarkable growth in the first half of 2024, according to the latest findings from Savills India. The total PE inflows into the sector amounted to USD 1.7 billion (INR 142 billion) during H1 2024, reflecting a substantial 42% year-over-year increase. This impressive growth underscores a strong investor confidence in the Indian real estate market, bolstered by favorable macro-economic conditions and sustained sector performance.

Year-Over-Year Growth in Investment

In H1 2024, the Indian real estate sector witnessed a significant surge in private equity investments, with the total amount reaching USD 1.7 billion. This marks a 42% increase from the same period the previous year, highlighting a robust upward trajectory for the sector. This growth can be attributed to several factors, including the resilience of the Indian economy, a favorable regulatory environment, and the strategic attractiveness of the real estate sector for both domestic and international investors.

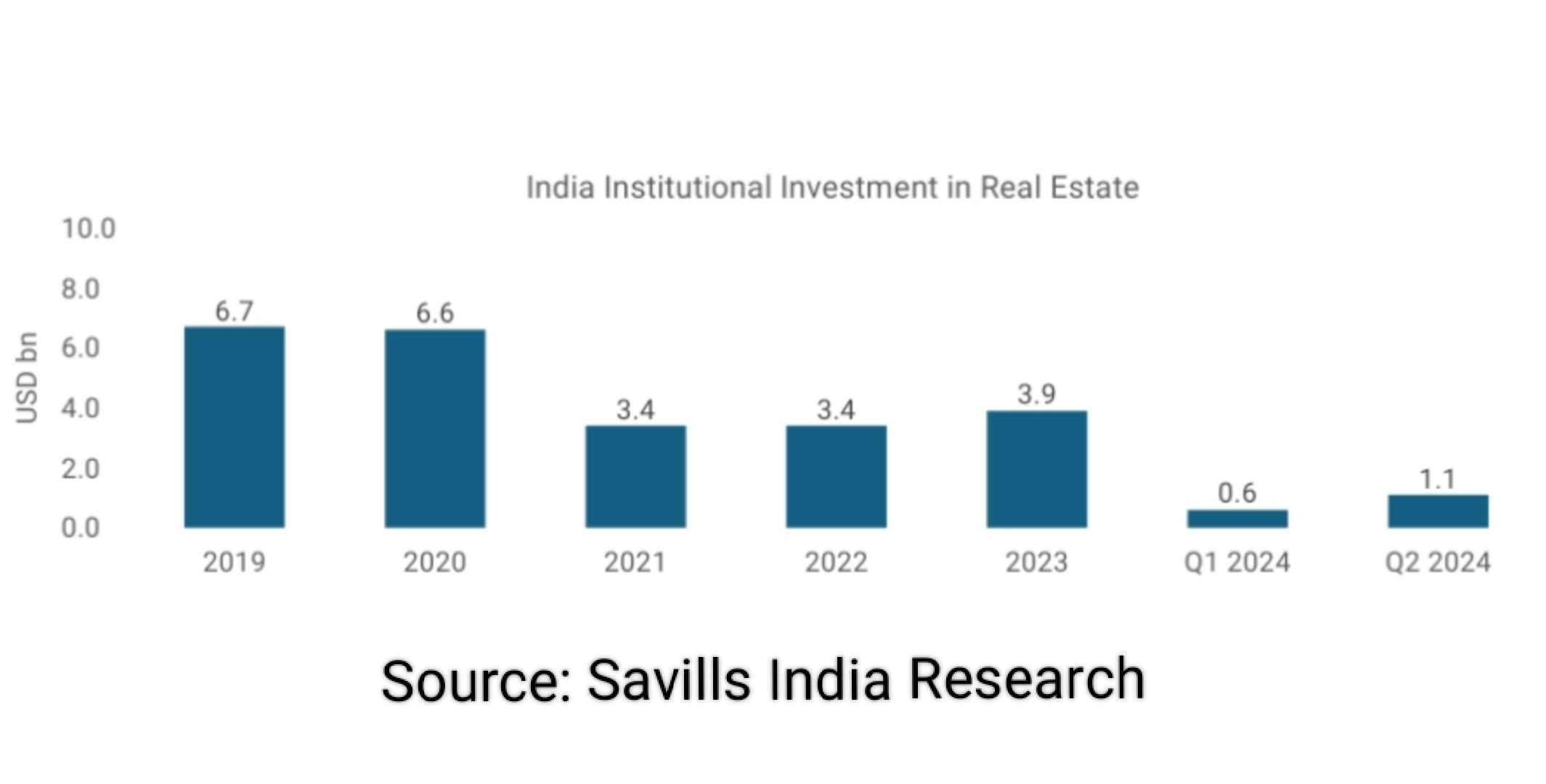

Quarterly Analysis: Q1 vs. Q2 2024

The report also breaks down the investment data on a quarterly basis, revealing that while H1 2024 overall saw a significant increase in PE inflows, the second quarter (Q2 2024) witnessed investment levels that were on par with the corresponding period from the previous year. In Q2 2024, private equity inflows stood at USD 1.1 billion (INR 96 billion), maintaining the same level of investment as Q2 2023. This stability in Q2 suggests that while there was a notable surge in the first quarter, the second quarter’s performance was consistent with historical trends.

Sector-Specific Investment Trends

The data from Savills India highlights that the commercial office sector continued to dominate the investment landscape, capturing approximately 51% of the total investment volume in H1 2024. This enduring preference for commercial office assets can be attributed to strong leasing activity in prime office locations and the continued demand for high-quality office spaces driven by a recovering post-pandemic economy.

In close pursuit, the residential sector accounted for 47% of the total private equity investments in H1 2024. This uptick in the residential sector reflects a renewed investor interest driven by sustained housing demand and the continuous introduction of new residential projects by developers. The residential market’s appeal is further bolstered by favorable government policies, a growing middle class, and the increased focus on affordable housing projects.

Regional Investment Insights

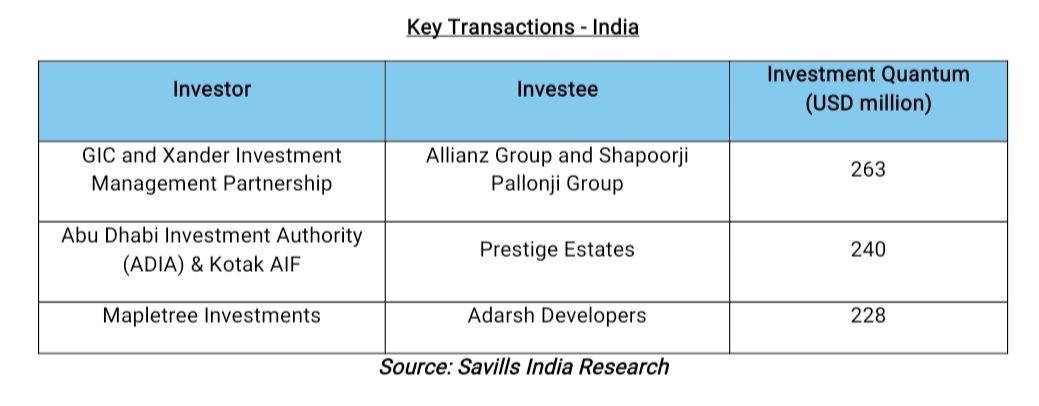

The report also sheds light on the geographical distribution of investment. A significant portion of the investments, approximately 78%, was contributed by Asian investors. This regional concentration points to a growing confidence among investors from the Asia-Pacific (APAC) region in the Indian real estate market. Among the cities receiving the most attention were Bengaluru and Hyderabad, which saw substantial investments in both commercial office spaces and residential developments. These cities are emerging as prime investment hubs due to their strong economic fundamentals, robust infrastructure development, and a thriving real estate market.

Investor Confidence and Market Outlook

Arvind Nandan, Managing Director of Research & Consulting at Savills India, attributes the strong performance in H1 2024 to India’s favorable macro-economic environment. According to Mr. Nandan, “In H1 2024, PE investment activity into Indian real estate continued its momentum aided by India’s strong macro-economic scenario. While the commercial office sector maintained the lead due to robust leasing in investible grade assets, the residential sector also saw a notable uptick fueled by sustained demand, thereby reflecting investors’ confidence. Investors from the APAC region have demonstrated a growing interest in the Indian real estate, contributing over 70% of investments in H1 2024.”

Mr. Nandan’s comments highlight a key trend: the increasing confidence of APAC investors in the Indian real estate market. This growing interest is reflective of the broader regional trends where investors are seeking to diversify their portfolios and capitalize on emerging markets like India. The substantial contribution of APAC investors indicates a positive outlook for the Indian real estate sector, with expectations for continued growth and development.

Conclusion

The Savills India report for H1 2024 paints an optimistic picture for the Indian real estate sector, marked by significant growth in private equity investments and a promising outlook for the future. The 42% year-over-year increase in investment inflows reflects strong investor confidence driven by a favorable economic environment and attractive investment opportunities. The continued dominance of the commercial office sector, alongside a notable rise in residential investments, underscores the sector’s resilience and appeal. Furthermore, the substantial involvement of Asian investors, particularly from the APAC region, signals a growing recognition of India as a key investment destination.

Image source- Pinterest

.png)