Godrej Properties Ltd. has received board approval to raise up to Rs 6,000 crore through a range of financial instruments. This decision, made during a board meeting, it is part of a comprehensive strategy aimed at enhancing the company's capital structure and leveraging the robust demand observed in the real estate market.

Fundraising Strategy

The capital raise will be executed through various methods, subject to shareholder consent. Godrej Properties plans to tap into multiple channels for this fundraising initiative, including the issuance of equity shares, convertible debentures, non-convertible debentures (with or without warrants), and preference shares convertible into equity. This diverse array of funding options is designed to optimize the company's financial flexibility and align with prevailing market conditions.

The potential routes for this fundraising effort include both public and private placements. Godrej Properties may opt for qualified institutional placements (QIP), rights issues, or further public offers, depending on the appetite from investors and the prevailing market dynamics. This flexibility in approach allows the company to adapt to market sentiments and maximize its capital-raising potential.

Market Performance and Growth

Godrej Properties' stock has experienced a remarkable trajectory over the past year, with its share price more than doubling. As of October 1, 2024, the stock was trading at Rs 3,194.75, representing an increase of over 1 percent in the late morning session. This impressive performance has pushed the company’s market capitalization to nearly Rs 89,000 crore, a testament to its strong position in the real estate sector.

In terms of year-to-date performance, the company’s share price has surged by over 60 percent since January 2024. This growth significantly outpaces the benchmark NSE Nifty 50 index, which has risen by 34 percent during the same period. Such strong market performance underscores investor confidence in Godrej Properties and its strategic initiatives.

Context of the Fundraising

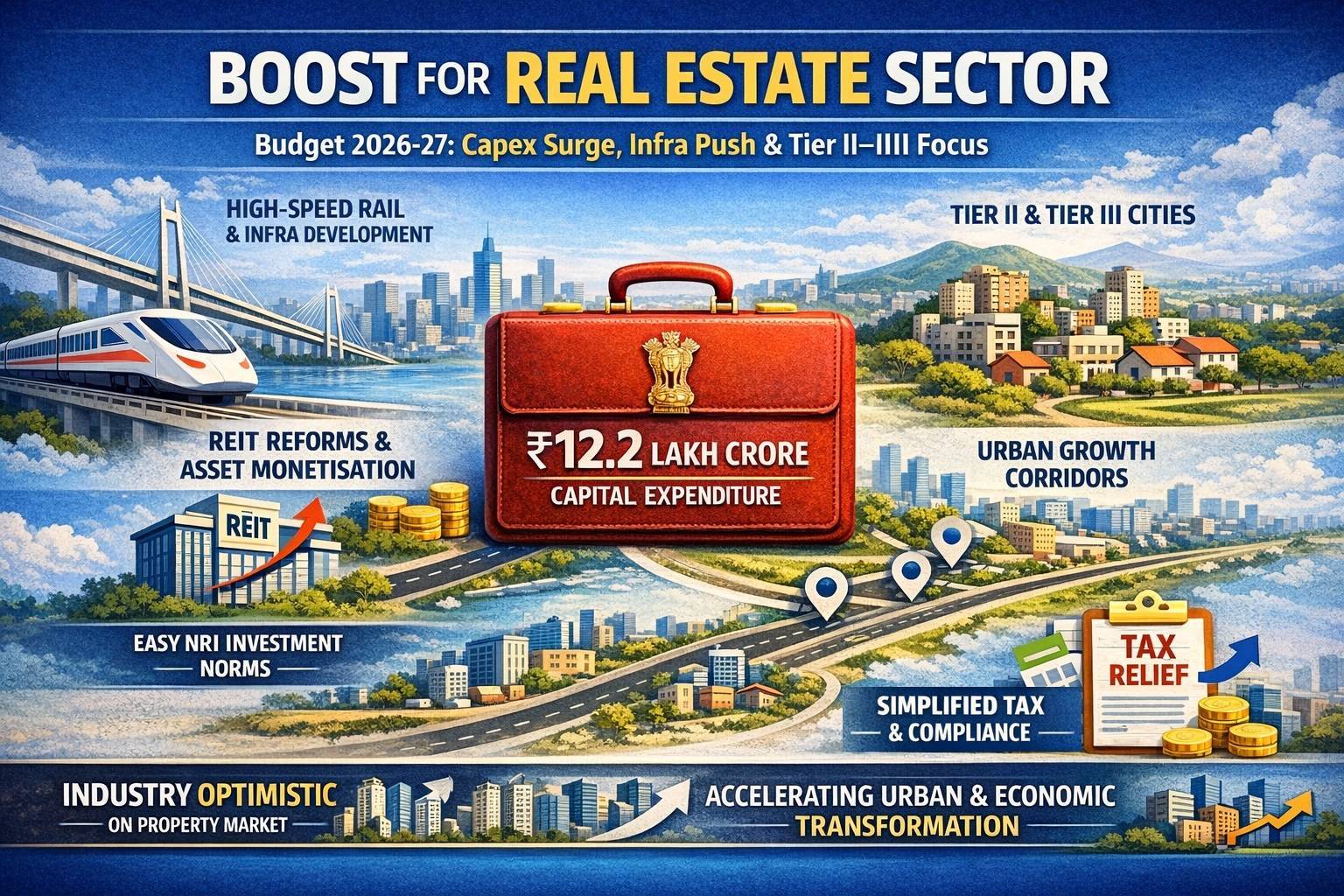

The decision to raise capital comes at a time when the Indian real estate sector is witnessing robust demand, driven by factors such as improving economic conditions, a rebound in consumer confidence, and government initiatives aimed at boosting housing and infrastructure development. The sector has shown resilience and growth potential, making it an attractive space for investment.

Godrej Properties, as one of the leading players in the Indian real estate market, is well-positioned to capitalize on these trends. The raised funds will likely be directed toward expanding its project portfolio, enhancing operational capabilities, and pursuing strategic acquisitions or joint ventures that align with its growth objectives.

As the real estate sector continues to grow, Godrej Properties is well-equipped to leverage new opportunities and drive future growth, further solidifying its status as a leader in the market. Investors and stakeholders will be keenly watching the developments surrounding this capital-raising effort, as it marks a critical step in the company’s journey towards sustained success.

.png)