The residential real estate sector in India is not just a marketplace for properties; it's a reflection of the nation's economic health, societal aspirations, and regulatory environment in the first quarter of 2024, India's residential real estate market witnessed notable shifts and encountered various challenges. This analysis delves into the prevailing trends and hurdles shaping the sector during this period. From evolving consumer preferences to regulatory impacts, exploring these dynamics provides valuable insights into the current state of India's housing market landscape.

Price Dynamics:

The first quarter of 2024 witnessed a significant surge in average housing prices across India's top eight cities, reflecting the resilience and dynamism of the residential real estate market. This surge was fueled by multiple factors, including robust demand, favorable economic conditions, and evolving consumer preferences. Bengaluru, known as the Silicon Valley of India, emerged as a frontrunner in price escalation, recording a remarkable 19% increase in housing prices. This surge can be attributed to the city's thriving technology sector, which continues to attract both domestic and international investors seeking prime real estate opportunities. Similarly, Delhi-NCR experienced a notable 16% surge in housing prices, signaling renewed investor confidence in the region's real estate market. Other cities such as Ahmedabad and Pune also witnessed double-digit growth, driven by a combination of factors such as infrastructure development, urbanization, and demographic trends. These price dynamics underscore the robustness of India's residential real estate market and highlight the opportunities it presents for investors and developers alike.

Regional Variations:

While the overall market sentiment remained positive, the dynamics of price variation across different regions underscored the diverse economic landscapes and local market conditions within India's top eight cities as per hindutantimes.com.

Bengaluru: The Silicon Valley of India, Bengaluru, exhibited robust growth in housing prices, outpacing other cities with a remarkable 19% increase. This surge can be attributed to the city's thriving IT and technology sector, which continues to attract skilled professionals and investment from around the globe. The city's cosmopolitan culture, coupled with its pleasant climate and robust infrastructure, further enhances its appeal to homebuyers and investors alike.

Delhi-NCR: Despite facing challenges in the past, Delhi-NCR experienced renewed investor confidence, reflected in a significant 16% surge in housing prices. The region's strategic location, coupled with ongoing infrastructure projects and government initiatives, contributed to its resurgence. Improved connectivity, particularly with the expansion of metro networks and expressways, has bolstered demand for residential properties in prime locations across Delhi and its satellite towns.

Ahmedabad: The commercial capital of Gujarat, Ahmedabad, witnessed double-digit growth in housing prices, reflecting the city's status as an emerging economic powerhouse. With a burgeoning industrial sector and a strong entrepreneurial ecosystem, Ahmedabad attracts both investors and end-users seeking affordable yet quality housing options. The government's focus on promoting business-friendly policies and infrastructure development has further fueled the city's real estate growth trajectory.

Pune: Known for its educational institutions and thriving IT sector, Pune experienced notable growth in housing prices, with a 13% annual increase. The city's vibrant job market, coupled with its pleasant climate and quality of life, makes it a preferred destination for young professionals and families. Strategic initiatives such as the Pune Metropolitan Region Development Authority's (PMRDA) infrastructure projects and the Pune Smart City Development Corporation Limited's (PSCDCL) urban renewal efforts have contributed to Pune's real estate vibrancy.

Chennai and Hyderabad: Chennai and Hyderabad, while witnessing more moderate growth rates compared to other cities, remain steady performers in the residential real estate market. Chennai's robust manufacturing and automotive sectors, coupled with Hyderabad's thriving IT and pharmaceutical industries, underpin their steady demand for housing. Both cities benefit from a relatively lower cost of living compared to other metropolitan areas, making them attractive destinations for homebuyers seeking affordability without compromising on quality of life.

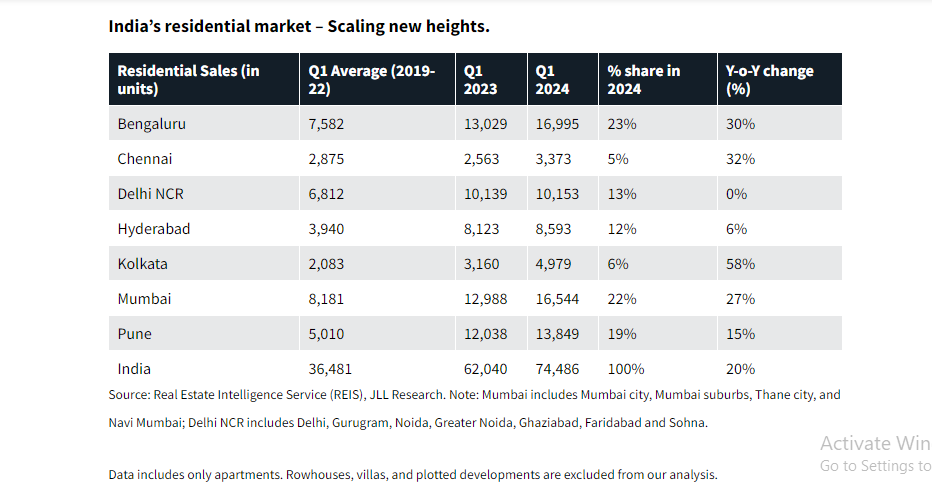

Sales Growth

The first quarter of 2024 (Q1 2024) achieved the highest residential sales to date, with a notable 20% increase compared to the same period in 2023, selling a total of 74,486 units. This quarter marks the second consecutive quarter where sales have exceeded 74,000 units, following the record-breaking performance in Q4 2023 (75,591 units). These results establish a strong foundation for continued growth in the residential market, surpassing the sales performance of 2023.

The quarterly sales were majorly contributed by the markets of Bengaluru, Mumbai, and Pune accounting for ~64% of the total sales. All these three cities saw robust launches that received good response from the buyers. While Bengaluru and Pune recorded highest sales in the INR 50 lakh-75 lakh price segment, Mumbai saw maximum sales in the INR 1.5 crore-3 crore price segment. The strategic launch of right products by the developers taking into cognizance the demand and market dynamics has led to this new growth phase in the residential market. Interestingly some of the branded developers are also planning to enter new markets and cities to expand their portfolio and market share, as per JLL India.

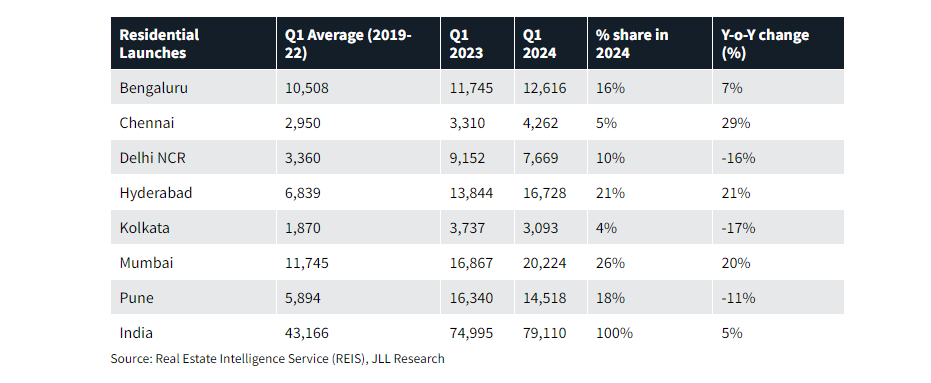

Q1 2024 new residential project launches

As per JLL report, the first quarter of 2024 witnessed highest number of residential launches with 79,110 units, surpassing the previous Q1 numbers. This represents a Y-O-Y growth of 5%. Developers have readjusted their marketing strategies, leading to a noticeable surge in the number of high-value projects being launched. Approximately 37% of these new launches were in the price bracket INR 1.5 crore and above.

Unsold Inventory and Market Absorption:

The management of unsold inventory emerged as a critical metric in assessing market health. As per Colliers-Liases Foras report the national trend reflected a marginal 3% year-on-year increase, Pune emerged as a beacon of efficiency with a significant 10% year-on-year drop in unsold inventory. This reduction, coupled with commendable reductions in Delhi-NCR and Ahmedabad, showcased a healthy absorption rate and market resilience. However, challenges persisted in regions like Mumbai Metropolitan Region (MMR), highlighting the need for innovative interventions to stimulate demand and alleviate inventory pressures.

As per JLL report, Q1 2024, unsold inventory across the seven cities increased by 1% on a Q-o-Q basis as launches outpaced sales. Mumbai, Bengaluru, and Hyderabad together account for 66% of the unsold stock. An assessment of years to sell (YTS) shows that the expected time to liquidate the stock has remained the same at 2.1 years in Q1 2024.

Government Initiatives and Regulatory Framework:

Regulatory frameworks, epitomized by bodies like Maharashtra Real Estate Regulatory Authority (MahaRERA), played a pivotal role in shaping the sector's trajectory. The introduction of new guidelines aimed at enhancing accessibility, safety, and sustainability in senior living communities underscored the government's commitment to holistic urban development. Moreover, policy measures focused on streamlining approvals and promoting transparency have instilled investor confidence and fostered a conducive ecosystem for sustainable growth.

Industry Perspectives and Future Outlook:

Industry experts and stakeholders maintain an optimistic outlook on the future of India's residential real estate sector, despite the challenges posed by factors such as affordability and regulatory compliance. Stable lending practices, infrastructural investments, and evolving consumer preferences are expected to drive growth, particularly in the luxury and ultra-luxury segments. The luxury segment, in particular, continues to attract high-net-worth individuals and investors seeking premium residential properties with top-notch amenities and facilities. Additionally, infrastructural developments such as the expansion of metro networks, the development of smart cities, and the improvement of connectivity are expected to further bolster demand for residential real estate across various cities.

In 2024, residential sales are expected to be around 300,000-315,000 units as the growth momentum currently seen is expected to be carried forward. Strategic land acquisitions at prime locations as well as along growth corridors in cities is expected to strengthen the supply inflow across cities as per JLL report. Established developers are expected to enter newer markets to fortify their portfolio and expand their market presence. Initiatives aimed at promoting affordable housing, simplifying regulatory processes, and fostering public-private partnerships will be crucial in ensuring the long-term sustainability and growth of India's residential real estate market. By embracing innovation, leveraging technology, and adopting forward-thinking strategies, the sector can navigate uncertainties and unlock its full potential for sustainable growth and development.

Conclusion

The first quarter of 2024 provided invaluable insights into the intricacies of India's residential real estate market. By deciphering regional nuances, leveraging regulatory frameworks, and embracing forward-thinking strategies, the sector can chart a course towards inclusive and sustainable growth, thereby fulfilling the aspirations of millions of homebuyers and investors alike.

.png)