Purchasing real estate property is a major investment, and dealing with a delayed or stalled housing project can lead to financial losses and immense stress for homebuyers. There is a significant number of delayed or stalled housing projects across many cities, which is impacting several homebuyers. The Indian Banks' Association (IBA) estimates that there are around 412,000 stressed residential units across the country, totaling over ₹4 lakh crore in value. More than half of these units, approximately 240,000, are located in the National Capital Region.

If you're a frustrated homebuyer dealing with a stalled real estate project in India, there are several avenues available for seeking relief. Buyers can claim compensation for delays under the sale agreement or RERA. They may withdraw from the project, seek a full refund with interest, or stay and demand compensation for the delay. Complaints can also be filed in consumer courts for service deficiencies, leading to monetary relief or other remedies. Buyers are entitled to project updates and can pursue legal action or cancel the builder-buyer agreement if the delay is the developer's fault.

Common Reasons for Delays in Real Estate Projects

Several factors contribute to delays in real estate projects, including regulatory hurdles, financial challenges, poor project planning, and unforeseen events. Delays in obtaining necessary approvals, inadequate funding, or mismanagement by developers can notably impact project timelines. External factors like unfavorable weather conditions, legal disputes, and changes in government policies or real estate regulations also play a role in causing setbacks. Additionally, poor coordination between contractors, delays in procuring materials, and labor shortages further stall construction progress, leading to cost overruns and dissatisfaction among buyers.

Legal Options

Here are five legal options available to homebuyers, provided insolvency proceedings have not been initiated against the developer:

1. File Complaint with RERA

If a developer delays the delivery or possession of a residential property, you can file a complaint with the state’s real estate regulatory authority. The Real Estate Regulation Act, 2016 (RERA) entitles homebuyers to compensation, which may include interest on the amount paid or a refund.

Steps Involved in RERA Complaint:

- Document Verification: You will need to provide scanned copies of property-related documents for verification by a lawyer.

- Complaint Drafting: The lawyer will draft the complaint within 10 days of receiving your documents and send it to you for review.

- Filing the Complaint: Once the draft is approved, the complaint will be filed with RERA within 3 days.

- Builder's Reply: The builder will respond to the complaint by submitting a formal reply.

- Hearing and Arguments: RERA will conduct hearings, during which both parties present their case. You will receive updates after each hearing.

- Judgment: RERA will issue a judgment based on the hearings and evidence presented.

- Execution: If the builder does not comply with the judgment, proceedings will be initiated to enforce the ruling, which may include attaching the builder’s assets.

RERA is applicable even to projects that started before the law came into effect but are now registered under the authority. Soumya Banerjee, Partner at AQUILAW, notes that because RERA is a relatively new law, cases are often resolved faster, typically within 7-8 years. However, enforcement of orders can be a challenge in some states, which may delay the process further. In such cases, homebuyers can escalate matters to the RERA appellate authority or the High Courts for contempt of order.

2. Seek Redress in Consumer Courts for Delayed Projects

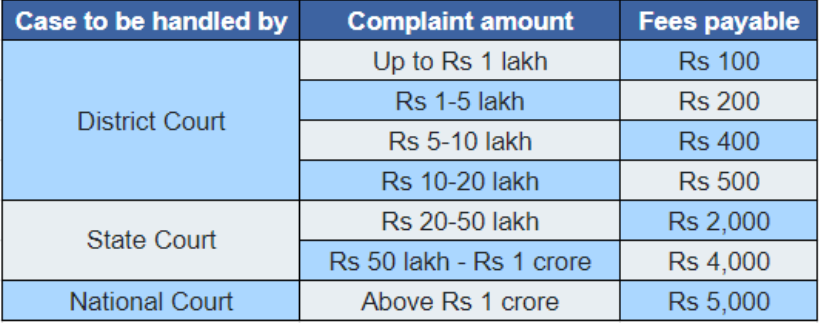

Under the Consumer Protection Act, 1986, homebuyers are recognized as consumers and can approach the National Consumer Disputes Redressal Commission for relief in cases of stalled projects. Complaints should be filed based on the property's value: for properties under ₹20 lakh, approach the district commission; for those between ₹20 lakh and ₹1 crore, the state commission; and for claims above ₹1 crore, the National commission.

How to File a Complaint in Consumer Court Against Builders?

Issue a Notice: First, send a formal notice to the developer outlining the issue and requesting a resolution. If no satisfactory response is received, you can proceed to file a complaint in consumer court. File a Complaint Online: Sign up at consumerhelpline.gov.in with your email and mobile number. Verify your account using an OTP. Submit your complaint under "Consumer Grievance," including supporting documents. Pay the Fee: After submitting the complaint form, pay the required fee online based on the claim amount. The table below breaks down the applicable fee structure on complaint claims starting Rs 1 lakh to Rs 1 crore.

- Issue a Notice: First, send a formal notice to the developer outlining the issue and requesting a resolution. If no satisfactory response is received, you can proceed to file a complaint in consumer court.

- File a Complaint Online:

- Sign up at consumerhelpline.gov.in with your email and mobile number.

- Verify your account using an OTP.

- Submit your complaint under "Consumer Grievance," including supporting documents.

- Pay the Fee: After submitting the complaint form, pay the required fee online based on the claim amount. The table below breaks down the applicable fee structure on complaint claims starting Rs 1 lakh to Rs 1 crore.

(Source: 99acres)

You can track your complaint status online via the portal.

Filing a complaint doesn’t require a lawyer, as the procedures are straightforward. There are currently over 50,000 real estate cases pending in consumer courts, highlighting the volume of grievances.

3. Resolution Under the Insolvency and Bankruptcy Code, 2016

In the case of significant project delays, homebuyers can initiate a corporate insolvency resolution process (CIRP) against the developer if at least 100 allottees or 10% of affected buyers join forces, provided the default amount exceeds ₹1 crore. The Insolvency and Bankruptcy Code, 2016 recognizes homebuyers as financial creditors, allowing them to seek resolution through the National Company Law Tribunal (NCLT).

Procedure for Homebuyers to Initiate Corporate Insolvency Resolution Process:

- Initiation of Insolvency Resolution Process (IRP): Under the Insolvency and Bankruptcy Code, 2016, the National Company Law Tribunal (NCLT) initiates a corporate insolvency resolution process (CIRP) when a company defaults on payment to creditors.

- Who Can File: A financial creditor, operational creditor, or the corporate debtor itself can file an application before the NCLT to initiate IRP. Post-amendment, homebuyers can also approach NCLT if a developer fails to provide possession of a property or refund the money.

- Appointment of Interim Resolution Professional (IRP): An interim resolution professional is appointed to take charge of the defaulting company, with the authority to manage its operations and revive the company.

- Powers of the IRP: The IRP is empowered to raise fresh funds, continue business operations, and take steps to restore the company's financial health.

- Resolution Timeline: The IRP is initially granted 180 days to find a resolution, with an option for a 90-day extension. If no resolution is found within this period, the company is liquidated to settle creditor claims.

4. Relief from Civil Courts

Homebuyers can file a money recovery suit under the Civil Procedure Code, 1908, or pursue criminal action under the Criminal Procedure Code, 1974, if the developer is found guilty of fraud or misrepresentation. However, Legal experts advise that aggrieved homebuyers should first file their case with RERA, followed by an appeal to the RERA Appellate Tribunal. If the dispute remains unresolved, they may approach the High Court, and ultimately, the Supreme Court.

According to Shabala Shinde, Partner at Grant Thornton Bharat, Section 79 of the RERA Act prohibits Civil Courts from handling disputes within the jurisdiction of RERA, its adjudicating officer, or the Appellate Tribunal.

The RERA Act functions alongside existing legal frameworks, allowing other laws to be considered during case proceedings. As outlined in Section 88, the RERA Act complements other applicable laws to avoid legal duplication and ensure consistent dispute resolution.

Appeal Timeline:

- RERA Appellate Tribunal: Must be filed within 60 days of receiving the RERA order.

- High Court: Appeals can be lodged within 60 days of the Appellate Tribunal's decision.

- Supreme Court: A Special Leave Petition (SLP) can be filed within 60 days of the High Court's final judgment.

5. File Complaint with the Competition Commission of India (CCI)

Under the Competition Act, 2002, homebuyers can file a complaint with the Competition Commission of India if a developer misuses a dominant market position to the buyer’s disadvantage. However, such cases are less common due to the stringent criteria for proving anti-competitive practices.

How to file information with the Competition Commission of India (CCI)?

- Provide Details: Use Format 1 from the CCI website to include your complete postal address, contact details, and the name/address of the enterprise(s) alleged to have violated the Competition Act.

- Submission: The information should be a signed statement detailing the contraventions, supported by relevant documents, affidavits, and evidence.

- Representation: You can file a case personally or authorize a representative (lawyer, chartered accountant, etc.) under Section 35 of the Competition Act, 2002.

- Send to Secretary: Submit the information in person, by registered post, courier, or fax to the Secretary of the Commission.

- Fee Payment: Pay the filing fee via demand draft, pay order, banker's cheque, or direct bank transfer to the CCI’s account.

For detailed filing procedures, refer to the CCI (General) Regulations, 2009.

Conclusion

Homebuyers' rights regarding project completion delays are established to safeguard their interests and ensure developers meet their contractual commitments. Hence, it is important for a homebuyer to stay vigilant and take immediate action when facing a delay in getting possession of a property. Under RERA and various legal provisions, homebuyers can seek compensation, refunds, and legal remedies, ensuring they are not unfairly impacted by delays in property delivery.

Important Note:

Homebuyers are advised not to pursue multiple remedies simultaneously, as this could complicate their cases. Seeking the right course of action can remarkably improve the chances of obtaining relief from stalled projects. We also recommend consulting a legal expert in order to take the right course of action.

.png)