India’s real estate market has witnessed a significant shift in pricing trends, with under-construction (UC) homes now surpassing the prices of ready-to-move (RTM) properties across major metropolitan cities. According to recent data from Magicbricks, a leading real estate platform in India, this price discrepancy is becoming more evident in cities such as Delhi, Gurugram, and Mumbai.

Price Comparison: UC vs RTM Homes

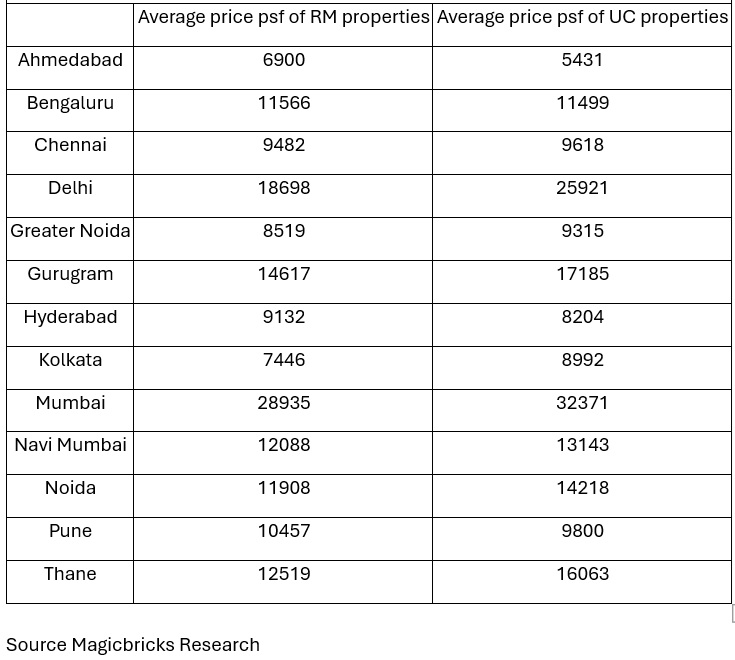

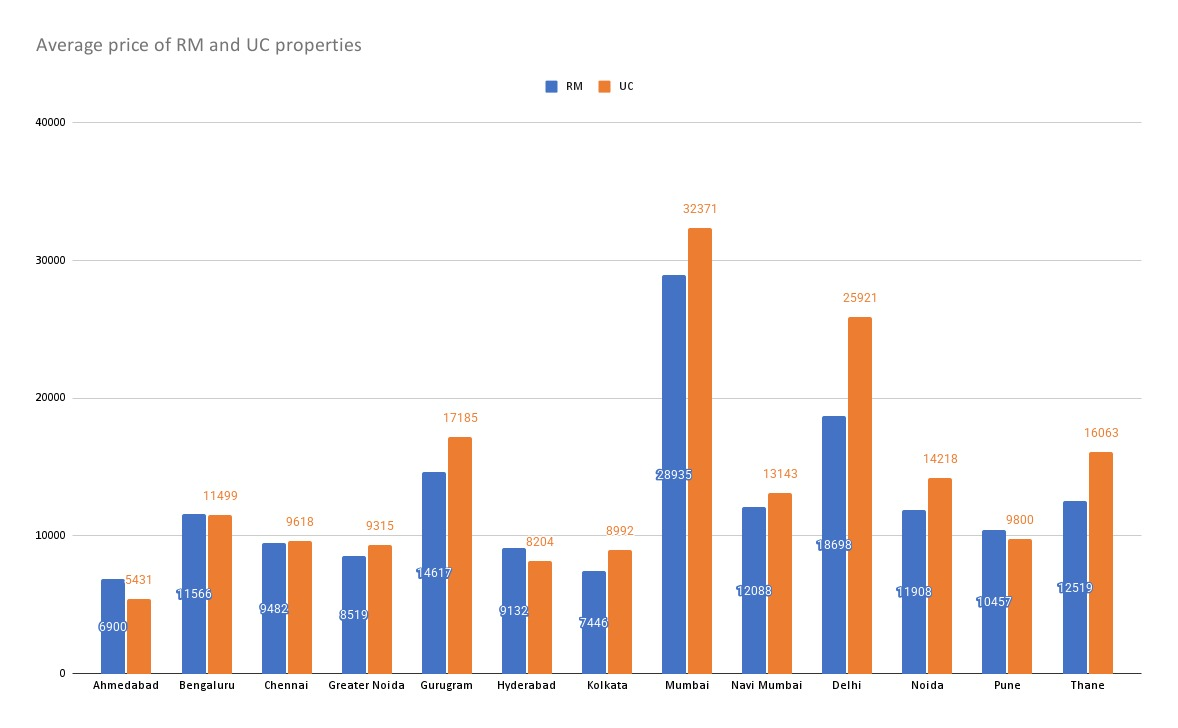

In New Delhi, the price of a ready-to-move apartment averages INR 18,698 per square foot. However, under-construction homes in the capital city have reached INR 25,921 per square foot, showing a substantial price gap. A similar trend is observed in Gurugram, where the price of UC homes stands at INR 17,185 per square foot, whereas RTM properties are priced at INR 14,617 per square foot.

Mumbai, traditionally India’s most expensive real estate market, is also following this trend. In the first quarter of 2025, under-construction property prices increased by 33.4% year-on-year (YoY), reaching INR 32,371 per square foot. In contrast, RTM properties are priced at INR 28,935 per square foot, further highlighting the growing price difference between new developments and existing homes.

Factors Driving the Price Surge of Under-Construction Homes

Several factors contribute to the rising cost of under-construction homes. One of the primary reasons is the evolving buyer preferences. Homebuyers are now seeking contemporary designs, better layouts, and superior construction quality, which has led developers to invest more in creating homes that meet these demands. As a result, developers are charging a premium for properties that offer these enhanced features, pushing up the prices of under-construction homes.

Another significant factor is the growing sentiment for homeownership post-pandemic. With the increased desire for personal space and secure living environments, more individuals are investing in new homes, even if they come with a higher price tag. This demand has put pressure on developers to increase their prices.

Additionally, the surge in the cost of raw materials, including cement, steel, and other essential construction inputs, has contributed to the rising construction costs. These increased costs have been passed on to buyers, further elevating the prices of under-construction properties.

The Shift in Buyer Behavior

The trend of higher-priced under-construction homes is indicative of changing buyer behavior. Historically, ready-to-move homes were preferred due to their immediate availability and certainty in terms of the final product. Buyers could inspect the property, make their decisions, and move in right away. However, as preferences shift towards newer homes with better amenities, layouts, and modern designs, under-construction homes have gained popularity despite the price increase.

The post-pandemic demand for residential properties has also played a key role in driving up the prices of new developments. With more people focusing on long-term investments in their homes, there is a growing inclination to purchase under-construction properties that promise potential value appreciation once completed.

Raw Material Costs and Its Impact on Pricing

The increase in raw material costs has been a crucial factor influencing the prices of under-construction homes. The cost of key construction materials has risen sharply in recent years, exacerbated by supply chain disruptions and inflationary pressures. Developers are compelled to adjust their pricing models to reflect these higher construction expenses, which is contributing to the price surge in under-construction properties.

Moreover, the construction industry has faced challenges such as labor shortages and logistical issues, further driving up the costs. These issues are being passed on to the consumer, making newly developed properties costlier than those that are already completed.

Despite the higher prices of under-construction homes, experts suggest that early investment in these properties could offer long-term value and capital appreciation. For buyers and investors, the prospect of purchasing at current rates might seem costly, but with the ongoing trend of rising home prices, these investments could prove profitable in the long run. As the demand for residential properties continues to grow, the potential for significant capital appreciation remains high, particularly in rapidly developing urban areas.

.png)