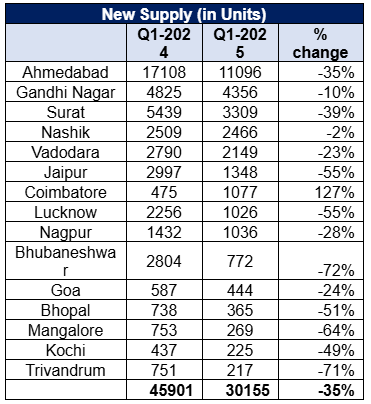

India’s top 15 Tier 2 cities witnessed a significant 35% year-on-year decline in housing supply during the January–March 2025 period, according to a report released by NSE-listed real estate data analytics firm PropEquity. The total number of newly launched housing units fell to 30,155 in Q1 2025 from 45,901 units recorded in the same quarter of the previous year. The majority of the new supply—nearly 48%—was concentrated in the ₹50 lakh to ₹1 crore price segment. This marks a shift in developer focus towards the mid-income segment amid challenges related to affordability and cost viability of lower-ticket homes.

Regionally, Eastern and Central India saw the steepest contraction in new launches, with a 68% decline year-on-year. Northern India followed with a 55% reduction in supply, while Western and Southern India recorded comparatively moderate declines of 28% and 26%, respectively. The report also pointed out that the seven state capitals among the 15 Tier 2 cities collectively witnessed a 43% drop in new supply during the quarter, further reinforcing the trend of a broad-based slowdown in project launches across key growth centers.

At the city level, Bhubaneswar registered the highest year-on-year decline of 72%, with new launches falling to just 772 units in Q1 2025. Trivandrum and Mangalore followed with declines of 71% and 64%, respectively. Jaipur and Lucknow also saw their new housing supply halve, dropping by 55% each. On the other hand, Nashik experienced the smallest decline at just 2%, while Coimbatore was the only city to record an increase in new supply, surging by 127% to 1,077 units from 475 units a year earlier.

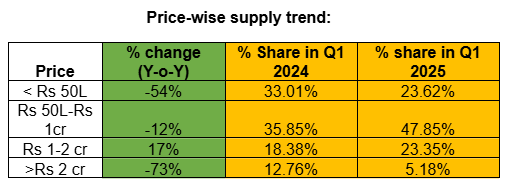

In terms of price-wise segmentation, the supply of housing units priced below ₹50 lakh more than halved, declining by 54% to 7,124 units in Q1 2025 from 15,420 units in Q1 2024. The share of this segment in total new launches dropped from 33.01% to 23.62%. Although the absolute number of units priced between ₹50 lakh and ₹1 crore declined by 12%, the segment’s market share increased significantly from 35.85% to 47.85%, indicating developers’ stronger preference for mid-range homes. Units priced between ₹1 crore and ₹2 crore saw a 17% year-on-year growth in supply, and their share rose from 18.38% to 23.35%. In contrast, the supply of premium units priced above ₹2 crore witnessed a sharp 73% contraction, with their market share shrinking from 12.76% to 5.18%.

Among the state capitals, the supply of affordable homes priced below ₹50 lakh plunged by 90% in Q1 2025, while homes priced between ₹50 lakh and ₹1 crore declined by 13%. Notably, there was a 31% increase in the supply of homes priced between ₹1 crore and ₹2 crore in these urban centers. These shifts indicate a notable change in developer strategy, likely influenced by cost pressures and the pursuit of higher margins in the mid-to-premium segments.

Samir Jasuja, Founder and CEO of PropEquity, explained that the sharp decline in housing supply across Tier 2 cities is largely due to a more cautious stance adopted by developers amid shifting market dynamics. “Developers with strong financial backing are increasingly focusing on premium housing segments to enhance profitability, which has made the launch of homes priced below ₹50 lakh less viable,” he said. “As a result, we’re seeing a sustained reduction in supply at the lower end of the market. On the other hand, homes priced between ₹1 crore and ₹2 crore have witnessed a 17% year-on-year increase in supply, with their share in total launches rising from 18% to 23%.”

He added, “With home loan rates currently ranging between 8% and 8.5%, the recent 50-basis-point cut in the repo rate by the RBI is expected to bring further relief to borrowers. This is likely to stimulate demand for homes priced between ₹50 lakh and ₹2 crore in Tier 2 cities,” .

Mr. Jasuja emphasized the long-term potential of these markets. “Tier 2 cities continue to offer significant opportunities for both developers and corporate players. With sustained infrastructure investments and the government’s push to position these cities as engines of economic growth, we expect to see a steady rise in end-user housing demand, ” he said.

The data from Q1 2025 reflects a clear shift in the housing landscape of India’s Tier 2 cities, as developers adapt their strategies to changing market conditions and evolving buyer preferences. While affordability concerns and rising construction costs have led to a slowdown in the supply of budget homes, the increased focus on mid-income and select premium housing segments highlights where future opportunities lie. Backed by infrastructure growth, policy support, and improving loan affordability, Tier 2 cities are poised to play an increasingly important role in the next phase of residential real estate development.

.png)