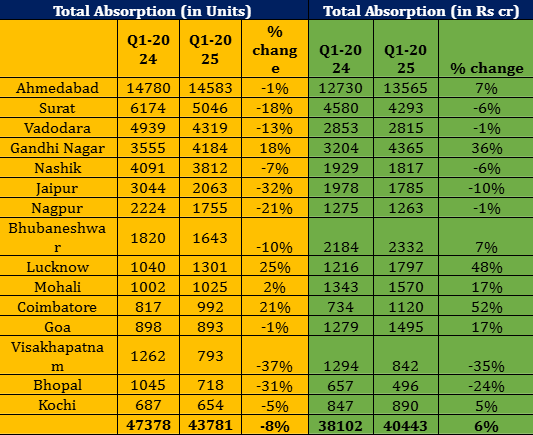

Housing sales in India’s top 15 tier 2 cities fell by 8% to 43,781 units in Q1 2025 as compared to 47,378 units in the same period last year with sales value, however, rising by 6% to Rs 40,443 crore in Q1 2025 as against Rs 38,102 crore in the same period last year, said a report by NSE-listed real estate data analytics firm PropEquity.

According to the report, Lucknow with 25% increase in number of units sold in Q1 2025 at 1301 units registered the highest growth amongst top 15 tier 2 cities. This was followed by Coimbatore 21%, Gandhi Nagar 18% and Mohali 2%.

Other 11 cities saw decline in number of units sold in Q1 2025 with Visakhapatnam registering the highest decline (37%) and Ahmedabad and Goa recording the least decline (1% each).

Coimbatore with 52% growth saw the highest increase in sales value at Rs 1120 crore in Q1, 2025. This was followed by Lucknow at 48%, Gandhi Nagar 36%, Mohali and Goa at 17% each, Ahmedabad and Bhubaneshwar at 7% each and Kochi 5%.

Other 7 cities saw a decline in sales value in Q1 2025 with Visakhapatnam recording the highest decline (35%) and Vadodara and Nagpur registering the least decline (1% each).

Samir Jasuja, Founder and CEO, PropEquity said, “The decline in sales in tier 2 cities in January-March period is in line with trends witnessed in tier 1 cities. However, lesser supply in this quarter resulted in lower sales in tier 2 cities. State Capitals performed relatively better.”

“Demand in tier 2 cities, however, remains robust as people have shown greater preference for organised living. Urban rejuvenation efforts, improved connectivity & social infrastructure, and more importantly greater employment opportunities mainly in IT and new manufacturing hubs in tier 2 cities have further accelerated demand not only from within but also from people who have migrated to metro cities and are preferring to purchase property in their hometowns. RBI has made 50bps cut in repo rate since January 2025 and is expected to cut rates further. As this gets transmitted by banks, homes loans will decline going forward thereby giving a boost to housing demand.”

The six State Capitals in top 15 tier 2 cities, namely Gandhi Nagar, Jaipur, Bhubaneshwar, Lucknow, Goa and Bhopal, saw 5% decline in sales and 17% increase in sales value, accounting for 25% of sales and 30% of sales value in Q1 2025.

Region-wise trend:

- Western India, comprising Ahmedabad, Surat, Vadodara, Gandhi Nagar, Nashik, Nagpur and Goa, saw 6% decline in number of units sold in Q1, 2025. However, sales value rose by 6% in Q1, 2025.

- Northern India, comprising Lucknow, Jaipur and Mohali saw 14% decline in number of units sold in Q1, 2025. However, sales value rose by 14% in Q1, 2025.

- Southern India, comprising Visakhapatnam, Kochi and Coimbatore, saw 12% decline in number of units sold and 1% decline in sales value in Q1, 2025.

- Central and Eastern India, comprising Bhopal and Bhubaneshwar, saw 18% decline in number of units sold in Q1, 2025. However, sales value remained flat.

Despite an 8% decline in housing sales across India’s top 15 Tier 2 cities in Q1 2025, a 6% rise in sales value signals sustained demand for higher-value homes, particularly in emerging hubs like Lucknow, Coimbatore, and Gandhinagar. These cities outperformed due to improved infrastructure, economic growth, and rising end-user interest, while others like Visakhapatnam and Bhopal saw sharper declines. State capitals and cities with strong connectivity and employment drivers fared better, highlighting a shift toward more resilient, quality-led demand. With the RBI’s 50 bps rate cut already in play and more expected, affordability is likely to improve further, potentially boosting housing demand. Tier 2 cities, backed by structural tailwinds and urban migration trends, are increasingly positioned as key drivers of India’s next phase of residential real estate growth.

.png)