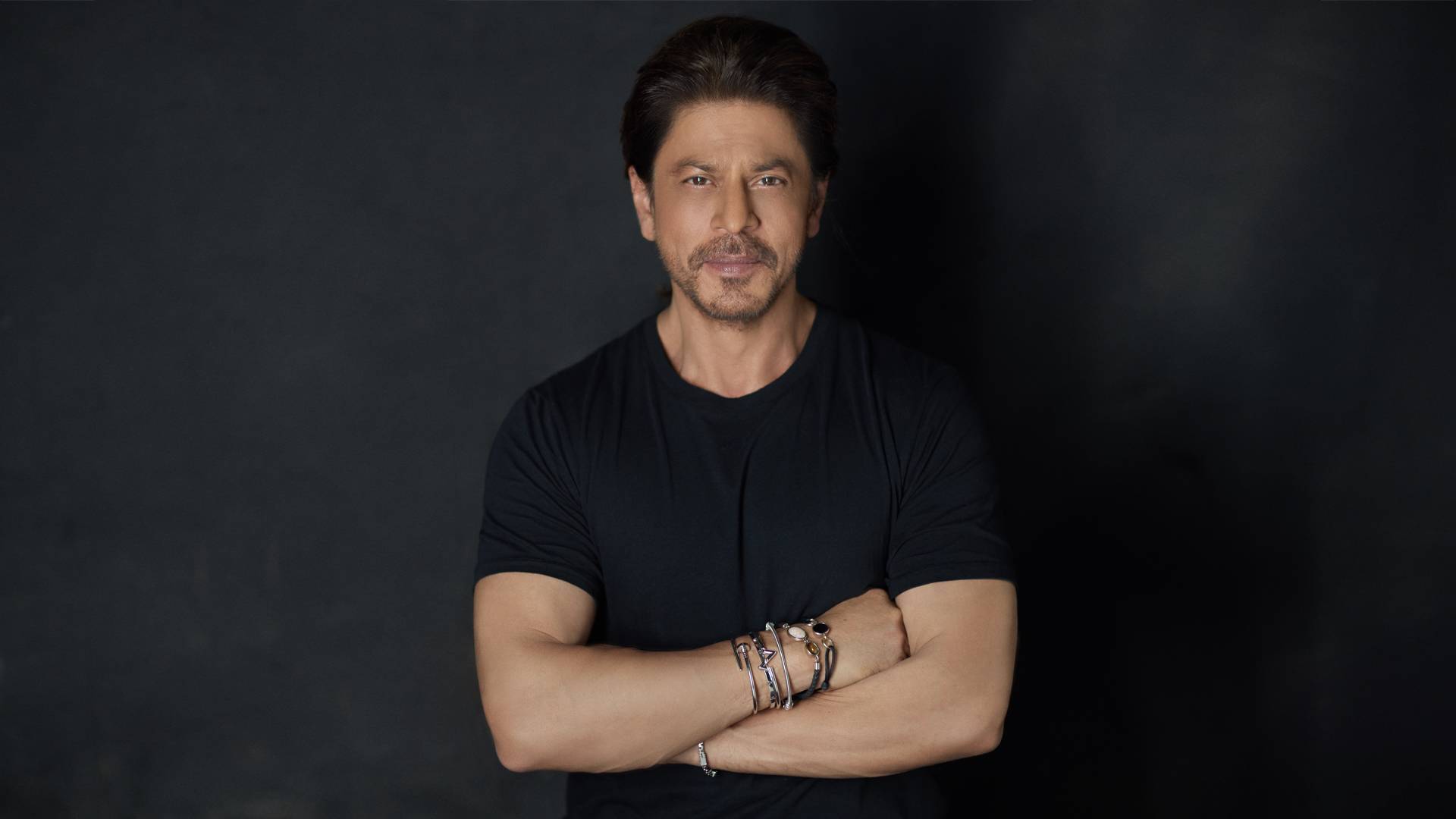

Actor Shah Rukh Khan’s family office is among 29 investors participating in a \$1 billion co-investment initiative managed by Mumbai-based Ashika Group. The average investment per family office in this round is estimated at around $35 million, according to individuals familiar with the matter. The identities of the other participating family offices were not disclosed.

Ashika Group operates across stockbroking, alternative investments, and investment banking advisory. It also offers services tailored for family offices. The group’s listed company, Ashika Credit Capital, closed at ₹387 on the Bombay Stock Exchange on Monday, down 0.8 percent. The Jains, who promote Ashika, charge about 1 percent of the profit as fees to co-investors. This is lower than what several larger portfolio managers typically charge.

Khan’s investment in Ashika adds to a series of recent transactions involving his family office. In addition to Ashika, Khan has invested in Sri Lotus Developers and Mythik, a media and technology startup launched by Freecharge founder Jason Kothari. Other investors in the Mythik round include Sakal Media Group, VC Grid, Visceral Capital, Bitkraft Ventures, Jaynti Kanani, and Enam Asset Management’s group chief executive Samir Vora. The round totaled $15 million.

Earlier this year, Khan and actor Amitabh Bachchan invested over ₹10 crore each in Sri Lotus Developers, a real estate firm led by film producer Anand Pandit. These investments follow a broader shift among high-net-worth individuals toward direct participation in early-stage ventures and curated real estate opportunities.

Khan’s known investment holdings span different sectors. His production companies, Dreamz Unlimited and Red Chillies Entertainment, operate in the film and digital content industry. He is also co-owner of the Indian Premier League cricket team Kolkata Knight Riders. In the entertainment and retail space, Khan has a stake in KidZania, a chain of indoor edutainment parks.

He owns multiple properties, including houses in Dubai, London, and the United States. In India, he owns a farmhouse in Alibaug, a house in Delhi, and Mannat, a sea-facing bungalow in Bandra. Mannat is currently undergoing structural and interior renovation. During the renovation period, Khan has leased four floors in the Puja Casa residential tower in Bandra for a term of 36 months beginning April 2025.

The SRK family office has also taken minority stakes in early-stage firms and wellness platforms. One such investment is in Numi, a mobile platform focused on personalised nutrition advice. His business activity spans content production, sports franchise ownership, health tech, and real estate. Brand endorsements and licensing deals are also part of his revenue model.

The co-investment structure facilitated by Ashika is being viewed by some wealth managers as a cost-efficient model for private offices seeking access to professionally sourced deals without building full-scale investment teams. The firm’s approach to pooled capital and profit-based fees has helped attract a group of investors interested in direct exposure across sectors.

Shah Rukh Khan’s participation in this initiative is in line with a growing number of Indian family offices exploring diverse allocation strategies. While he continues his work in cinema and related industries, the deployment of capital through structured co-investment frameworks reflects a shift in how celebrity and private wealth are being managed.

.png)