Bengaluru-based RMZ Corporation and Canada Pension Plan Investment Board (CPP Investments) have sold One Paramount 1, an office space in Chennai, to Singapore-based Keppel Ltd for over Rs 2,200 crore ($264 million). This significant deal, announced on August 6, 2024, underscores the robust investor confidence in India's commercial real estate sector and highlights RMZ Corp's strategic plans to expand its portfolio.

Strategic Location and Specifications

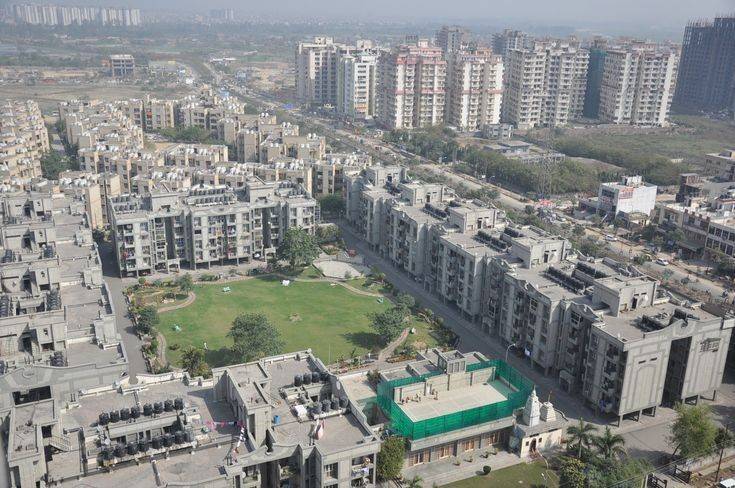

One Paramount 1 is part of the One Paramount project, a Grade A prime office asset developed through a joint venture between RMZ and CPP Investments. Strategically located in Porur, Chennai, One Paramount 1 spans 12.6 acres and offers 2.4 million square feet of leasable space. This property is designed to meet the needs of modern businesses, providing high-quality office space in a prime location. The location's connectivity and amenities make it a highly sought-after commercial property, attracting top-tier tenants from various sectors.

Financial Details and Future Plans

The proceeds from the sale, amounting to over Rs 2,200 crore, are expected to bolster RMZ Corp's expansion plans. Sources indicate that RMZ Corp will reinvest the funds to expand its existing commercial portfolio across India. In November 2023, RMZ Corp announced plans to invest $7 billion in equity over the next five years to develop over 125 million square feet of space in various projects valued at $25 billion. These projects are spread across major cities, including Mumbai, Bengaluru, Delhi, and Hyderabad.

This massive investment plan aligns with the growing demand for high-quality commercial spaces in India’s urban centers, driven by rapid urbanization and economic growth. RMZ Corp’s strategic reinvestment will likely focus on creating innovative, sustainable, and technologically advanced office spaces to meet the evolving needs of modern businesses.

Joint Venture and Remaining Assets

Despite the sale of One Paramount 1, RMZ Corp and CPP Investments will continue to hold stakes in an additional 12.5 million square feet of core and under-development commercial assets across India. The joint venture has successfully developed prime office assets, including RMZ One Paramount in Chennai and RMZ Nexity and RMZ Spire in Hyderabad.

The divestment of One Paramount 1 reflects RMZ Corp's commitment to efficient capital management, allowing the company to reallocate resources into newer, high-growth opportunities within its portfolio. This transaction not only reflects strong investor confidence in India's commercial real estate sector but also emphasizes RMZ’s commitment to unlocking immense stakeholder value. Keppel’s acquisition of One Paramount 1 reinforces investor appetite for Grade A office assets in the top office markets of India.

Market Impact and Investor Confidence

The sale of One Paramount 1 to Keppel Ltd underscores the growing interest of international investors in India's commercial real estate market. Grade A office assets, such as those developed by RMZ Corp, are particularly attractive due to their high-quality infrastructure, strategic locations, and potential for significant returns on investment. The acquisition by Keppel Ltd, a prominent Singapore-based company, highlights the global appeal of Indian commercial properties and the confidence international investors have in the country's real estate sector.

This deal reflects a broader trend of increasing foreign investments in Indian real estate, driven by favorable government policies, economic stability, and the potential for high returns. It also signals a positive outlook for the commercial real estate market, which is expected to grow significantly in the coming years.

Image source- rmzoffice.com

.png)