HDFC Capital–Curated Living Solutions Rental Housing Platform- Key Highlights

- HDFC Capital Advisors has partnered with Curated Living Solutions (CLS) to create a ₹1,000 crore platform focused on developing and owning professionally managed rental housing across India.

- The platform will address rising demand from students, young professionals, and migrant workers, supporting India’s shift from fragmented rentals to institutional-grade, organised formats.

- CLS, promoted by Bhaskar Raju of DivyaSree Group, currently manages over 13,000 beds across co-living, student housing, and worker accommodation, bringing proven execution capability to the partnership.

- The initiative is aligned with long-term trends such as urban migration, workforce mobility, and evolving lifestyle preferences, positioning rental housing as a key enabler of economic mobility.

- The platform will prioritise well-designed, safe, and sustainable rental assets, combining HDFC Capital’s long-term investment approach with CLS’s operational expertise to scale across major urban centres.

HDFC Capital Advisors Limited, the real estate private equity arm of the HDFC Group, has entered a strategic partnership with Curated Living Solutions (CLS), promoted by Mr. Bhaskar Raju of the DivyaSree Group, to establish a INR 1,000 crore rental housing platform in India.

The platform will focus on the development, ownership, and operation of institutional-grade rental housing assets to meet the growing demand for professionally managed rental accommodation across major urban centres. The partnership seeks to leverage long-term demographic and urbanization trends, including workforce and student mobility and evolving lifestyle preferences, while supporting the transition of India’s rental housing market towards organised, institutionally owned formats.

CLS brings extensive development and operational capabilities across co-living, student accommodation, and worker housing, and currently manages over 13,000 beds across India.

Commenting on the partnership, Vipul Roongta, CEO, HDFC Capital, said “India’s urban rental housing market is at an inflection point, shaped by a young and mobile population and rental housing is essential to enhance mobility, particularly for students, young professionals, and migrant workers. Divyasree Group and CLS have strong governance and execution track record, and this partnership will focus on development of scalable, professionally managed rental housing assets across top urban centers in India.”

Bhaskar Raju, Promoter, Curated Living Solutions and DivyaSree Group, said “By combining HDFC Capital’s long-term capital with CLS’s operating expertise, the platform will focus on developing and owning high-quality rental housing assets with a clear emphasis on safety, functional design, and sustainability.”

Jai Challa, CEO, Curated Living Solutions, added “Our priority has been to deliver well-designed and efficiently managed rental housing solutions. Partnering with HDFC Capital allows us to scale the platform and expand our presence across key urban markets in India.”

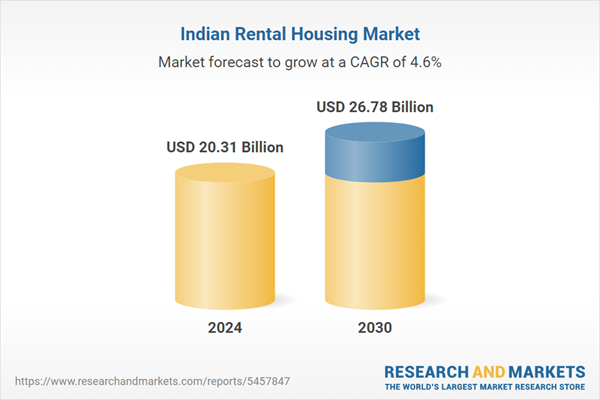

As per Research and Markets Report, The Indian rental housing market, valued at USD 20.31 billion in 2024, is projected to reach USD 26.78 billion by 2030, growing at a CAGR of 4.56%. This market comprises residential properties leased to tenants, including apartments, independent homes, condominiums, and shared or co-living spaces, catering to individuals and families seeking flexibility or affordability over homeownership. It plays a critical role in urban India, especially in cities with strong employment and education hubs, where population growth and rapid urbanisation fuel demand. While India’s residential sales market has witnessed strong momentum, home sales touching USD 42 billion in FY23 with 379,095 units sold, the high cost of ownership continues to sustain a parallel and expanding rental ecosystem supported by landlords, developers, property managers, and tenants.

Key growth drivers include declining housing affordability, supportive government policies, and evolving lifestyle preferences. Escalating property prices, construction costs, and home loan interest rates have pushed many middle-income households and young professionals toward renting, particularly in metros like Mumbai, Delhi, and Bengaluru.

Government initiatives such as the Model Tenancy Act and affordable rental housing schemes under PMAY have improved transparency, legal protection, and investor confidence. Simultaneously, changing preferences among millennials and Gen Z, who value mobility, shorter commitments, and ready-to-move-in homes, have boosted demand for rental and co-living formats. Together, these factors are making rental housing a mainstream, resilient, and increasingly organised segment of India’s real estate market.

.png)