Raymond Limited, announced the vertical demerger of its real estate business into its wholly owned subsidiary, Raymond Realty Limited (RRL). This decision is part of Raymond's broader strategy to streamline its operations and focus on core growth areas. Post-demerger, Raymond Ltd. and Raymond Realty Limited will operate as separate listed entities within the Raymond Group, subject to necessary statutory approvals.

In a regulatory filing, Raymond Ltd. outlined that the scheme of arrangement between Raymond Ltd (demerged company) and Raymond Realty Ltd (resulting company) will result in each shareholder of Raymond Ltd. receiving one share of Raymond Realty for every one share held. The real estate division reported standalone operational revenue of ₹1,592.65 crore in the last fiscal year, which constituted 24% of Raymond Ltd. total revenue.

The demerger is intended to unlock the value of the real estate business, which has achieved significant scale. In the fiscal year 2024, Raymond's Real Estate Business reported revenue of ₹1,593 crore, marking a 43% year-on-year growth, and an EBITDA of ₹370 crore. This positions Raymond Realty well to chart its own growth path as a separate entity, focusing on real estate development and attracting new investors and strategic partners.

Raymond Realty holds approximately 100 acres of land in Thane, with around 11.4 million square feet of RERA-approved carpet area, of which about 40 acres are currently under development. The ongoing projects on this land are valued at around ₹9,000 crore, with an additional potential to generate more than ₹16,000 crore. This gives Raymond Realty a total potential revenue of over ₹25,000 crore from its Thane land bank.

Moreover, Raymond Realty has adopted an asset-light model and launched its first Joint Development Agreement (JDA) project in Bandra, Mumbai. The company has also signed three new JDAs in Mahim, Sion, and another in Bandra East, Mumbai. The combined revenue potential from these four JDA projects in the Mumbai Metropolitan Region is over ₹7,000 crore. Altogether, the Thane Land Bank and the current four JDAs provide the company with a potential revenue of ₹32,000 crore.

Commenting on the development, Gautam Hari Singhania, Chairman and Managing Director of Raymond Limited, emphasized that the demerger aligns with the group's objectives of simplifying its corporate structure and enhancing shareholder value. He stated, “This corporate action is in line with creating shareholder value creation. The existing shareholders of Raymond Limited will get the shares in the new listed Real Estate company in a ratio of 1:1.”

The demerger will also enable Raymond Ltd. to focus on its core business areas—Lifestyle, Real Estate, and Engineering. This strategic move is expected to sharpen business focus and tailor investment strategies to each sector's unique dynamics. The demerger is subject to requisite approvals from the National Company Law Tribunal (NCLT), shareholders, creditors, central government, and other competent authorities.

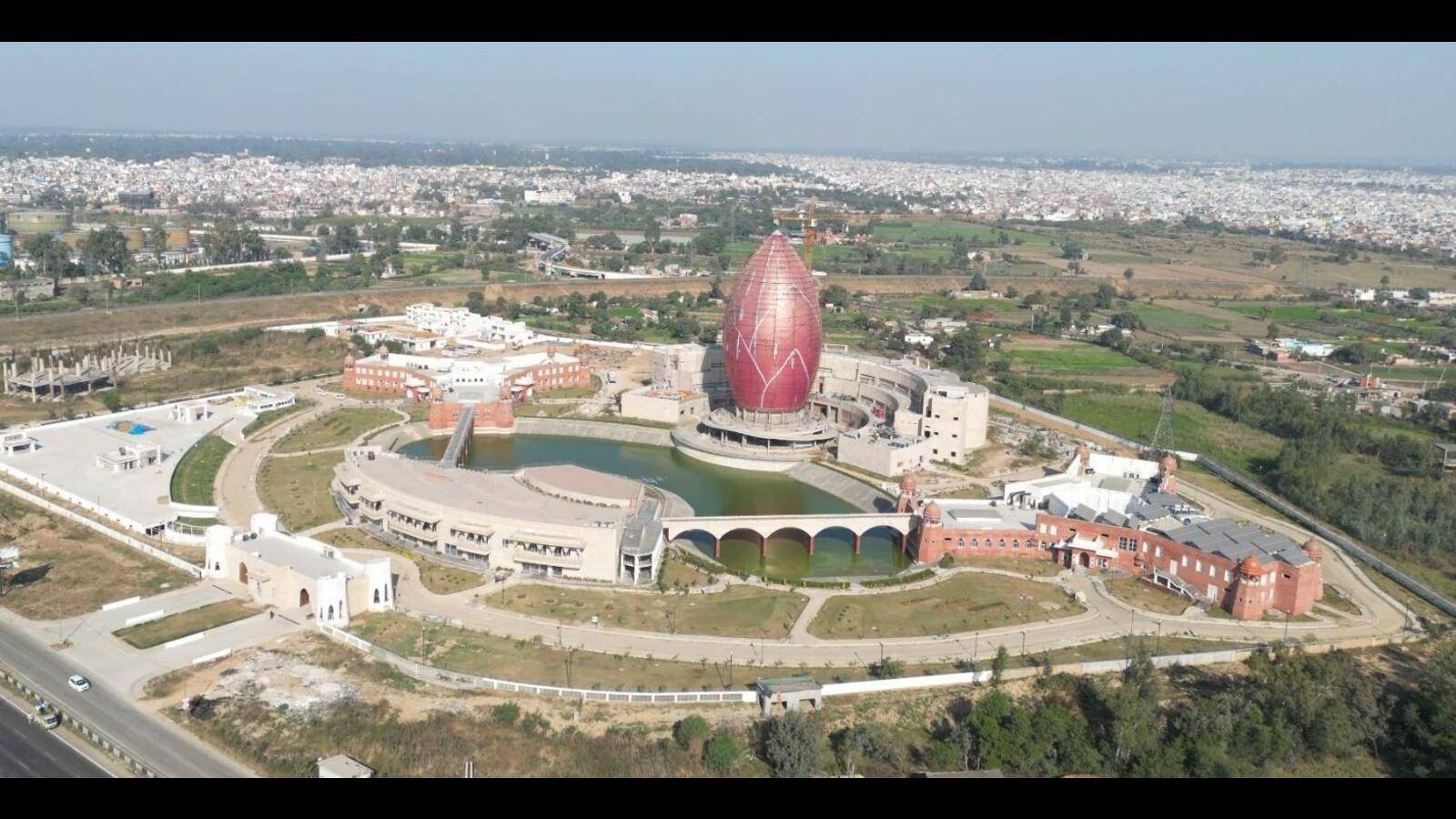

Image source- raymondrealty.in

.png)