Despite a turbulent stock market in 2024, India witnessed a record-breaking year in Qualified Institutional Placements (QIPs), with real estate emerging as the top sector. According to Anarock research, institutional investors remained bullish on India’s economic growth, pushing total QIP fundraising to an all-time high.

The Indian stock market has seen significant ups and downs, with steep corrections affecting investor sentiment. After reaching record highs earlier in the year, major indices like Nifty 50 and Sensex faced sharp declines starting in September 2024. However, while many retail investors became cautious, institutional investors stayed confident and pumped in funds through QIPs, particularly in real estate.

Real Estate Leads in QIP Fundraising

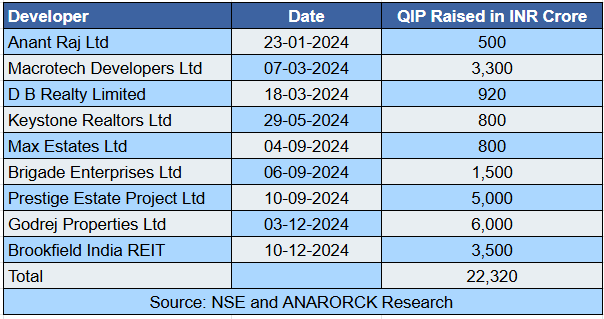

Anuj Puri, Chairman of Anarock Group, highlighted how real estate dominated QIP fundraising in 2024, proving its resilience despite market volatility. He stated, "Anarock’s analysis of QIP fundraising in 2024 highlights the real estate sector’s strength, with institutional investors displaying unwavering confidence in India’s economic fundamentals. The sector saw eight developers and one REIT collectively raise ₹22,320 crore. This financial strength will fuel a wave of new real estate developments."

The overall QIP fundraising across all sectors reached a record high of ₹1,41,482 crore, a 75% increase from the previous record of ₹80,816 crore in 2020. Real estate played a major role in this surge, securing the largest share of funds and recording the highest number of QIP issues.

Why Are QIPs Gaining Popularity?

QIPs offer several advantages for real estate developers compared to traditional funding methods like private equity or bank loans. These benefits include:

- Faster and cost-effective fundraising with minimal shareholder dilution.

- Attracting institutional investors like mutual funds and pension funds, ensuring substantial capital flow.

- Flexibility in fund utilization for land acquisitions, construction, or debt refinancing.

- Enhancing market credibility, signaling strong investor confidence in a company’s growth potential.

These advantages allow developers to accelerate their projects and plan large-scale expansions without financial bottlenecks.

QIP Trends from Previous Years

In 2023, total QIP fundraising across all sectors was ₹55,109 crore, raised through 43 issues—comparable to the ₹56,152 crore raised in 2017. Notably, real estate developers did not raise funds through QIPs in 2023, making their strong comeback in 2024 even more significant.

Real Estate Performance Amid Market Fluctuations

The broader equity market in 2024 was highly volatile. While the first half of the year saw strong corporate earnings, foreign investment inflows, and robust GDP growth, the second half was impacted by global uncertainties like geopolitical tensions, fluctuating oil prices, and shifting monetary policies. These factors triggered market corrections, leading investors to reassess their strategies.

Despite this uncertainty, five Nifty sectoral indices posted gains above 30% in 2024. The Real Estate index secured the fourth spot with an impressive 34.67% annual gain, reinforcing institutional confidence in the sector’s long-term potential.

Outlook for 2025: What’s Next?

Looking ahead, experts predict a mixed outlook for QIP fundraising in 2025. Given the heightened volatility in late 2024, some investors may exercise caution in the coming months. However, the strong performance of the real estate sector and continued investor confidence suggest that QIP fundraising in real estate could remain robust.

Anuj Puri noted, "The real estate sector’s ability to attract large QIP investments despite market fluctuations signals long-term optimism. If global monetary policies stabilize and India’s economic indicators remain strong, we can expect further momentum in 2025. This will support expansion, land acquisitions, and debt refinancing for major developers."

As institutional investors continue to focus on stable and high-growth sectors, real estate is expected

.png)