With an unwavering focus on sustainable built spaces, occupiers’ preference to lease in green certified buildings has gained momentum in key office markets across India. During Q2 2024, about 13 mn sq ft of office space in the top six cities has been leased in green-certified buildings. This represents a 24% YoY increase and accounts for an impressive 82% share in overall leasing during the quarter. This rapid growth is an indication of the rising awareness amongst corporate occupiers with respect to the role that built structures have to play in containing issues related to climate change through reducing carbon footprint. The share of Bengaluru followed by Mumbai remained significant, together accounting for over 50% of the leases in green-certified buildings in Q2 2024. Interestingly, of the 13 mn sq ft of leases signed in green buildings, about 60% were in relatively newer developments which have come in the last 5 years.

Currently, LEED, GRIHA and WELL are some of the prominent green certifications available in the Indian market, which validate buildings as ‘green’ by assessing various parameters including energy consumption, waste generation and alignment of design with health and wellness aspects. Real estate developers are increasingly aligning their offerings with global sustainability standards, simultaneously presenting various tangible benefits to their tenants including lower operational costs, improved indoor air quality and enhanced employee productivity.

Technology and Engineering & Manufacturing companies at the forefront

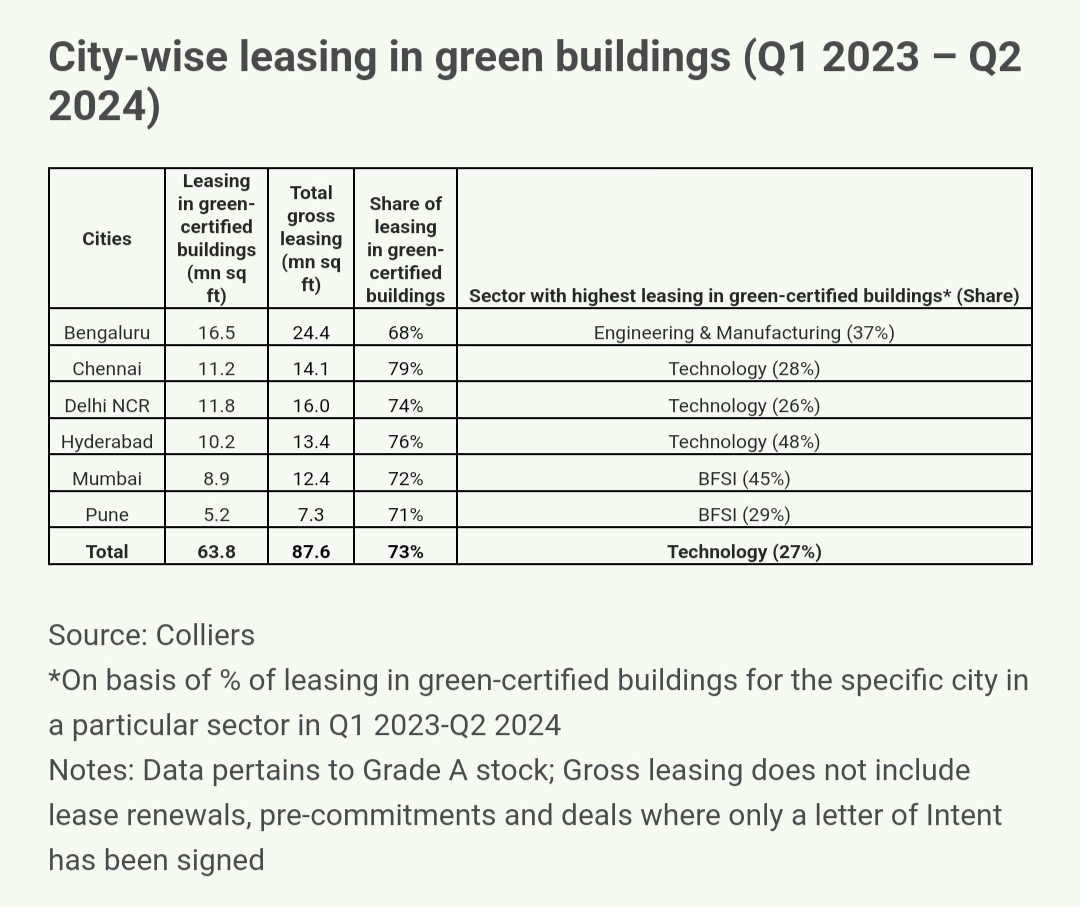

About 80% of leasing by technology and engineering & manufacturing firms since 2023 were in green-certified buildings. Moreover, it is noteworthy that 62% of the flex players prefer space take-up in green-certified buildings. Overall, at an India level, technology sector accounted for about 27% share in the cumulative space take up in green-certified buildings since 2023, followed by occupiers from Engineering & Manufacturing and BFSI sectors with about 19% share each.

“Over the last few quarters, developers, investors & occupiers in the office market have increasingly embraced adoption of sustainable elements in their portfolios. With 13 mn sq ft of leasing in green- certified buildings in Q2 2024, a significant 82% of occupiers were inclined towards green-certified buildings. This also reflects occupiers’ strong commitment to align their sustainability goals with the broader sustainability targets of the country. Since 2023, about 70-80% of the space uptake by Engineering & Manufacturing, Technology and BFSI players has been in green-certified buildings. The trend is expected to further accelerate in the next few years. Moreover, SEBI’s mandatory sustainability reporting further provides a thrust to occupiers, investors and developers to increasingly consider green portfolios while meeting their ESG targets, “says Arpit Mehrotra, Managing Director, Office services, India, Colliers.

More than two-thirds of Grade A office stock in India is currently green certified

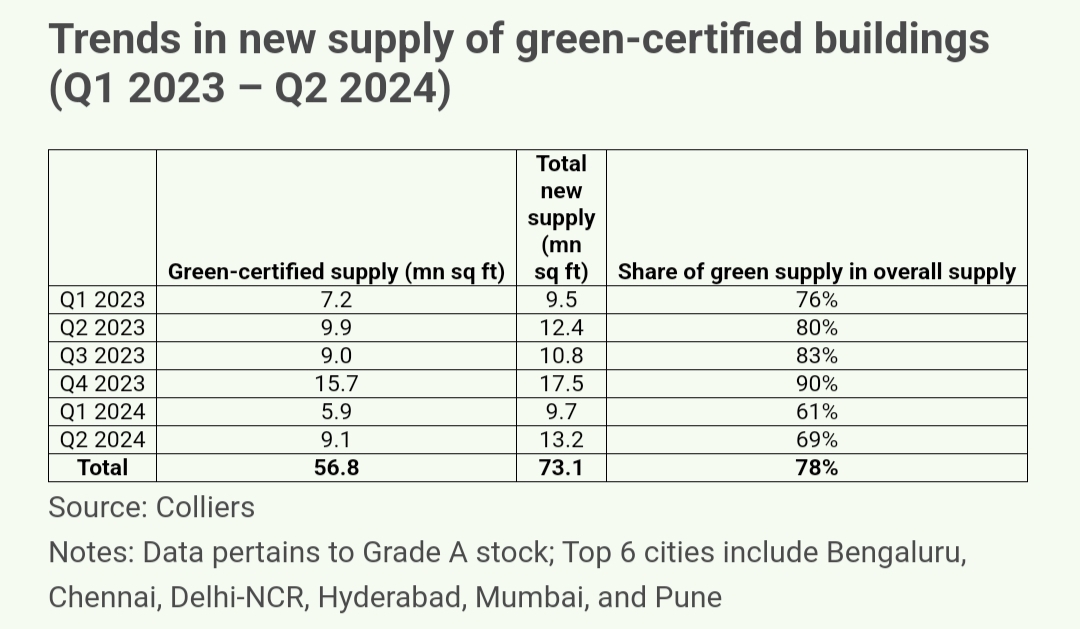

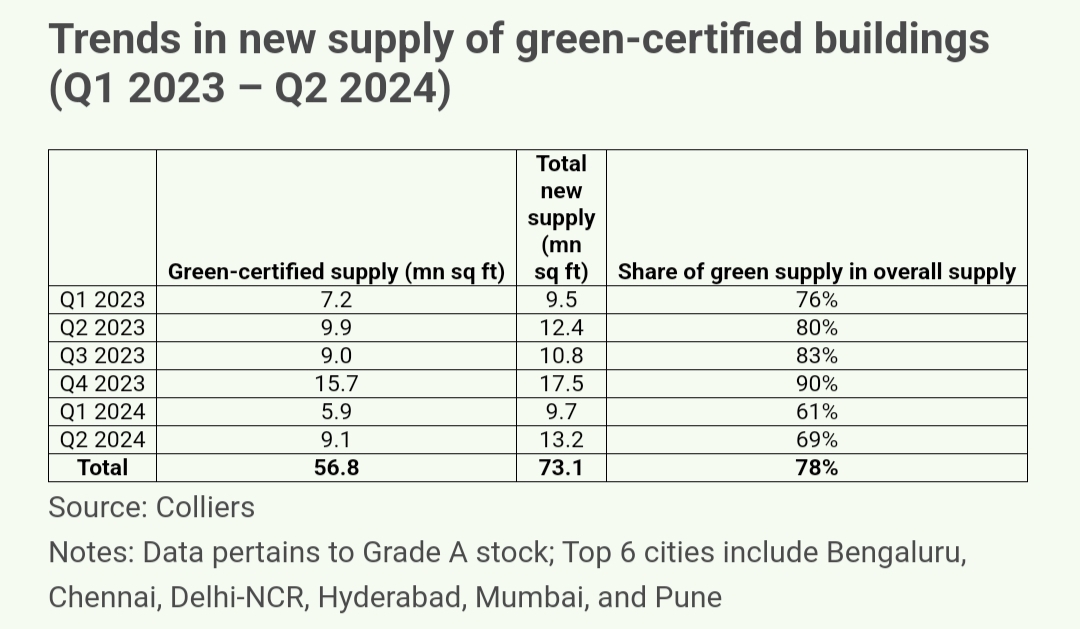

In tandem with the rise in demand for green-certified building, green building stock is also seeing an increase. According to Colliers, as of June 2024, about 67% of the Grade A office buildings across the top six cities were green certified. Bengaluru and Delhi NCR account for about half of the green office stock in the country. Of the 13.2 mn sq ft of new Grade A office completions in Q2 2024, almost 70% are green-certified. In the next two-three years, majority of the over 150 mn sq ft Grade A office developments in various stages of construction across the six major cities are likely to be green certified, expanding Grade A green stock to over 600 mn sq ft.

“With increased inclination amongst occupiers for green-certified buildings, several Grade A developers are increasing sustainable offerings in their commercial portfolios. During the second quarter of 2024, almost 70% of the new supply was green-certified. With growing demand, developers are also retrofitting ageing office stock and incorporating sustainable elements in overall building design & construction. About 300-350 mn sq ft of commercial building stock older than 10 years hold the potential to get refurbished in the next few years and add to the green-certified office stock of the country.” says Vimal Nadar, Senior Director and Head of Research, Colliers India.

Conclusion

The increasing preference for green-certified office spaces among occupiers is reshaping India's commercial real estate landscape, with sustainability becoming a key factor in leasing decisions. As demand for green-certified buildings continues to rise, developers are aligning their portfolios with global sustainability standards, contributing to a significant expansion of green office stock. This trend is expected to accelerate, driven by corporate commitments to ESG goals and regulatory requirements, positioning green-certified buildings as a central component of India's future office market.

.png)