After a prolonged period of steep rent hikes across Indian metros, rental inflation has started to moderate in the first half of 2025. According to a report by NoBroker, rents across six major cities, Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai, and Pune—have grown between 7% and 9% during the January–June period. This marks a clear slowdown compared to the 12–24% year-on-year increases observed from 2021 through 2024.

The correction comes as new housing inventory gradually enters the market. According to NoBroker, improved housing supply is helping reduce the pressure that had been building up due to low availability and high urban migration during the post-pandemic years. The easing of the demand-supply mismatch is seen as a key reason behind the recent stabilisation.

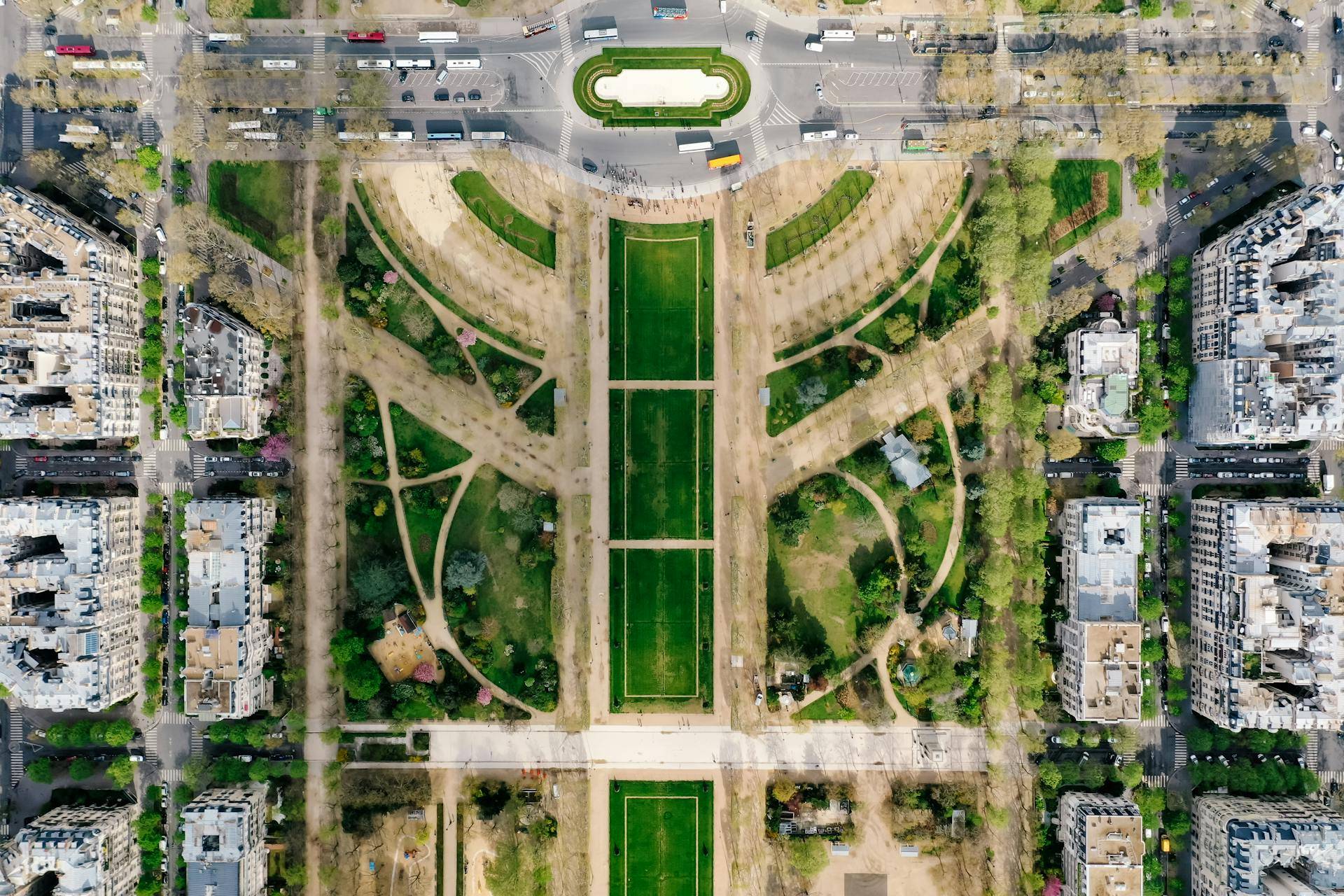

In parallel, infrastructure upgrades, particularly metro rail expansions and improved road connectivity are shaping demand patterns. The report noted that while city-wide rent inflation is slowing, pockets with enhanced infrastructure and new employment hubs continue to see rent appreciation.

Rental Growth Still Outpacing Wage Hikes

Despite the moderation in rent growth rates, affordability remains a challenge in many high-demand locations. The report noted that between 2020 and 2024, rents across Indian metros rose by 35% to 80%, depending on location and unit type. In contrast, regular inflation hovered around 5–7%, and average wage growth remained close to 7%.

This discrepancy has widened the gap between rental costs and household earnings, especially in centrally located areas. Even in 2025, with the Consumer Price Index cooling to 3%, rent inflation continues to outpace headline inflation, highlighting the lingering impact of housing cost escalation.

Bengaluru Trends: Growth in Peripheral Locations

Bengaluru, which saw some of the highest rental increases in the past two years, is now witnessing a more balanced trend. In the first half of 2025, the city recorded an average rental rise of 8%, down from double-digit spikes observed in 2023. Still, certain areas remain outliers due to ongoing infrastructure projects and concentrated job demand.

Localities such as Electronic City, KR Puram, Bellandur, JP Nagar, and BTM Layout recorded double-digit rental increases ranging from 10% to 12%. These areas are benefiting from new metro corridors, road upgrades, and proximity to technology parks and startup clusters. Electronic City saw an 11% rental jump, while Ramamurthy Nagar rose by 10% due to its affordability and upcoming connectivity improvements.

Bellandur and KR Puram, both of which are key to Bengaluru’s Outer Ring Road corridor, witnessed 12% growth. BTM Layout, located close to key education institutions and start-up hubs, remains popular among students and young professionals.

Peripheral Markets: Scope for Affordable Rentals

The report also pointed to emerging opportunities in Bengaluru's outer areas. Locations such as Sarjapur Road, KR Puram, Devanahalli, and Hebbal are gaining traction due to upcoming infrastructure like the Peripheral Ring Road (PRR), metro connectivity, and new tech clusters.

For instance, average 2BHK rents in Whitefield range between ₹25,000 and ₹40,000. With metro line connectivity scheduled to improve in the next year, rents in Whitefield are expected to rise by another 10–12%. Similarly, Bellandur and Sarjapur, with current average rents between ₹35,000 and ₹45,000, may see an 8–12% rise depending on local demand and progress on tech park development.

KR Puram, currently in the ₹20,000–₹30,000 range for a 2BHK, is benefiting from PRR work and metro construction. Rents here are projected to increase by 10–15% over the next year.

Hebbal, a northern suburb with good airport access, currently has average 2BHK rents between ₹28,000 and ₹40,000. New mall and office space developments are expected to add to the area’s rental demand.

Devanahalli, traditionally a low-rent zone with 2BHK rentals between ₹12,000 and ₹17,000, is expected to see the highest percentage rise in Bengaluru. Large infrastructure projects such as the upcoming BIAL ITIR, the Foxconn manufacturing plant, and new roads are projected to push rents up by 12–20% in the next 6 to 12 months.

Across cities, the combination of new supply and decentralised infrastructure development is expected to reduce pressure in central urban zones. The report identifies better-connected peripheral markets as key to unlocking more affordable housing options in the long term.

Though rent escalation has not been fully neutralised, the pace of growth is slowing. This is expected to provide some relief to tenants, many of whom have faced steep rent hikes over the past three years. Market watchers say if ongoing housing supply remains consistent and infra projects stick to timelines, rents in most metros will likely stay within single-digit growth bands through 2025.