Micromitti Real Estate Ventures, a proptech firm based in Indore plans to launch Real Estate Investment Trusts (REITs), AIF Category 2 Real Estate Funds, and Private Equity investments. The initiative aims to offer structured, high-return investment opportunities to individual investors, including those with limited capital.

This initiative marks a significant step forward in democratizing real estate investment, traditionally a domain reserved for high-net-worth individuals. By leveraging the power of technology, Micromitti aims to enable fractional ownership of prime real estate assets, allowing retail investors to invest without the high upfront costs or the usual responsibilities associated with property ownership.

Micromitti’s innovative approach aligns with the growing trend of using technology to revolutionize the real estate sector. The company’s Founder and CEO, Manoj Dhanotiya, emphasized that their upcoming investment vehicles will make real estate accessible to a wider audience, providing flexibility and strong returns for retail investors. Dhanotiya highlighted that through fractional ownership, even small investors can have a stake in premium properties, making real estate investment an option for many who previously couldn't afford it.

With assets under management exceeding ₹700 crore, Micromitti is well-positioned to lead investor groups in India, particularly in Central India, where the company has already established a solid presence. Investors from across the country and even internationally are showing interest in the opportunities Micromitti is creating, as the company aims to tap into the rapidly expanding real estate market.

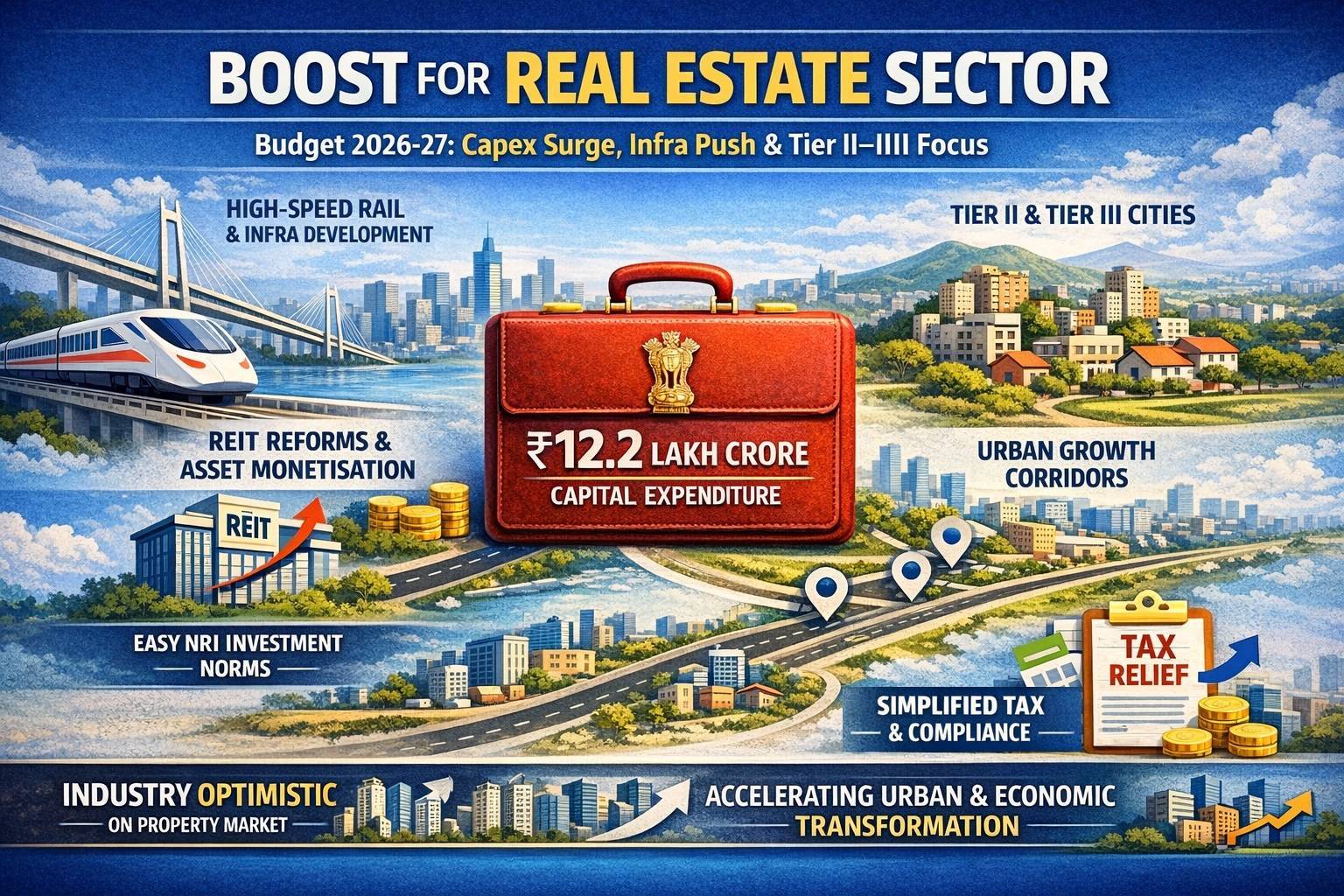

The company is currently in the process of filing papers with SEBI (Securities and Exchange Board of India) for the launch of these new investment vehicles. Once approved, these investment options will likely attract a significant number of investors looking to diversify their portfolios with real estate, which has historically been a strong hedge against inflation and a steady source of returns.

Mr. Dhanotiya believes that technology plays a crucial role in this transformation. By utilizing advanced platforms, Micromitti will allow investors to easily participate in fractional ownership schemes, giving them the flexibility to buy, sell, or trade their real estate shares as they would in the stock market. This level of flexibility, combined with the potential for high returns, makes this investment option particularly attractive for retail investors.

The evolution of India’s PropTech sector has opened up new possibilities for both investors and developers. Micromitti is at the forefront of this change, particularly in Central India, where the company has been successful in attracting a diverse range of investors. As the real estate market continues to evolve, PropTech companies like Micromitti are playing a pivotal role in shaping the future of real estate investment by making it more accessible, transparent, and efficient.

As India’s economy grows and the demand for real estate increases, particularly in urban centers, the introduction of REITs and similar investment vehicles will provide a valuable avenue for individuals to invest in real estate without needing to purchase entire properties. This is especially important in premium real estate markets, where prices are often out of reach for average investors. By offering fractional ownership, Micromitti is creating opportunities for micro-investors to enter the market at a more affordable price point.

The real estate sector has long been viewed as one of the most lucrative investment options, providing steady returns and long-term appreciation. However, the high cost of entry has often excluded smaller investors. Micromitti's new investment vehicles are poised to change that by offering a more inclusive and accessible approach to real estate investing. This will enable a larger segment of the population to benefit from the wealth-building potential of real estate, which was once limited to a select few.

Micromitti’s planned REITs and other investment mechanisms will also contribute to the growth of India’s real estate market, as more capital will become available for developers and property owners. The company’s innovative approach, combined with the use of technology, ensures that its investment offerings will be both flexible and attractive to a wide range of investors.

Image source- facebook.com

This new direction for Micromitti comes at a time when the Indian real estate market is experiencing rapid growth. The rise of urbanization, coupled with increasing demand for commercial and residential spaces, has led to significant appreciation in property values across the country. By allowing smaller investors to access these markets, Micromitti is not only creating opportunities for individuals but also contributing to the overall growth and development of the real estate sector.

.png)