Key Highlights – Housing Price & Market Trends 2025 (PropTiger Report)

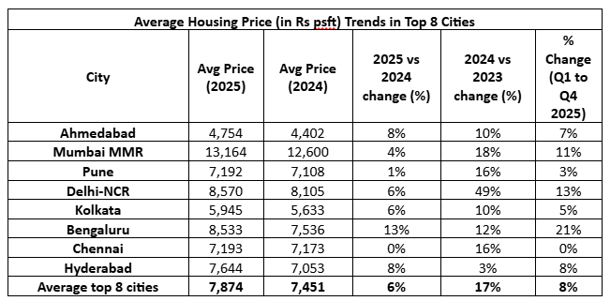

- Housing price growth slowed sharply to 6% in 2025 across the top 8 cities, down from 17% in 2024, indicating market normalization.

- Bengaluru and Hyderabad outperformed other cities, recording price growth of 13% and 8% respectively, driven by steady end-user demand.

- Mumbai MMR saw price consolidation, with growth moderating to 4% in 2025 from 18% in 2024, reflecting stability in the premium housing segment.

- Pune and Chennai remained largely flat, with Pune growing just 1% and Chennai showing no price growth in 2025.

- Delhi-NCR and Kolkata recorded measured growth of 6% each, a significant moderation compared to the sharp surge seen in 2024.

- Bengaluru emerged as the second most expensive housing market, with prices reaching ₹9,500 per sq. ft. in Q4 2025, overtaking Delhi-NCR.

- Housing sales declined 12% YoY to 3.86 lakh units in 2025, marking the lowest annual sales since 2022.

- New housing supply fell 6% YoY to 3.61 lakh units, the lowest since 2021, reflecting cautious developer activity.

The average housing price growth slowed to 6% in 2025 across top 8 cities in India, a significant dip from 17% growth recorded in 2024, according to a report by PropTiger.com. While Bengaluru and Hyderabad showed relatively stronger momentum with average housing price growth of 13% (12% in 2024) and 8% (3% in 2024) respectively in 2025 supported by steady end-user demand, price growth slowed in the other six cities in 2025.

Housing price grew by 8% in Ahmedabad (10% in 2024), 4% in Mumbai MMR (18% in 2024), 1% in Pune (16% in 2024), 6% in Delhi-NCR (49% in 2024), 6% in Kolkata (10% in 2024) and stayed flat in Chennai (16% in 2024).

According to Real Insight- Residential CY 2025, the annual housing market report released by PropTiger.com, through the year 2025 (between Q1 to Q4), residential property prices continued to firm growing at an average 8% in the eight cities, reflecting normalization rather than acceleration. During the year, Bengaluru saw 21% growth reaching Rs 9500 per sq. ft. in Q4 2025, thereby exceeding Delhi NCR (Rs 9167 per sq. ft. in Q4) and emerging as the second most expensive housing market after Mumbai MMR (Rs 14,000 per sq. ft. in Q4).

Mr. Onkar Shetye, Executive Director of Aurum PropTech said, “Mumbai MMR price trends through 2025 reflects price consolidation in the region's premium market while that of Pune and Ahmedabad remaining broadly stable. Delhi NCR and Kolkata also saw measured price increases amid selective demand. Bengaluru and Hyderabad showed steady end-user demand and balanced absorption.”

“Overall, resilient pricing alongside moderating sales volumes highlights a disciplined, supply-calibrated market, where developers protected price integrity and inventory remained well managed-creating a stable pricing base heading into 2026,” he added.

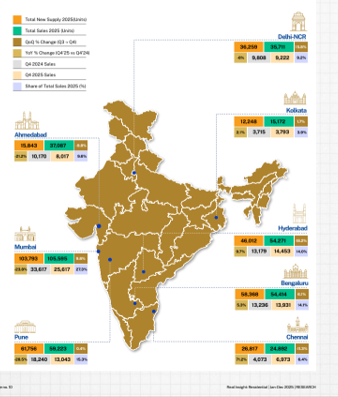

This graph summarises residential sales and new supply across India’s top eight cities in CY 2025, highlighting quarterly momentum, YoY shifts, and each city’s share in total sales. It provides a snapshot of how closely supply aligned with demand amid a year of market normalisation.

According to the report, inventory overhang remained within comfortable limits, indicating that supply was not materially outpacing demand. Unsold inventory growth was more visible in higher ticket-size categories, reflecting longer decision cycles and lower liquidity compared to mass and mid-income housing.

Mr. Shetye added, “The combination of rising prices, stable quarterly increments, and controlled supply additions indicates that inventory levels remained well managed through 2025. The market continued to operate within a comfort zone, with developers prioritising price integrity and project viability over volume-led liquidation.”

Housing Sales and Supply Trends 2025

According to the report, across the top eight cities, all-India residential sales declined by 12% to 3,86,365 units in 2025 as compared to 4,36,992 units in 2024. This is the lowest annual sales since 2022.

In Q4 2025, sales contracted 10% YoY and 0.5% QoQ to 95,049 units. This is the lowest quarterly sales since Q2 2023 (80,250 units).

The total new supply fell 6% to 3,61,096 units in 2025 as against 3,85,221 units in 2024. This is the lowest annual supply since 2021.

In the October-December (Q4) 2025, supply rose 4% YoY and 0.2% QoQ to 92007 units.

Accirding to Mr. Lalit Parihar, Managing Director, Aaiji Group,a Dholera-based real estate firm,, "Ahmedabad’s 8% year-on-year rise in housing prices reflects the city’s fundamentally strong, end-user-driven demand. Growth here is being powered by genuine demand, improving infrastructure, and sustained economic activity across Gujarat. This steady appreciation reinforces Ahmedabad’s position as one of India’s most affordable and stable real estate markets for both homebuyers and long-term investors.”

Looking ahead to 2026, India’s housing market is expected to remain stable with moderate, region-specific price appreciation rather than broad-based acceleration. With inventory overhang under control and supply additions calibrated, developers are likely to continue prioritising project viability, cash-flow discipline, and selective launches aligned to end-user demand. Sales volumes may recover gradually, led by mid-income and affordable segments, while premium housing could see longer absorption cycles. Cities such as Bengaluru and Hyderabad are poised to sustain relatively stronger momentum due to job-led demand, whereas other markets may witness steady but restrained growth. Overall, resilient pricing, cautious supply, and improving affordability dynamics position the residential sector for balanced, sustainable growth rather than speculative expansion.

.png)