FICCI-ANAROCK Report: India’s Commercial Real Estate to Reach USD 105–110 Billion by 2030- Key Highlights

- India’s Global Capability Centres (GCCs) expected to exceed 2,400 by 2030, employing over 2.8 million professionals, with GCCs already driving more than 40% of office leasing in top seven cities.

- Commercial real estate market size doubled from USD 30B in 2019 to USD 64B in 2024, projected to grow to USD 105–110B by 2030 at a CAGR of 10%.

- Bengaluru leads with 875+ GCCs (29%), followed by Pune (15%), Delhi-NCR (14%), and Hyderabad (14%). Tier 2 cities like Jaipur, Kochi, Indore, Surat, and Coimbatore are emerging as new GCC destinations.

- Top seven cities recorded 80.5 million sq ft leased in 2025, with GCCs accounting for 32.5 million sq ft; Grade A office stock now ~800 million sq ft.

- Listed REITs market cap ~USD 18B, representing only 20% of institutional real estate, with potential to grow to 25–30% by 2030; FDI inflows at USD 81.04B in FY24-25, up 14% YoY, signaling strong investment appeal.

India's Global Capability Centres are poised to exceed 2,400 by 2030, employing more than 2.8 million professionals, as the country's commercial real estate sector records its strongest performance despite global economic headwinds, according to a new industry report.

The findings, published in the FICCI-ANAROCK report "Workplaces 2025: India Commercial Real Estate Reimagined," reveal that GCCs now account for more than 40 per cent of total gross office leasing across India's top seven cities, cementing their position as structural anchors of the country's property market.

As of end-2024, India housed over 1,700 GCCs employing more than 1.9 million professionals. The sector's market size has more than doubled from USD 30 billion in 2019 to approximately USD 64 billion in 2024, with projections indicating growth to USD 105–110 billion by 2030 at a compound annual growth rate of 10 per cent.

The expansion is being driven by sustained demand from IT-ITeS, banking and financial services, healthcare and life sciences, and engineering research and development sectors, alongside India's cost efficiency and deep talent pools.

Mr Raj Menda, Chairman of the FICCI Committee on Urban Development and Real Estate and Chairman of the Supervisory Board, RMZ Corporation, said: "India's commercial real estate sector is at a pivotal inflection point. Record office demand underscores a decisive shift toward high-quality, flexible, and technology-led assets. Global Capability Centres have emerged as a structural anchor of this growth, fundamentally reshaping office demand and accelerating the development of premium, future-ready workplaces across both established and emerging cities."

Notably, GCC operations are expanding beyond established metros into Tier 2 cities. Jaipur, Kochi, Indore, Surat, and Coimbatore are emerging as the next wave of GCC destinations, reflecting broader geographical diversification of India's knowledge economy.

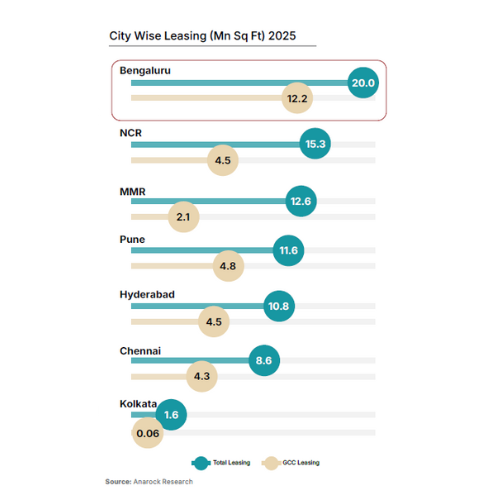

GCC LEASING IN TOP 7 CITIES

India’s office market has continued its strong upward trajectory, reflecting a period of steady expansion and renewed confidence. In 2025, leasing activity across the top seven cities crossed a significant mark of 80 Mn sq ft, setting a milestone for the top 7 cities. The continued rise highlights the depth of occupier demand and the resilience of India’s commercial real estate sector, the reason being the growing footprints of GCCs share in overall leasing. In 2025, GCCs accounted for a little over 32 Mn sq ft of the total office leasing across the top 7 cities.

GCC LEASING – CITY WISE

Bengaluru continues to dominate India's GCC landscape, hosting more than 875 centres—representing 29 per cent of the national total. The city captured over one-third of India's GCC leasing in 2025, followed by Pune at 15 per cent, with Delhi-NCR and Hyderabad each accounting for 14 per cent.

The report also highlights the structural transformation underway in India's Real Estate Investment Trust segment. With five listed REITs commanding a market capitalisation of nearly USD 18 billion, the sector has democratised property investment for retail participants. However, REITs currently represent just 20 per cent of institutional real estate—significantly below mature markets such as the United States, Singapore, and Japan.

Of approximately 520 million square feet of REIT-worthy office stock, only 165 million square feet is presently listed, indicating substantial headroom for institutionalisation. The report projects REIT penetration could rise to 25–30 per cent by 2030, driven by diversification into data centres, logistics parks, and retail assets.

Menda added: "Sustaining this momentum will require consistent policy support, long-term institutional capital, and continued collaboration between industry and government."

Foreign direct investment inflows rose to a provisional USD 81.04 billion in FY 2024-25, marking a 14 per cent increase from the previous year and underscoring India's continued appeal as a preferred investment destination.

With favourable government policies, proactive state-level GCC frameworks, and office demand increasingly diversified across co-working, BFSI, consultancy, and manufacturing sectors, the outlook for India's commercial real estate market remains decidedly positive.

.png)