As per, Colliers Report,iInstitutional investments in the Indian real estate sector stood at USD 4.3 billion during the first nine months of 2025, marking a 9% year-on-year decline. This in a way reflects the cautious investor approach amidst prevailing global headwinds, trade frictions and other external volatilities. However, despite the annual dip, nine-months investment volumes remained above the average of USD 4 billion inflows in the January-September period of last five years. The trend underscores ongoing investor confidence in the fundamentals of Indian economy and real estate market.

Investment inflows in 2025 reflected a balanced mix of domestic and foreign capital. While foreign investments moderated by 36% YoY to USD 2.1 billion, domestic institutional capital surged 52% YoY to USD 2.2 billion, signifying the growing depth of institutional investors in Indian real estate. Given that capital allocation was largely driven by foreign investors, with their share at 84% in 2021, the ongoing structural shift highlights the growing prominence of domestic investors. Looking ahead, while domestic institutions are expected to remain a steady source of capital, global investors are likely to maintain a cautious stance in the near-term, amid evolving global economic narrative and stricter cross-border capital deployment.

"Institutional investments in Indian real estate touched USD 1.3 billion in Q3 2025 —an 11% increase year-on-year. This reflects continued investor confidence in India’s economic fundamentals and resilience of the real estate sector. Domestic capital contributed 60% of the quarterly inflows, with strong interest in office and residential segments. Notably, office assets accounted for over three-fourths of the domestic investments during the quarter, indicating a continued appetite for both ready and developmental commercial properties. With sustained demand across core asset classes and increasing depth of domestic capital, investment momentum is likely to hold steady, even as global headwinds may keep foreign investors cautious in the near-term,” said Badal Yagnik, Chief Executive Officer, Colliers India.

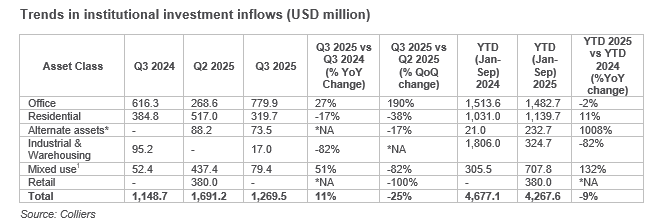

Note: *Alternate assets include data centers, life sciences, senior housing, holiday homes, student housing, schools etc. *NA-Not applicable: Investment inflows were limited for Retail assets in YTD 2024 and Q3 2025; for Industrial & warehousing segment in Q2 2025; and for alternate assets in Q3 2024

Office segment dominates with 35% share in 2025, followed by residential assets

Institutional inflows in the office segment touched USD 1.5 billion in the first nine months of 2025, almost at par with the levels seen in the corresponding period of 2024, driving 35% of the inflows in the year so far. Residential assets meanwhile saw investments to the tune of USD 1.1 billion, an increase of 11% on a YoY basis, backed by rising interest from both domestic and foreign investors. Additionally, mixed-use, retail and alternative assets too saw a notable surge, together accounting for nearly one-third of the total inflows in 2025.

“After a relatively subdued first half, institutional investments in India’s office segment rebounded strongly in Q3 2025, rising 27% year-on-year to USD 0.8 billion. Office assets accounted for over 60% of total quarterly inflows, led by notable acquisitions of ready commercial properties, particularly in Chennai and Pune. With Grade A space uptake remaining strong backed by stricter implementation of office-first mandates and a robust supply pipeline, the office market continues to offer compelling opportunities for investors in India. Moreover, with institutionalisation of office segment picking pace, investor appetite across established Tier I markets and emerging Tier II destinations is likely to remain unabated,” said Vimal Nadar, National Director & Head of Research, Colliers India.

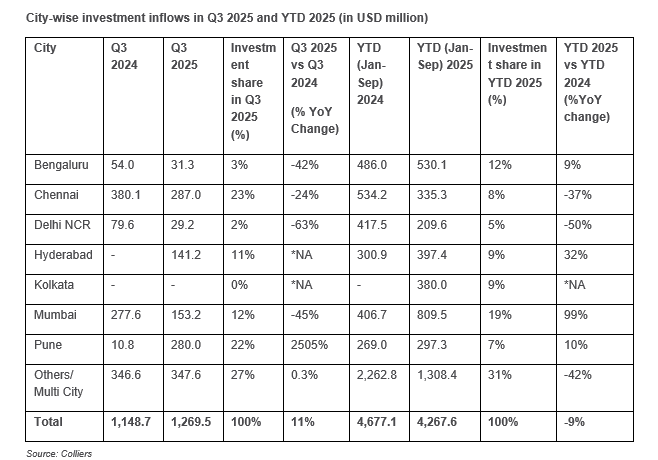

Mumbai & Bengaluru together drive one-third of real estate investments in 2025

At USD 0.8 billion inflows, Mumbai drove 19% of the total investments in 2025, led by deals in office and residential assets. Bengaluru, too witnessed significant traction and attracted USD 0.5 billion investments, contributing nearly 12% to the total inflows. Notably, investment activity across other major cities such as Hyderabad, Kolkata, Chennai, Pune, and Delhi NCR remained evenly spread out, with each city recording inflows in the range of USD 0.2–0.4 billion during the nine-month period.

Additionally, multi-city deals accounted for over 30% of the total investments so far in 2025, reflecting a growing geographical diversification of institutional capital across key markets. This trend underscores the growing prominence of Tier II cities and thus, resulting in equitable real estate growth across India.

.png)