Colliers’ Asia Pacific Report: 2025 Global Investor Outlook report anticipates significant opportunities for cross-border investments and renewed market activity in 2025, highlighting growing optimism in the APAC real estate market. The report reveals a local investment landscape gearing up for a lower interest rate environment in many markets, following a prolonged inflationary period that kept many investors on the sidelines. Expectations of rate cuts, along with factors such as continued narrowing of pricing and valuation gaps, are expected to help drive transaction volumes in the APAC region, particularly in the office and logistics sectors.

Key APAC survey findings include:

- 69% of APAC survey respondents intend to allocate more than 30% of their total global assets under management (AUM) to real estate in the next five years.

- 68% expect regional economic growth to have a positive impact.

- 67% plan to invest in the region in 2025, as industrial and office sectors continue to be APAC investors’ top choice in 2025.

- 61% plan to invest in industrial and logistics, office and multi-family/build-to-rent sectors in 2025.

- 61% of APAC respondents planning to invest in the office sector intend to invest in core or core-plus CBD office assets.

- Nearly 90% expect their ESG-compliant office assets to achieve some value premium over the next three years.

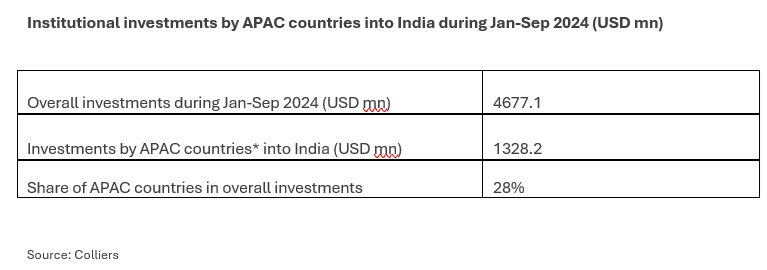

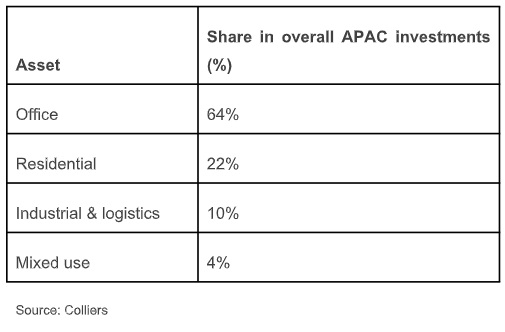

Positive signals of heightened real estate investments in the APAC region also augur well for India. Coupled with strong domestic economic growth prospects, India looks uniquely positioned to attract both domestic and foreign institutional investments in the coming years. Interestingly, capital inflows from countries in the APAC region have been on the surge in recent years.

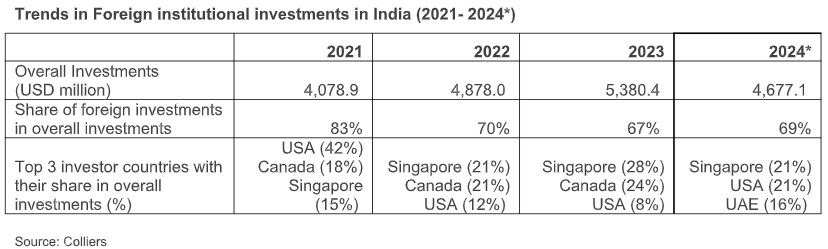

India’s real estate sector continues to attract robust institutional investments, underscoring sustained investor confidence. Since 2021, institutional inflows have totaled USD 19 billion, with investment volumes rising each passing year. This growth is fueled by surging demand across core real estate segments. While office assets have driven over 40% of inflows during the last four years (2021-24), both industrial & warehousing and residential sectors are now seeing accelerated momentum in recent years.

Continuing the momentum of the past three years, institutional investments in Indian real estate in 2024 are poised to surpass 2023 levels, driven by robust investments in office, industrial & warehousing, and residential sectors. In the first three quarters of 2024 alone, investments have reached USD 4.7 billion, accounting for 87% of the inflows in the entire year of 2023. This momentum also sets a promising tone for institutional investments across real estate asset classes in 2025.

“The office sector is likely to have its best year in India, with record absorption fueled by GCCs and domestic demand. The residential sector is witnessing strong end-user sales. Equity capital in Indian real estate is now more diversified, with an increasing share of domestic capital." said Piyush Gupta, Managing Director, Capital Markets & Investment Services at Colliers India.

Note: The institutional flow of funds includes investments by family offices, foreign corporate groups, foreign banks, proprietary books, pension funds, private equity, real estate fund-cum-developers, foreign-funded NBFCs, listed REITs and sovereign wealth funds. The data has been compiled as per available information in the public domain | For investment deals involving multiple countries, an equal share is considered for each participating country I * Jan-Sep 2024

Note: * Includes investments from other countries in the APAC region such as Singapore, Australia & Japan and do not include domestic investments. For investment deals involving multiple countries, an equal share is considered for each participating country.

"The evolving real estate landscape in India offers compelling opportunities for investors across both core and non-core segments in 2025. The office sector will continue to present increased opportunities in developmental assets, while rising and evolving consumption patterns and strong demand from e-commerce and third-party logistics (3PL) players will bolster the industrial and warehousing sector. Residential real estate, meanwhile, is likely to witness increased investor participation in joint venture platforms, redevelopment projects in Tier I cities. Additionally, with evolving demographic patterns, investments in alternatives such as data centers, senior living, student housing, schools, life sciences, holiday homes etc. will continue to hold immense long-term potential." said Vimal Nadar, Senior Director and Head of Research, Colliers India.

"Logistics is very much a core strategy now for investors and it's definitely become mainstream. Investors are specifically targeting assets like data centers, last-mile logistics and cold storage, with interest centered in markets like Japan, Australia, and South Korea. There's also a lot of demand for alternatives as investors look to diversify the way they invest in real estate. But the biggest challenge, not just in Asia Pacific but globally, is that there's still a lack of investable grade assets in a lot of these sectors, whether it's senior living or life sciences. We don’t expect supply to ramp up in 2025. But as future strategies they have really strong potential.” said Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets, Asia Pacific.

"Logistics is very much a core strategy now for investors and it's definitely become mainstream. Investors are specifically targeting assets like data centers, last-mile logistics and cold storage, with interest centered in markets like Japan, Australia, and South Korea. There's also a lot of demand for alternatives as investors look to diversify the way they invest in real estate. But the biggest challenge, not just in Asia Pacific but globally, is that there's still a lack of investable grade assets in a lot of these sectors, whether it's senior living or life sciences. We don’t expect supply to ramp up in 2025. But as future strategies they have really strong potential.” said Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets, Asia Pacific.

India's real estate sector is set to witness increased institutional investments in 2025, supported by a growing focus on core and alternative asset classes and favorable economic conditions.

.png)