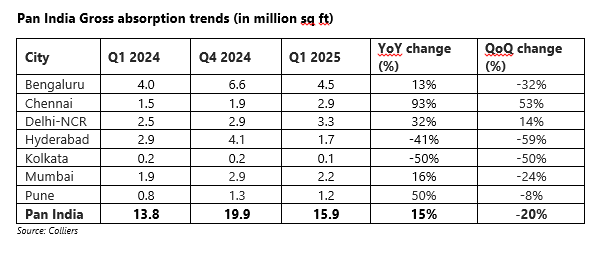

Office leasing across India's top seven markets maintained strong momentum in Q1 2025, reaching 15.9 million sq. ft.—a 15% year-on-year (YoY) increase, as per the Colliers Report. The sustained demand reflects growing confidence in the country’s office market, with Bengaluru and Delhi NCR accounting for nearly half of the total leasing activity. Delhi NCR recorded its highest quarterly leasing volume in the last 10 quarters, while Chennai saw an exceptional 93% YoY surge to 2.9 million sq. ft., driven by technology firms. This steady growth highlights the resilience of key office hubs, including Bengaluru, Chennai, Delhi NCR, Hyderabad, Kolkata, Mumbai, and Pune.

“2025 has started on a positive note, with office leasing witnessing a commendable 15% year-on-year growth at 15.9 million square feet in the first quarter. Key markets are seeing strong Grade A space uptake, driven by corporate expansions, rising investments in commercial real estate, amidst promising domestic growth prospects. We anticipate the demand momentum to gain pace throughout 2025, fueled by expansionary plans of leading firms across Technology, Engineering & Manufacturing and BFSI sectors. Additionally, aided by the policy level push in major states, long-term demand for GCCs will continue to remain strong in most Tier I and select Tier II cities of the country”, says Arpit Mehrotra, Managing Director, Office Services, India, Colliers.

Gross absorption does not include lease renewals, pre-commitments and deals where only a letter of Intent has been signed.

Rentals surged 8% annually amidst steady new supply and robust demand

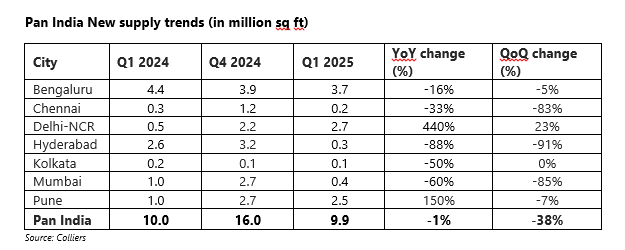

Overall new supply touched 9.9 million square feet during Q1 2025, almost at par with the same period last year. Bengaluru and Delhi NCR together drove two-third of the new supply during Q1 2025. While majority of the markets saw a decline in new supply on an annual basis, Delhi NCR and Pune witnessed multifold growth in new completions, as compared to Q1 2024. In fact, almost 90% of the new supply during Q1 2025 was concentrated in three cities – Bengaluru, Delhi NCR and Pune.

With demand outpacing new supply across most cities, average office rentals increased annually by 8% during Q1 2025. Amidst limited new supply, growth in rentals was higher in select high activity micro markets such as BKC & Andheri East in Mumbai, SBD (Madhapur, HITEC City, Kondapur & Rai Durg) in Hyderabad and NH 48 & Golf Course Extension Road in Delhi NCR. At the India level, vacancy levels meanwhile dropped by 120 basis points on an annual basis to 16.2%. This was a 55 basis points decline on a sequential basis.

Technology firms drove conventional office space demand, Flex space leasing remained buoyant in Q1 2025

Of the 15.9 million square feet of Grade A office space demand in Q1 2025, 86% came from conventional workspaces. Flex space leasing, meanwhile, at 2.2 million square feet witnessed a 22% YoY growth.

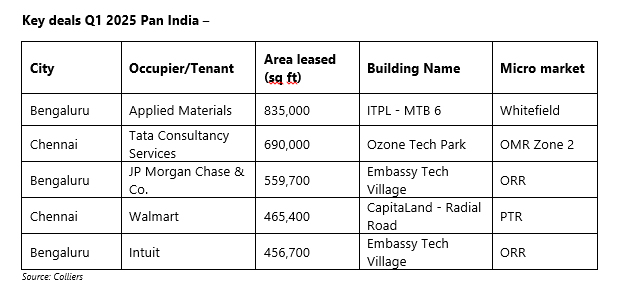

Technology sector continued to drive office space demand, leasing 4.4 million square feet of conventional office space during Q1 2025, 28% of the total demand during the quarter. BFSI and Engineering & Manufacturing demand was also healthy at 3.4 million square feet and 2.4 million square feet, together accounting for 36% of the total conventional space uptake in the quarter.

“Q1 2025 saw 2.2 million square feet of flex space leasing across the top 7 cities of the country, a 22% YoY increase. Leasing by flex space operators was particularly strong in Delhi NCR, Pune, and Bengaluru with these three cities together accounting for almost 80% of the total flex space uptake in the quarter. Fully managed office spaces driven by enterprise-level offerings, plug & play facilities and a high degree of customisable solutions are expected to drive flex space momentum throughout 2025. Consequently, flex spaces are likely to gain further prominence, and their share in occupiers’ portfolio can potentially reach 12-15% in the coming years”, said Vimal Nadar, Senior Director and Head of Research, Colliers India.

India’s office market is expected to sustain its growth, driven by corporate expansions, increasing investments in commercial real estate, and policy support in key states. The demand for Grade A office spaces, particularly from the technology, BFSI, and engineering sectors, along with the rising prominence of flex spaces, will continue to shape the market. With vacancy levels declining and rentals seeing steady growth, the outlook for 2025 remains positive, reinforcing the strength of the country’s top office hubs.

.png)