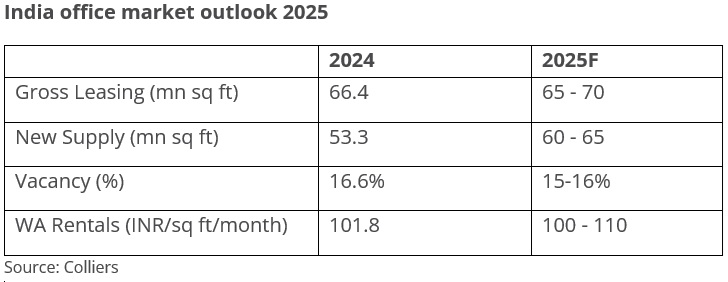

India’s top six cities have seen a steady rise in office leasing and supply, pushing the market to new levels each year. This growth, driven by changing occupier needs, is expected to continue, with gross leasing across these cities projected to reach 65-70 million sq ft in 2025, according to Colliers' latest report, India Office: Setting New Standards for 2025, released at the FICCI 18th Real Estate Summit. The forecast considers ongoing business confidence while factoring out potential external disruptions or market fluctuations.

The surge in overall leasing volume is likely to be driven by diversification of occupier base, continued expansion of Global Capability Centers (GCCs) and business optimism amidst domestic occupiers. The office market will continue to evolve from a supply-led environment to an occupier-driven landscape, shaping the next growth phase of commercial real estate in India. This transition has pushed developers to become more agile and tailor office spaces to match evolving occupier needs. Approximately 60-65 million sq ft of new supply is anticipated in 2025. Moreover, a growing emphasis on energy efficiency and sustainable material & energy usage is set to further redefine standards in Indian commercial estate throughout 2025.

Note: Data pertains to Grade A buildings only and top 6 cities include- Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai, and Pune | Gross absorption does not include lease renewals, pre-commitments and deals where only a Letter of Intent has been signed | Weighted Average Quoted (WAQ) Rents are in INR per square feet per month for warm shell offices and do not include Common Area Maintenance (CAM) or taxes.

“Bengaluru will account for an estimated one-third of the overall office space demand in 2025, led by space uptake from GCCs, engineering & manufacturing firms and flex space operators. While Bengaluru will continue to lead the other major markets by a considerable margin, Hyderabad and Delhi NCR are likely to see heightened activity and register 10-15 million sq ft of leasing activity each, 5-10% higher compared to previous year. Mumbai, Chennai and Pune will meanwhile continue to be preferred by occupiers from BFSI and Engineering & manufacturing sectors and flex space operators respectively. The three cities are likely to witness 5-10 million sq ft of Grade A office space demand each in 2025.” says Arpit Mehrotra, Managing Director, Office Services, Colliers India.

Note: Data pertains to Grade A buildings only | Gross absorption does not include lease renewals, pre-commitments and deals where only a Letter of Intent has been signed

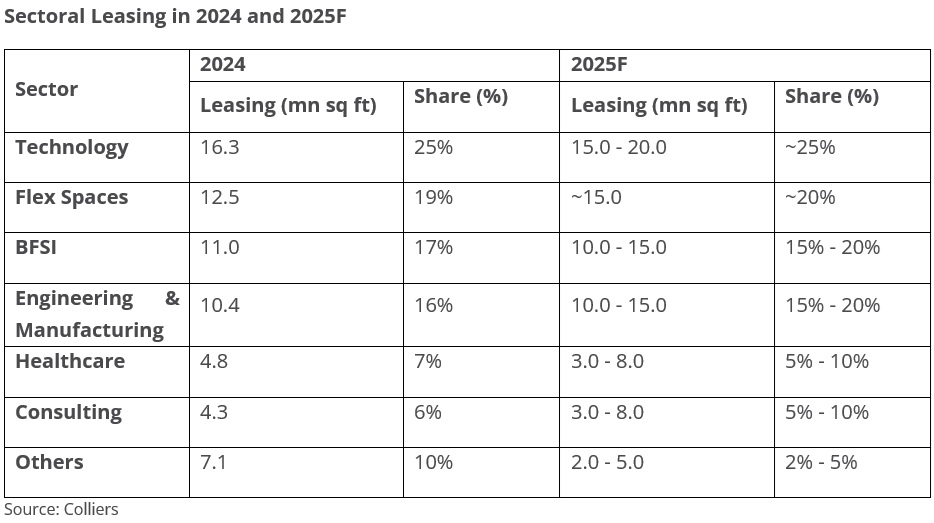

Demand from Engineering & Manufacturing, BFSI firms and flex space operators can surge by 10-15% in 2025

Engineering & manufacturing, BFSI firms and flex space operators are expected to drive office demand in 2025, with each segment poised for a 10-15% annual rise in space uptake. Cumulatively, these three sectors are likely to continue to account for half of the leasing activity in 2025. Engineering & manufacturing sector will see heightened activity across most major office markets, with Bengaluru likely to dominate leasing volumes. BFSI firms will continue to prefer having a presence in Mumbai, but increasing traction in Bengaluru, Hyderabad, and Pune highlights a growing trend of diversification beyond traditional hubs. Meanwhile, flex space operators are set to emerge as one of the leading demand drivers, accounting for nearly 20% of total leasing activity in 2025.

Note: Data pertains to Grade A buildings only and top 6 cities include- Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai, and Pune | Gross absorption does not include lease renewals, pre-commitments and deals where only a Letter of Intent has been signed

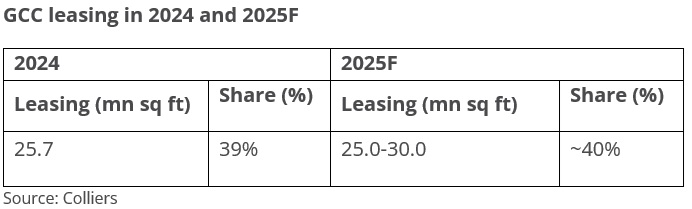

GCC demand to further gain ground in India

GCC leasing saw a 41% YoY increase in 2024, at 25.7 million sq ft across the top 6 cities. This demand is expected to further increase and be close to 30 million sq ft, accounting for around 40% of the total office space demand in 2025. Bengaluru and Hyderabad are likely to remain preferred knowledge and innovation-driven GCC hubs. In line with past trends, US-based companies are likely to drive GCC expansion across most markets and contribute around 70% of the GCC demand in 2025, led by Technology, BFSI & Engineering & manufacturing firms.

Note: Data pertains to Grade A buildings only and top 6 cities include- Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai, and Pune | Gross absorption does not include lease renewals, pre-commitments and deals where only a Letter of Intent has been signed

Asset quality to improve with increasing focus on sustainability and inclusion in REITs

With REITs in India gaining traction, driven by increasing retail investor participation and favorable regulatory environment, developers are focusing on curating high-quality real estate portfolios. Simultaneously, the growing occupier demand for sustainable, green-certified developments can fast-track the realization of national carbon emission and net-zero goals. Increasing adoption of sustainable elements and low-carbon construction materials in built environment especially commercial real estate can accelerate long-term green economy transition.

“India’s commercial real estate is focused on creating high-quality assets and leading developers are prioritizing construction of high-quality, rent-yielding assets, to ultimately list them as REITs. At the same time, rising demand for green-certified workplaces is pushing developers to align with global sustainability standards, and increasingly focus on energy efficiency, carbon reduction, and environmental compliance. Over the past few years green leasing has been gaining traction and 80-85% of Grade A office space demand in 2025 is likely to be concentrated in green-certified developments." says Vimal Nadar, Senior Director & Head of Research, Colliers India.

Way Forward

India’s office market in 2025 is set for sustained growth, driven by occupier-centric development, the expansion of Global Capability Centers (GCCs), and rising demand for flex spaces. Developers must focus on creating high-quality, sustainable, and tech-enabled office spaces to align with evolving workplace needs. The increasing preference for green-certified developments, coupled with the expanding REIT market, will enhance asset quality and long-term rental yields. As business sentiment remains strong, integrating smart workplace solutions, adaptive leasing models, and energy-efficient designs will be key to shaping the next phase of India’s commercial real estate landscape

.png)