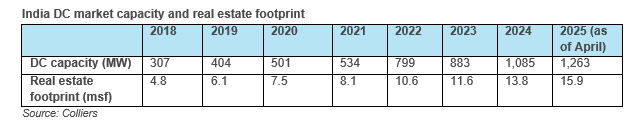

India’s data center (DC) market has entered a transformative phase and has scaled up significantly in recent years. DC capacity has grown over 4X times in the last 6-7 years and stands at 1,263 MW as of April 2025. This growth is driven by the surge in demand for digital & cloud services, increasing adoption of Artificial Intelligence (AI) & Internet of Things (IoT), and higher internet penetration, supported by favorable government policies. At the city level, Mumbai continued to account for majority of the DC capacity with 41% share, followed by Chennai & Delhi NCR at 23% & 14% respectively. This rapid expansion in capacity has resulted in over 3X times increase in real estate footprint over the last 6-7 years, across top seven DC markets of the country, taking it to 16 million sq ft as of April 2025.

According to the recent Colliers’ report “The digital backbone: Data center growth prospects in India” DC capacity across the top seven cities is expected to cross 4,500 MW by 2030 which in turn is likely to translate into real estate footprint of around 55 million sq ft in the next 5-6 years. This potential growth is supported by established global connectivity through submarine cables, availability of land & power at comparatively lower costs, supportive government policies, and burgeoning demand. Additionally, major DC operators are planning to expand their presence and are committing long-term investments across multiple Tier II/III cities.

Data pertains to co-location data centers in top 7 cities - Bengaluru, Chennai, Delhi NCR, Hyderabad, Kolkata, Mumbai and Pune | Data center capacity represents total IT load capacity including occupied as well as unoccupied space.

“With a DC capacity of about 1,263 MW across the top seven markets, India’s data center industry has witnessed significant scaling up in the last few years. India is becoming a global DC hotspot, fueled by rapid digitalization, data localization norms and strong government support. As this growth trajectory continues, India’s DC capacity is likely to cross 4,500 MW in the next 5-6 years, translating into a real estate footprint of 55 million sq ft. Undoubtedly, India’s strategic advantages such as availability of land parcels, power supply for usage and availability of skilled talent, reinforces its position as one of the preferred destination for data centers in the APAC region. Interestingly, the market is expanding beyond large-scale colocation facilities and hyperscalers to edge data centers driven by increasing need for lower latency, real-time analysis, enhanced app performance, and business agility,” said Jatin Shah, Chief Operating Officer, Colliers India.

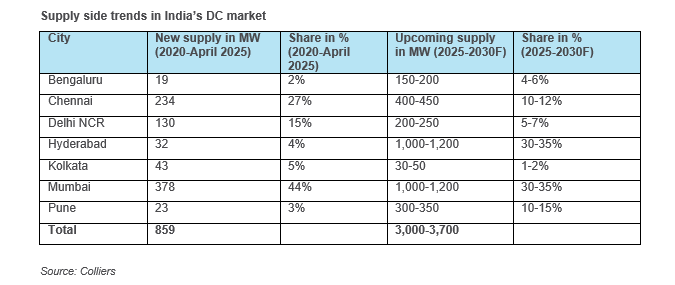

Mumbai drove 44% of the DC capacity additions since 2020

On the supply front, India has witnessed 859 MW of capacity addition across the top seven primary DC markets since the beginning of 2020. In terms of geographical spread, 44% of the new supply since 2020 was concentrated in Mumbai. This was followed by Chennai and Delhi NCR which together accounted for 42% of the capacity addition since 2020.

In the next 5-6 years too, majority of the primary DC markets are set to witness significant influx of new supply. These Tier I markets are likely to witness 3,000- 3,700 MW of DC capacity additions during 2025-2030, about 4X times compared to the new supply during 2020-2025. While Mumbai will continue to dominate the overall DC market, relatively smaller growth markets such as Hyderabad, Bengaluru and Pune are likely to see multifold growth in inventory levels. Hyderabad, specifically, is likely to see significant traction and emerge as a major hub, in addition to cities such as Mumbai, Chennai & Delhi NCR.

Data center capacity represents total designed IT load capacity including occupied as well as unoccupied space. Data as of April 2025 | Upcoming supply additions are based on announcements made by individual companies across the DC industry.

DCs exceeding 50 MW to account for nearly two-thirds of the capacity by 2030

The rise in proportion of larger-sized DCs (>20 MW) from 42% during 2020 to 56% as of April 2025, indicates heightened traction in large hyperscale data centers, especially in recent years. About 44% of the new supply since 2020 was in the 21-50 MW category. Within the 21-50 MW category, Mumbai drove about three-fourths of the new supply additions. Interestingly, Chennai accounted for 45% of the new completions during the period in the >50 MW category. Going ahead we estimate, DCs exceeding 50 MW capacity are likely to account for nearly two-thirds of the inventory by 2030.

DC industry to see investments worth USD 20-25 billion over the next 5-6 years

The scale-up in Indian DC industry has been accompanied by equally impressive investments in the last 5-6 years. The industry has already seen investments to the tune of USD 14.7 billion since the beginning of 2020. These investments have been largely focused on land acquisition, project construction & development etc. In the next 5-6 years, amidst massive adoption of cloud computation and AI in India, DCs are likely to attract investments to the tune of USD 20-25 billion.

“India’s DC market is likely to mature amidst increasing demand, supportive government policies and country’s continued commitment towards digital transformation. In the coming years, the demand for high density rack configurations & advanced computing infrastructure will further rise. DC investments of about USD 20-25 billion are likely to materialize over the course of the next 5-6 years. Operators & developers will increasingly seek land-banking strategies and expand into growing markets with high data consumption levels. Moreover, investments in energy efficient and green certified DCs too will gain larger ground, as leading players increasingly imbibe sustainable practices. Green penetration in the industry, thus is likely to increase from 25% currently, to 30-40% by 2030,” said Vimal Nadar, National Director & Head of Research, Colliers India.

India’s data center ecosystem faces both exciting opportunities and critical challenges that will shape its trajectory. Infrastructure scalability, energy consumption management, and the integration of cutting-edge technologies will demand focused innovation and strategic foresight. Additionally, developing a skilled workforce and fostering sustainable practices will be vital to maintaining competitive advantage in a rapidly evolving global landscape. As investments continue to pour in and new markets emerge, the industry must prioritize resilience, efficiency, and collaboration to ensure that India not only meets growing demand but also becomes a global leader in digital infrastructure, powering the next wave of technological transformation.

.png)